- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Big Brother is back, leading us to the pinnacle to feast on success. U.S. stock GameStop soared over

On May 13, GameStop (GME) saw a long-awaited surge. Due to significant volatility, trading was halted five times during the session, with the stock price at one point soaring over 110%. By the close, GameStop’s stock price had increased by 62.37%, ending at $30.47 per share, with a market capitalization of $9.33 billion. Notably, the stock continued to rise more than 20% after hours! After three years, GameStop has gone ‘crazy’ again.

GME Market Trend, BiyaPay App

What happened exactly?

In 2020, Ryan Cohen bought into GameStop shares in two instances, becoming a major shareholder; plus, GameStop’s business received a boost, causing its stock price to surge. From a low of $2.8 per share in April 2020 to $19 per share by the end of the year. At this point, differences emerged, with short-selling institutions believing the stock was overvalued, shorting the company, and spreading unfavorable news about it. Earlier, Keith Gill had started building positions in the stock, purchasing shares in June 2019 when the company was on its last legs. He not only bought shares but also started a new YouTube channel ‘Roaring Kitty,’ spending several hours a week discussing GameStop extensively. In August the same year, he began posting on the social platform Reddit.

When the stock was suppressed by shorts, Keith Gill called on retail investors to buy GameStop shares to fight against short-sellers, making the shorts pay a price.

2021 ‘Retail Investors vs. Wall Street’ event:

Initially, the forces of both sides were evenly matched.

From the beginning of January 2021, the stock price hovered between $18-$20: On January 7, the price once fell to $17 per share, remaining at $20 per share until January 12.

From January 13 to January 19, the stock price was pushed from $20 to $40 per share.

As the stock price rose, the event escalated, becoming a symbolic stock of retail vs. Wall Street: Retailers believed short-selling institutions were ruthless, and the negative impressions from the 2008 financial crisis resurfaced.

On January 25, the stock price had been pushed from $40 on the 19th to $77 per share.

Short-selling institutions held too large a proportion of short positions, forming massive losses. If they closed their positions, it would cause the stock price to rise even more, and the stock price soared like a runaway wild horse.

On January 26, the stock price was pushed to $148 per share, and short-sellers like Citron could no longer turn the tide, buying stocks at high prices and returning them to brokers, exiting with huge losses.

On January 27, retail investors pursued the victory, pushing the stock price to $348 per share. Elon Musk jumped out and scolded the brokers, expressing support for the actions of retail investors.

On January 27, GameStop’s stock price soared to $347.51 per share. According to a screenshot posted by Gill on Reddit, the return on his GameStop stocks and options exceeded 40 times. This meant that his initial $53,000 turned into $48 million.

On January 28, the stock price surged to $483 per share, reaching its historical peak, during which 17 trading halts were triggered.

However, at this time, government agencies intervened, indicating issues with brokers and stating a full review of GameStop’s issues was necessary. Retail trading was restricted, causing the stock price to plummet.

On January 29, the stock price fell back to $325 per share.

On February 1, the stock price dropped to $211 per share. The brokerage platform Robinhood used by retail investors announced: each customer could only buy 1 share of GameStop.

On February 2, the stock price continued to fall to $90 per share. On February 4, the stock price continued to fall to $54 per share.

‘Sequel to Retail vs. Wall Street’?

In addition to celebrities like Musk, renowned investor Duan Yongping also participated in this game, shorting GameStop due to its high stock price. The well-known short-selling institution Citron, due to short-selling losses, even changed its investment strategy, stating that it would no longer play the short-selling game, focusing on long opportunities.

In early 2021, bestselling author Ben Mezrich wrote a non-fiction literary work based on this event, ‘The Anti-Social Network: GameStop’s Short Squeeze and the Amateur Retail Mob that Beat Wall Street,’ and later Sony Pictures adapted this novel into the movie ‘Dumb Money’ released in 2023, starring Paul Dano.

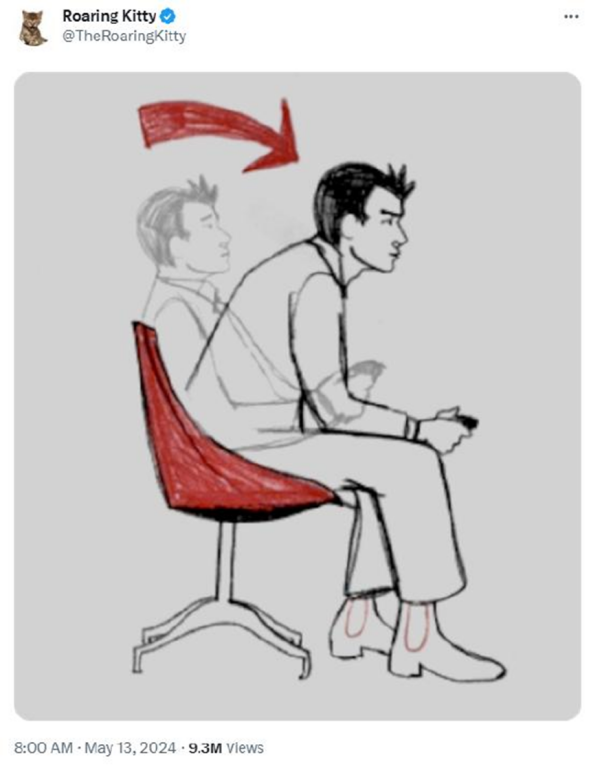

In 2021, Roaring Kitty, the ‘Big Brother’ of American retail investors who pushed the ‘Retail vs. Wall Street’ and fueled the surge in GameStop (GME) stock prices, returned three years later to X (username Roaring Kitten).

About three years ago, he stopped updating on X. But on Sunday, he posted a sketch of a ‘man leaning forward in a chair.’ This is a very popular meme among gamers, indicating that things are getting serious. This is also the first post he has published on the X platform since mid-2021.

Roaring Kitty, known as the ‘Big Brother’ of American retail investors, had pushed retail fervor for GameStop in 2021. Through continuous sharing of orders and posting predictive comments, he attracted substantial capital inflow to GameStop and ultimately destroyed the short-selling hedge funds. During this recent surge, an investor wrote on Reddit’s GameStop message board: ‘Oh my God, it’s him, he’s really back.’ And claimed ‘Keith Gill can give hedge funds a heart attack.’

So, why does Keith Gill’s return trigger such a massive market response?

First, his return brings new hope and momentum to retail investors. During the previous ‘Retail vs. Wall Street,’ retail investors showed strong cohesion and combat effectiveness, and Keith Gill, as a leader among them, became a spiritual leader for retail investors. His return will undoubtedly rekindle the enthusiasm of retail investors, encouraging them to refocus on companies like GameStop that the market has overlooked.

Second, Keith Gill’s return also reflects some trends and changes in the current market. With the rise of digital currency technology, investors are increasingly interested in decentralized, intermediary-free trading methods. Keith Gill and other retail investors represent the promoters and practitioners of this trend. Their actions not only challenge the authority and status of traditional financial institutions but also promote innovation and change in the financial market.

However, we also need to be aware that while the actions of retail investors have a powerful influence, they also involve certain risks and uncertainties. First, retail investors usually lack professional investment knowledge and experience and are easily influenced by market sentiment and rumors, making incorrect investment decisions. Second, the actions of retail investors are often short-term and speculative, lacking a long-term investment perspective and planning. Therefore, when participating in market investments, we need to remain rational and calm, not blindly follow the trend or make impulsive investments.

If investors are optimistic about this company and want to enter the market, they can monitor stock prices regularly at traditional brokers like Interactive Brokers, Charles Schwab, Tiger Brokers, or at the new multi-asset trading wallet BiyaPay, and buy or sell stocks at the right time. BiyaPay not only allows you to recharge USDT to trade U.S. and Hong Kong stocks but also supports USDT withdrawals to bank accounts in U.S. dollars or Hong Kong dollars, and then cash out the fiat currency to other securities for investment. This method can be described as fast, without any quota restrictions, without any troubles of fund inflows and outflows, and can also keep up with stock market trends at any time.

Moreover, we also need to pay attention to the attitude and policies of regulatory agencies towards the actions of retail investors. During the previous ‘Retail vs. Wall Street,’ regulatory agencies had restricted and intervened in the actions of retail investors to prevent excessive market fluctuations and risks. Therefore, in future market investments, we need to closely monitor the policy trends and regulatory intensity of regulatory agencies to better grasp market opportunities and avoid risks.

In summary, Keith Gill’s return brings new vitality and activity to companies like GameStop that the market has overlooked. However, when participating in market investments, we need to remain rational and calm, not blindly follow the trend or make impulsive investments. At the same time, we also need to pay attention to the policy trends and regulatory intensity of regulatory agencies to better grasp market opportunities and avoid risks. In this financial market full of opportunities and challenges, only by continuously learning and progressing can we stand invincible."