- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

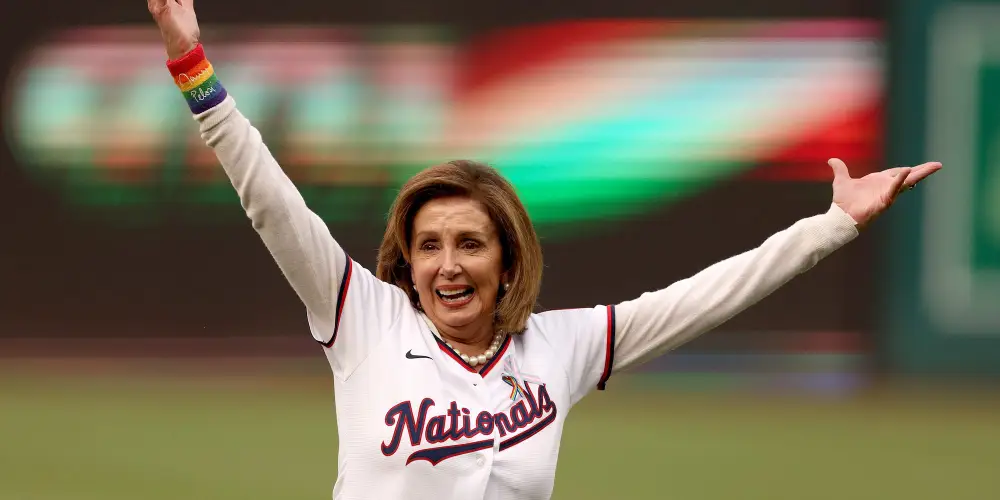

"Capitol Hill's Stock Maven" Nancy Pelosi Outperforms Buffett

For years, American legislators, notably led by Nancy Pelosi, dubbed “Capitol Hill’s Stock Maven,” have faced public criticism for allegedly leveraging their official roles to gain insider information for stock trading. One notable instance occurred on January 24, 2020, when the Senate Health and Foreign Relations Committee briefed senators in a confidential session about the coronavirus’s impending threat and its potential to become a pandemic. Immediately following the briefing, bipartisan members sold off their holdings in the hospitality and entertainment sectors and shifted their investments to biopharmaceuticals and healthcare stocks. This strategic shift came just before the U.S. stock market faced a series of four emergency halts in March, but the details of these substantial stock purchases only surfaced after the market had already reacted.

By 2022, former House Speaker Nancy Pelosi indicated that the Senate was poised to vote on legislation that would ban Congress members from trading individual stocks. Fast forward two years, Pelosi has since stepped down as Speaker, yet Congress members are still allowed to trade stocks provided they disclose their transactions within a 45-day window.

Reports emerged that on November 22, last year, Pelosi’s husband Paul invested between one and five million dollars in bullish Nvidia options. However, Pelosi did not disclose this transaction until the approach of Christmas, delaying the announcement significantly.

Following this, Nvidia’s stock prices soared in the subsequent months, significantly profiting the Pelosi family. Christopher Josephs, co-founder of Autopilot, estimates Pelosi’s recent investments around 2.5 million dollars, which yielded about 1.25 million dollars in net earnings as the stock surged over 50% in just three months.

Considering a typical U.S. Representative earns an annual salary of about 174,000 dollars, Pelosi’s gains from Nvidia alone in roughly three months amounted to several times her yearly income.

Interestingly, Pelosi’s connection with Nvidia dates back even before this incident. Weeks before a 2022 congressional vote on subsidies for semiconductor manufacturing, Pelosi’s husband had already secured over a million dollars in Nvidia bullish options. However, following criticism over the timing of these purchases, Paul, amidst increasing scrutiny, offloaded these options.

Still, the Pelosis maintain significant stock holdings, recently trading in companies such as:

- Palo Alto Networks Inc. (PANW)

- Nvidia Corp. (NVDA)

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Alphabet Inc. (GOOG)

- Tesla Inc. (TSLA)

- AllianceBernstein Holding LP (AB)

- Walt Disney Co. (DIS)

According to industry statistics, the Pelosi family’s investment portfolio surged by 83.5% in the latter half of last year alone, boasting a remarkable 65% net gain for the entire year, outperforming both the S&P 500 index’s 25% increase and Berkshire Hathaway’s 15.8% return rate. This performance solidified Pelosi as one of 2023’s most adept stock trading Congress members.

ETF fund manager Christian Cooper suggests that politicians might access insider information not available to the average investor, explaining their trading acumen. This perceived edge has spurred interest in Pelosi’s investment strategies among retail investors, who eagerly seek to emulate her success. The demand for a dedicated Nancy Pelosi stock tracker has spiked among traders on social media platforms.

Currently, the public can emulate the strategies of Pelosi and other politicians, potentially reaping significant returns.

For those outside the U.S., BiyaPay offers an alternative by allowing direct USDT deposits for trading U.S. and Hong Kong stocks and various ETFs, ensuring secure transactions without freezing withdrawals. BiyaPay recently enhanced its regulatory compliance by acquiring a New Zealand FSP license, adding to its existing U.S. and Canadian MSB licenses and a U.S. SEC RIA license.

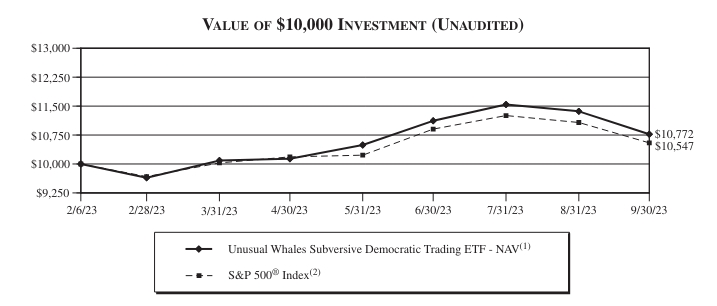

In early 2023, a New York-based firm, Subversive ETFs, launched the Unusual Whales Democratic ETF, ticker NANC, a bond market index-tracking ETF. Using big data, Subversive Capital tracks the stock transactions of Democratic Congress members and their spouses, forming a portfolio of 500-600 stocks and adjusting it based on detected trading activities. This approach, according to the firm, harnesses collective actions and public wisdom to help ordinary individuals outperform the elite.

Since its inception, the NANC ETF has flourished, boasting a 30% return by February 2024, surpassing the S&P 500 index’s 24% gain in the same period.

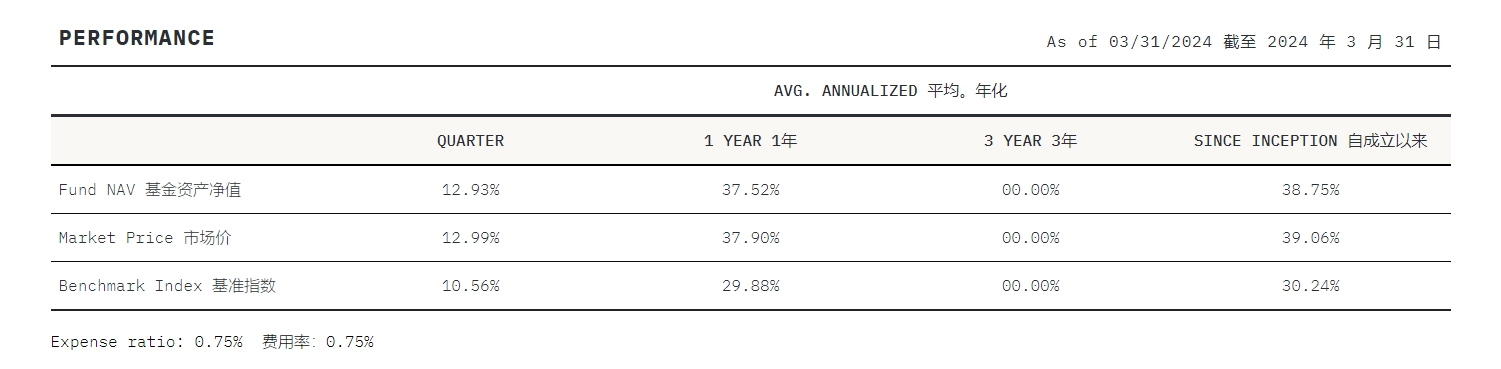

As of March 31, 2024, the fund’s annualized net asset value growth reached 37.52%.

A heavy focus on large tech stocks like Microsoft, which alone represents nearly 10% of the fund’s holdings, has driven its success.

The fund’s concentrated top ten stocks, including tech giants such as Amazon, Apple, Nvidia, Salesforce, and Alphabet, together comprise 32% of its total market value, with Crowdstrike and Netflix among its other significant investments.

As tech stocks continue to lead, Nancy Pelosi remains a formidable force in stock trading this year.

Are you ready to hop on the “Capitol Hill Stock Maven’s” winning train? Remember, investing is risky, and entering the market requires caution.