- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Amazon's Q1 financial report is impressive! AI continues to empower, investment opportunities should

Summary

- Amazon’s Q1 was a glimpse of what to expect in 2024.

- The resurgence in AWS was just one of the encouraging signs.

- Here is why Amazon is a terrific long-term buy.

Amazon’s (NASDAQ:AMZN) (NEOE:AMZN:CA) Q1 earnings were a breath of fresh air for several reasons. I was relieved to see AWS growth move to 17% year-over-year compared to 12% in Q4. Free cash flow and advertising were bright spots, and there was even a surprise operating profit internationally. Let’s take a look at what this means for 2024.

Amazon Q1 2024 Earnings

Amazon’s much-anticipated Q1 earnings dropped on April 30th and did not disappoint. Total sales rose 13% to $143 billion, and operating income rose from $5 billion in Q1 2023 to $15 billion in Q1 this year. Operating cash flow and free cash flow improved. It was an excellent quarter, despite a somewhat muted reaction from Wall Street, and propelled the stock higher, as shown below.

Amazon stock is steadily marching higher, and 2024 could be a tremendous year.

Here are three major takeaways from Q1.

AWS

2023 was a challenging year for AWS. It seems like a long time ago, but when companies were budgeting for 2023, most were battening down the hatches for a recession. Data budgets were reigned in, and Amazon actively assisted its customers in lowering their usage or moving to lower-cost plans. It hurt in the short term, but was the right move in the long run. It’s far better to keep a customer for years than to try to squeeze in a few extra dollars during lean times.

Some took the 2023 slowdown as a sign that AWS had “rolled over.” I don’t understand this thinking. We will use the cloud for storage and processing more in the future (much more!), not less. The runway is long.

Meanwhile, the artificial intelligence (AI) race commenced. Companies must leverage this technology for efficiency in a highly competitive landscape. This means experimenting with various software tools. Foundational models, like those offered by Amazon Bedrock, are an excellent place to start.

It also means increased data needs.

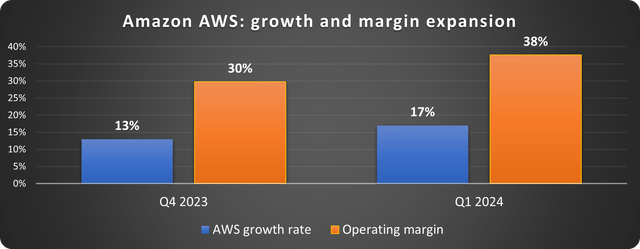

AWS sales rose 17% year-over-year (YOY) in Q1 compared to 13% in Q4. Perhaps more impressive, the operating margin rose from 30% to 38%, as depicted below.

This is a terrific sign for 2024.

Cash flow outpaces 2021

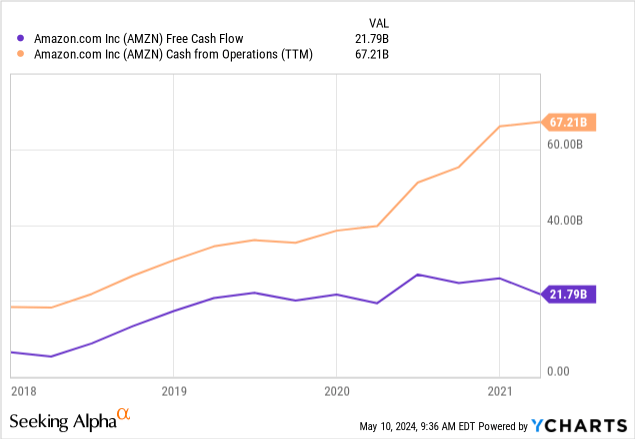

Harken back to 2020 and 2021. Stimulus cash is rolling through the economy like a tsunami and Amazon became a victim of its own success. Massive sales growth (67% from 2019 to 2021) pushed cash from operations and free cash flow to all-time highs, as depicted below.

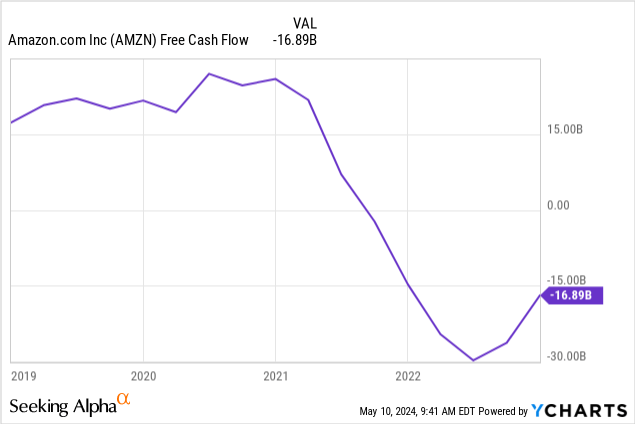

However, the growth in AWS and the need to upgrade its logistics operations meant daunting capital expenditures (CapEx). Amazon spent just $17 billion on property and equipment in 2019, but this rose to $40 billion in 2020 and then more than $60 billion in the following two years. In all, Amazon spent $218 on CapEx from 2020 to 2023. This is a gigantic number, even for a company as large as Amazon.

Around 2022,free cash flow plummeted:

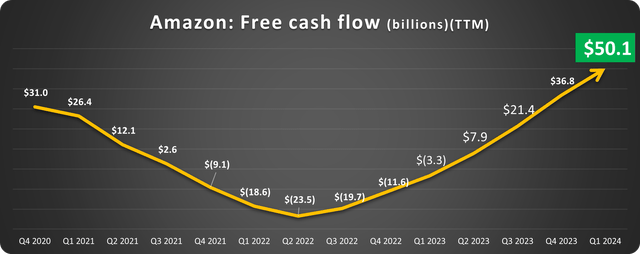

The chart below is used to track the progress of Amazon’s free cash flow:

Observing the chart, it’s clear that the first-quarter free cash flow not only recovered but also soared past its previous stimulus-driven highs. This performance also reflects the management’s praiseworthy focus on the company’s long-term value and health.

On the earnings call, management mentioned an increase in CapEx is coming in 2024. This is a bullish sign. As we see above, this upfront spending pays large dividends in a short amount of time.

High-value revenue

A few years ago, Amazon’s advertising sales weren’t even worthy of being reported separately. Now, they outpace subscription sales. This is another segment that should benefit from companies loosening budgets in 2024. The 24% Q1 growth is encouraging.

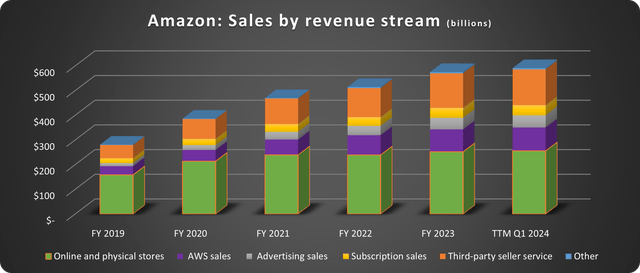

Advertising, AWS, and third-party seller services showed solid growth. As depicted below, the trend toward higher-margin sales continues.

Online and physical store sales made up 56% of revenue in 2019, just 43% over the trailing twelve months (TTMs).

New artificial intelligence tools like Amazon Bedrock and Amazon’s Trainium chip used on large language models (LLMs) could have green shoots this year as well:

I mentioned we have a multibillion-dollar revenue run rate that we see in AI already, and it’s still relatively early days. At a high level, there’s a few things that we’re seeing that’s driving that growth. First of all, there are so many companies that are still building their models…And those models consume an incredible amount of data with a lot of tokens, and they’re significant to actually go train. And a lot of those are being built on top of AWS, and I expect an increasing amount of those to be built on AWS over time because our operational performance and security, as well as our chips, both what we offer from NVIDIA, but if you take Anthropic, as an example, they’re training their future models on our custom silicon on Trainium. So, I think we’ll have a real opportunity for a lot of those models to run on top of AWS.

-Andy Jassy on the Q1 earnings call.

Is Amazon stock a buy now?

Although the value of Amazon stocks is not as incredible as it was in most of 2022 and 2023, it is still a great long-term buying opportunity. If investors are interested in investing, they can choose a more reliable securities firm for investment. For example, Jiaxin Wealth Management is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment in US stocks. You can also search for its code on the platform to make purchases. At the same time, investors can monitor stock prices regularly according to their investment strategies and buy or sell stocks at the appropriate time.

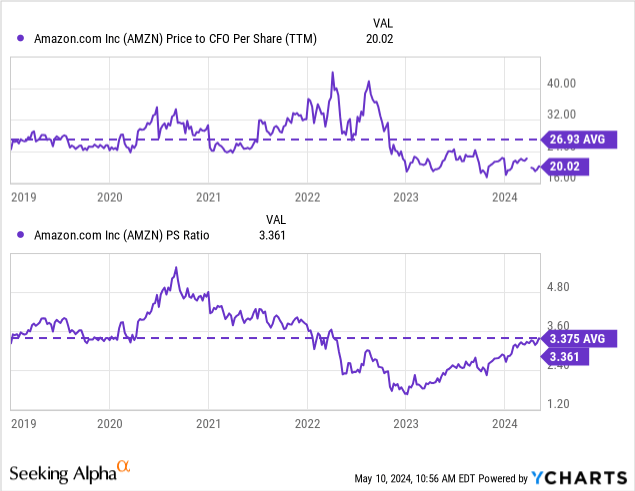

Next, let’s look at the following two valuation metrics: price-to-cash from operations ratio and price-to-sales (P/S) ratio.

The rapid rise in cash flow pushed that metric well below historical averages. The P/S ratio is back to its 5-year average; however, Amazon should trade at a higher sales valuation because of its trend towards higher-margin revenue streams and the resurgence of AWS growth and profitability.

The Q1 report reaffirmed Amazon stock as an excellent long-term investment. It’s an opportunity worth seizing for investors.

Source: Seeking Alpha

Editor: BiyaPay Finance