- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Prospects of a Federal Reserve Rate Cut Remain Uncertain, U.S. Stocks May Face a Major Test This

As we enter May, U.S. stocks are back on track. Despite Federal Reserve officials being generally cautious about rate cuts, the market still views the recent weak U.S. economic data as a strong signal for policy easing.

With risk appetite somewhat restored, the VIX index, which measures market volatility, is approaching its lowest level this year. This week, key inflation data will be released in the U.S., which could once again influence the Fed’s decisions on rate cuts, potentially triggering a new round of market volatility.

Inflation Expectations Rise, Increasing Pressure on the Fed

Following Powell’s remarks over the past two weeks, which alleviated market concerns about rate hikes, employment data revealed that April’s non-farm employment numbers were significantly below expectations—the largest discrepancy since December 2021. The unemployment rate unexpectedly rose to 3.9%, higher than the anticipated 3.8%; and the number of initial unemployment claims last week was significantly higher than expected, reaching the highest level since August 2023, further indicating a cooling job market. These factors have strengthened the market’s bets on a Fed rate cut later this year, boosting optimism about rate cut expectations and driving the continued rise of the three major U.S. stock indices last week.

As progress against inflation seems stalled, more signs indicate that high interest rates have started to fracture the U.S. economy. Data released at the beginning of May showed that U.S. consumer confidence fell more than expected, and inflation expectations for the coming year rebounded unexpectedly, sparking concerns about the U.S. economy entering stagflation. The lower-than-expected consumer confidence data serves as a warning that strong consumer spending should not be taken for granted. Furthermore, inflation expectations are also rising. This is a double blow for the Fed, painting a picture of “stagflation.”

Additionally, a study by the San Francisco Fed showed that cash savings accumulated by U.S. households during the pandemic have been depleted. Last week’s earnings reports from Amazon and Starbucks show that consumers are becoming increasingly budget-conscious, and consumer spending is expected to slow down from strong growth in 2023.

As employment and consumption cool, inflation remains stubborn. A Gallup poll showed that confidence in Fed Chair Jerome Powell is near historical lows, making him the “least favored Fed Chair in 25 years.”

Against the backdrop of stubborn inflation, several policymakers have called for maintaining high interest rates for an extended period.

Fed Governor Bowman made a strong hawkish statement last Friday, believing it inappropriate for the Fed to cut rates in 2024; she needs more time to be confident about bringing inflation down to target.

Dallas Fed President Logan noted that considering the unsatisfactory inflation data this year, it is too early to consider a rate cut.

Atlanta Fed President Bostic, although noting the slow pace of inflation decline, still believes the Fed will make one rate cut this year.

Chicago Fed President Goolsbee stated that there is little evidence inflation has stalled at 3%.

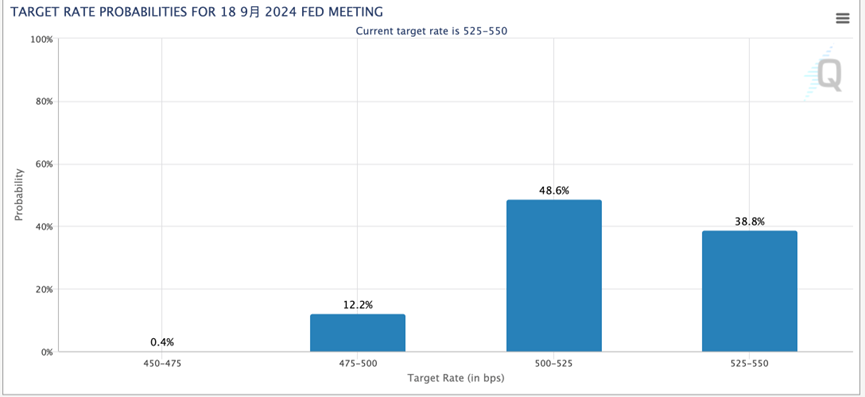

In this context, traders are betting that the Fed’s first rate cut could move from November to September, with about a 50% probability of a September cut according to the Chicago Mercantile Exchange’s Fed Watch Tool, while pricing for the entire year still suggests less than two cuts.

Citadel founder Griffin stated last week that if the Fed remains inactive in September, a rate cut might occur in December. Citibank believes that unless the U.S. enters a recession, the Fed is likely to continue its balance sheet reduction until the second quarter of 2025, which is longer than previously forecasted.

As expectations for a Fed rate cut continue to be adjusted, this is undoubtedly a significant event worth paying attention to for investors. A rate cut implies an increase in money supply and enhanced liquidity in the market, undoubtedly providing investors with more investment opportunities.

Could U.S. Stock Volatility Increase?

The three major U.S. stock indices continued their strong performance last week, with the Dow achieving eight consecutive daily gains and once again approaching the 40,000 mark. The S&P and Nasdaq achieved three consecutive weekly gains, with investors’ hopes for rate cuts igniting a preference for risk. According to FactSet, the Cboe Volatility Index (VIX) fell below the 13 mark, approaching a new low for the year.

Meanwhile, corporate earnings overall remain impressive. According to Dow Jones Market Data, among the 459 S&P 500 companies, 77% exceeded market earnings expectations. Analysts currently predict a 7.3% year-over-year increase in net profits for U.S. stocks in the first quarter, a significant improvement from the 5.1% forecast at the beginning of the month.

Fund flow data show that U.S. stock funds experienced their first weekly inflow in six weeks. Data provided by the London Stock Exchange Group (LSEG) show that investors net purchased $1.14 billion in U.S. stock funds this past week, with large-cap stocks continuing to be the focus of capital chasing, with tech giants such as Apple, Microsoft, Amazon, and Nvidia once again challenging historical highs.

However, the weakness in the consumer sector may indicate challenges faced by American households, including companies like McDonald’s, Shake Shack, Starbucks, and Yum! Brands reporting sluggish sales growth in the first quarter.

Wall Street star analyst and Morgan Stanley’s chief U.S. equity strategist Mike Wilson believes that with mixed economic signals, investors should buy into defensive sectors such as consumer staples. He said, “Overall, we can describe the consumer background as a split between stability at the high end and weakness at the low end. If indicators of business activity further slow, we might even consider increasing exposure to defensive sectors such as utilities and necessities.”

Charles Schwab wrote in its market outlook that evidence from weak employment data and corporate executives’ comments suggests that consumers are cutting spending, which indicates that the economy may eventually slow down. However, how much it will slow remains to be seen. The bullish scenario is that the recent slowdown is sufficient to bring inflation down to the Fed’s target but not enough to harm corporate earnings.

The institution believes that volatility could increase this week as the market faces two key indicators: inflation and retail sales. Given that the S&P 500 is approaching previous highs, if inflation and consumption are hot, the market could face panic and a short-term dive again. Conversely, if both align with expectations, the market might see a slight uptick and high-level fluctuations.

Investor Advice and Investment Opportunities in U.S. Stocks

Of course, there are no absolutely safe investments in the stock market; timing is everything—knowing when to enter and when to exit. Beyond figuring out how to make money, traders also need to focus on avoiding losses. Furthermore, it’s critical to closely monitor the Federal Reserve’s impact on the market to avoid making misguided decisions based on market speculation. For investors who are not familiar with technical analysis, it’s wise to wait for undervalued quality assets and purchase at the right moment.

Thousands of regulated stock exchanges around the world offer services for trading U.S. stocks to global users, such as Interactive Brokers, Jiaxing Securities, Goldman Sachs Securities, Tiger Securities, and Futu Securities. These traditional stock exchanges provide global cash inflow and outflow services, with massive amounts of capital pouring into the U.S. stock market daily.

Additionally, in recent years, due to the development of blockchain technology, new types of brokerages have emerged that allow for depositing cryptocurrencies, such as USDT, to trade U.S. stocks—BiyaPay is one such brokerage. A review of BiyaPay’s official website reveals that it not only allows for depositing cryptocurrencies (USDT, BTC, etc.) to trade U.S. and Hong Kong stocks but also supports withdrawing U.S. dollars or Hong Kong dollars to bank accounts, and then transferring funds to other brokerage platforms, effectively using BiyaPay as a tool for U.S. and Hong Kong stock transactions. Such new brokerages not only facilitate investors’ trading in U.S. stocks but also help increase the market value of U.S. stocks.

In conclusion, being cautious with timing is crucial. Acting too hastily comes at a cost. The primary mindset for stock investment is patience. Patience means facing volatility with equanimity, remaining calm and undisturbed. Investors should aim to purchase cheap quality assets rather than cheap junk assets.

Here’s to everyone enjoying their investments, with hopes that stocks soar and financial freedom is achieved sooner rather than later.