- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The new powerhouse in the gold market! Wheaton is now valued at $24.4 billion. Is this the perfect t

Source:Seeking Alpha

Editor:BiyaPay Finance

Wheaton Precious Metals (NYSE:WPM) is one of the biggest streaming companies in the world, primarily focused on the gold and silver sector. The world leader in this space was the Franco-Nevada Corporation (FNV) which has a Market Capitalization of $24.24B.

However, Wheaton Precious Metals continues to grow and now has a Market Cap of $24.41B, so these two Streaming companies are neck and neck in terms of size.

Fundamentals

Wheaton Precious Metals currently have streaming agreements for 18 operating mines with an additional 27 projects in the development stage. These income streams have been acquired by paying an upfront fee, followed by an agreed further payment upon delivery of the metal.

They are ambitious and have come a long way since their formation as Silver Wheaton Corp back in 2004.

We should take note that the competition is building up and there are now around 20 Streaming companies in this space, so organic growth may well need to be supplemented by the acquisition of some of the smaller streaming companies who have made good quality deals and could have an immediate impact on Wheaton’s bottom line.

And something that is of interest to me is that Wheaton Precious Metals has a combined employee base of 41 employees across two offices and a market capitalization of $24.03B. However, when compared to a similar sized mining company such as Agnico Eagle Mines Limited (AEM) with a market capitalization of $32.441B and they employ 15,875 staff. So it is an incredible achievement to have grown so large with such a small team.

Financials and Q1 2024 Results

Today, we will take a quick look at their recently published Q1 Financial Results, and the following is a summary of the metrics that I find of interest as an investor in this company.

We start with the President and Chief Executive Officer, Randy Smallwood who had the following to say about the company’s progress:

“Wheaton delivered a robust quarter to start the year, generating over $219 million in operating cash flows, and underscoring the effectiveness of our business model in leveraging rising commodity prices while maintaining strong cash operating margins,”

Going forward, they are forecasting production growth of 40% by 2028, having completed 8 acquisitions in 2023, which reflects their aggressive approach to identifying new opportunities and closing deals. They are forecasting annual production of over 800,000 gold equivalent ounces (“GEOs”) by 2028. So 800,000Ozs at today’s gold price of $2350/Oz would generate a turnover of approximately $1,880.000.000, which is not too shabby.

As an investor, I am pleased to see that in line with guidance they have declared a quarterly dividend of $0.155 per common share. And given their current cash position of $306 million, no debt, and a revolving credit facility of $2 billion I think we can look forward to a future of growth and profitability.

I would also draw your attention to the cost side of the business where they have reported that average cash costs in the Q1 of 2024 were down to $430 per GEO from $475 in Q1 of 2023, another step in the right direction.

Finally, we have their Earnings per share for Q1 2024 they were $0.362 and for Q1 2023 they were $0.246, again a positive improvement.

Wheaton Precious Metals has a market capitalization of $24.24B, a PE Ratio (TTM) of 46.07 and an EPS (TTM) 1.18. On a forward-looking basis it has a P/E Ratio (FWD) of 42.94 and an EPS of (FWD) 1.25. It should be noted that these figures do change on a daily basis and, as we know, a week can be a long time in the life of a Streaming Company.

Wheaton Precious Metals pays regular dividends, which adds to its attractiveness for would-be investors. The average volume of shares traded on any given day is 2,307,660, which provides enough liquidity for most speculators to open and close trades in this stock easily. The editor believes that we should choose a reputable brokerage for investment, such as the globally recognized Charles Schwab, which offers a bank account with the same name upon opening an investment account. You can deposit cryptocurrencies (USDT) into the multi-asset wallet, BiyaPay, and then withdraw fiat money to Charles Schwab to invest in U.S. stocks.

The U.S. stock market is ever-changing, and on this platform, we can search for the ticker symbol WPM to stay updated on stock price movements. Based on individual investment strategies, one can choose the right moment to buy or sell.

The 52-week trading range has been as low of $38.37 to a high of $54.47 so we do need to be prepared for a fair amount of volatility. It should also be noted that they acquire metal at a fixed delivery price so any increase in the price of the metals will provide an immediate benefit in terms of turnover and profit.

Taking a quick look at SA Quants we can see that Wheaton is Ranked in Sector 112 out of 283, and Ranked in Industry 24 out of 44, pretty much middle of the road so take care with this one.

As this Bull Market in precious metals unfolds, volatility will be the order of the day given the myriad of factors that affect the price of both gold and silver. So, in turn, we should brace ourselves for some wide oscillations of this company’s stock price. This can be seen over the last 52-week period where from a low to its high is an increase of around 42%, so it is a possibility that the stock price could halve or double in just one year of its life.

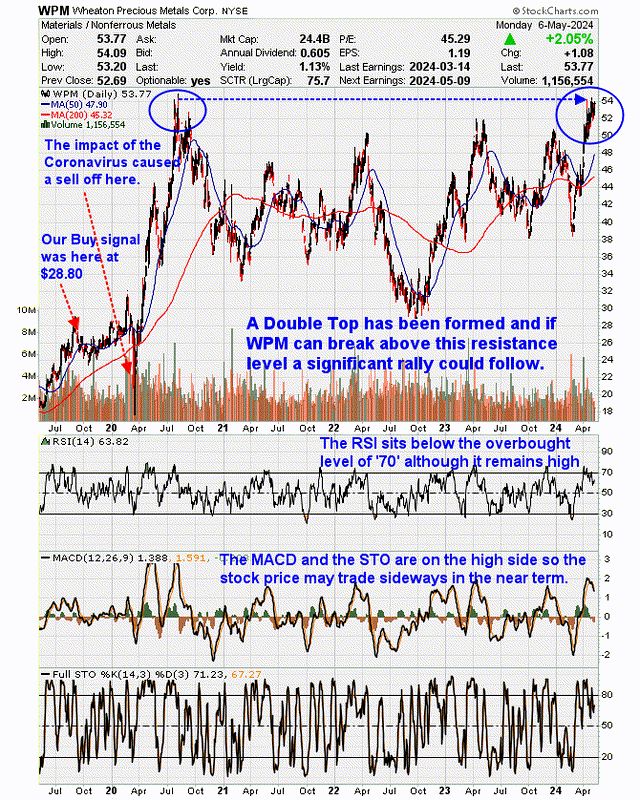

A Quick Look At The Chart Of Wheaton Precious Metals

A Double Top has been formed and if WPM can break above this resistance level a significant rally could follow.

Wheaton Precious Metals Progress Chart TA by Bob Kirtley (Stockcharts)

The RSI sits below the overbought level of ‘70’ although it remains high. The MACD and the STO are on the high side, so the stock price may trade sideways in the near term.

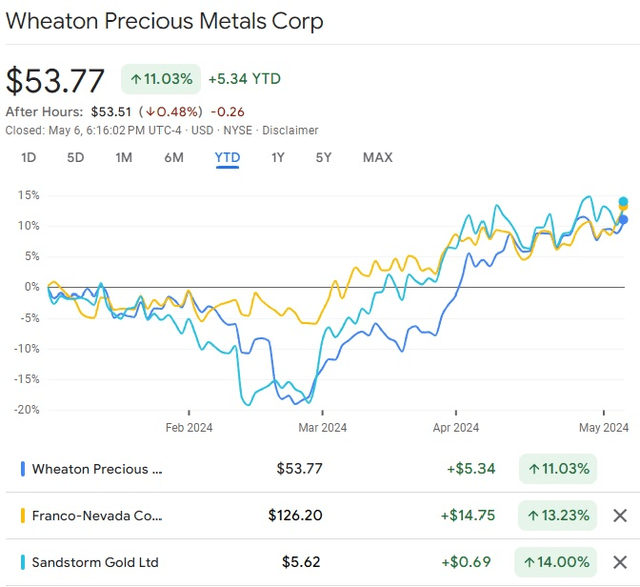

A quick look at the Chart Of Wheaton Precious Metals compared with Franco-Nevada Corp, Sandstorm Gold Ltd.

Wheaton Precious Metals Compared To Similar Stocks (Google Finance)

This chart compares three similar stocks in the gold and silver space on a YTD basis. It shows the downward trend until around March 2024, when a reversal took place and a recovery began. This reversal is largely due to the price increases of the underlying commodities of gold and silver. Gold, for example, was trading at $2000/Oz in March, and today it is trading at $2331/Oz registering a gain of 16%. Over the same period silver rose from $22/Oz to $28/Oz registering a gain of 27%

The three stocks shown above have followed along at slightly under the same rate of progress, which surprises me as I expected them to outpace the physical metals. As readers know patience is something I have difficulty managing and maybe the stocks are just lagging behind for now and greater gains lie just ahead of us.

Conclusion

Wheaton Precious Metals has positioned itself as the ‘go-to’ streaming company in the precious metals space and should benefit greatly from increased profits and capital gains over the near to mid-term.

Their main source of income is, of course, dependent upon the underlying commodities of gold and silver which are doing very well right now.

Their relentless approach to deal making has catapulted a once small silver streamer to a market leader in this tiny sector of the market.

The precious metals market is volatile and in turn the associated stocks suffer from wild oscillations, so wear your toughest hard hat and dig in for a white-knuckle ride.