- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

After ten consecutive gains, did the Hong Kong stock market "stall"? Is it a rebound or a reversal?

Recently, the Hang Seng Index achieved ten consecutive gains, setting a new record for the longest consecutive gains since 2018. After being criticized for three years, Hong Kong stocks have finally regained their pride!

The week before the International Workers’ Day holiday (April 22 to April 26), the Hang Seng Index surged 13.43%, the largest weekly increase since October 2011.

During the International Workers’ Day holiday (May 2nd to May 3rd), despite the absence of southbound funds, Hong Kong stocks continued to rise. Among them, Hang Seng Technology rose sharply by 7.31%, while the Hang Seng Index and Hang Seng State-owned Enterprises rose by 4.01% and 4.36% respectively.

If calculated from the low point of the year, the Hang Seng Index, Hang Seng State-owned Enterprises, and Hang Seng Technology have accumulated gains of 24.18%, 31.40%, and 33.33% respectively, all of which have entered the technical bull market (data as of May 6th).

HSI Market Trend, Chart BiyaPay App

The speed of the increase is beyond the imagination of most people. Some friends are envious when they see others making money. Of course, the “disciples of Gai Bang” (those who have bought Chinese concept stocks) are even more excited. Is it really possible to get out of the trap?

What happened to the Hong Kong stock market? Did this rise really reverse, or is it just a rebound during the decline?

Friends who understand Capital Markets must know that as an internationalization market, the pricing of Hong Kong stocks is not only influenced by domestic fundamentals, but also has a great relationship with domestic and foreign capital.

1. Internal and external funds are awesome

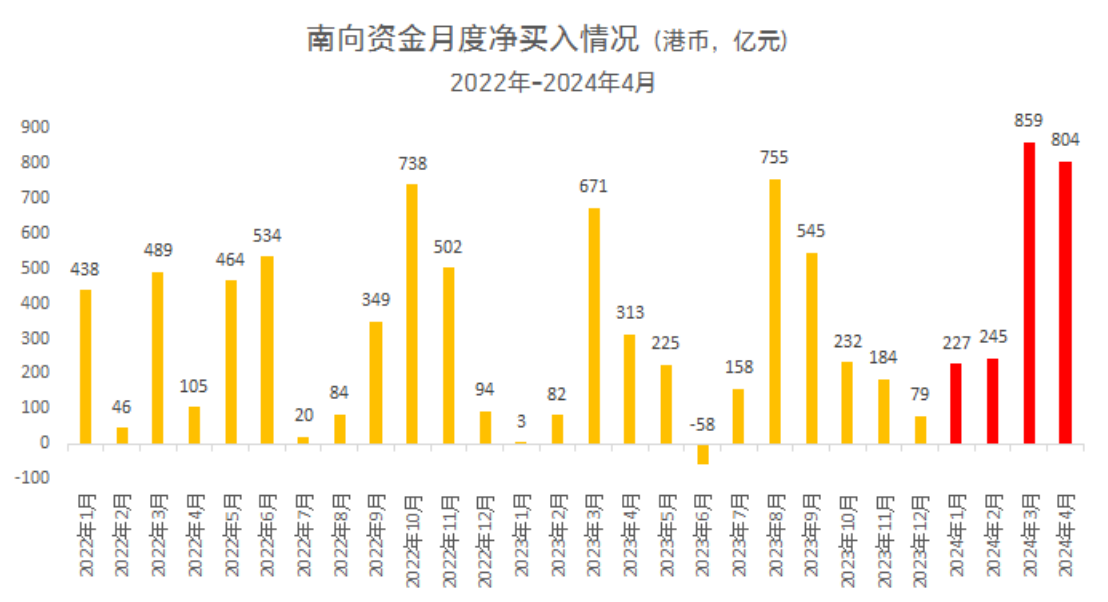

Since the beginning of this year, southbound funds have significantly accelerated, which is an important reason why the Hong Kong stock market has started to strengthen during the same period.

According to Wind data, as of April 30, the cumulative inflow this year has reached 213.50 billion Hong Kong dollars, exceeding two-thirds of the level for the whole year of 2023.

Not only domestic capital is awesome, but foreign capital also favors Hong Kong stocks.

The Bank of Japan started the process of raising interest rates on March 19th this year, which led to the rapid depreciation of the yen. Coupled with the shock pattern of Nikkei and US stocks, overseas investors began to withdraw from US and Japanese stocks and gradually replenish Hong Kong stock assets under the promotion of global asset positioning rebalancing.

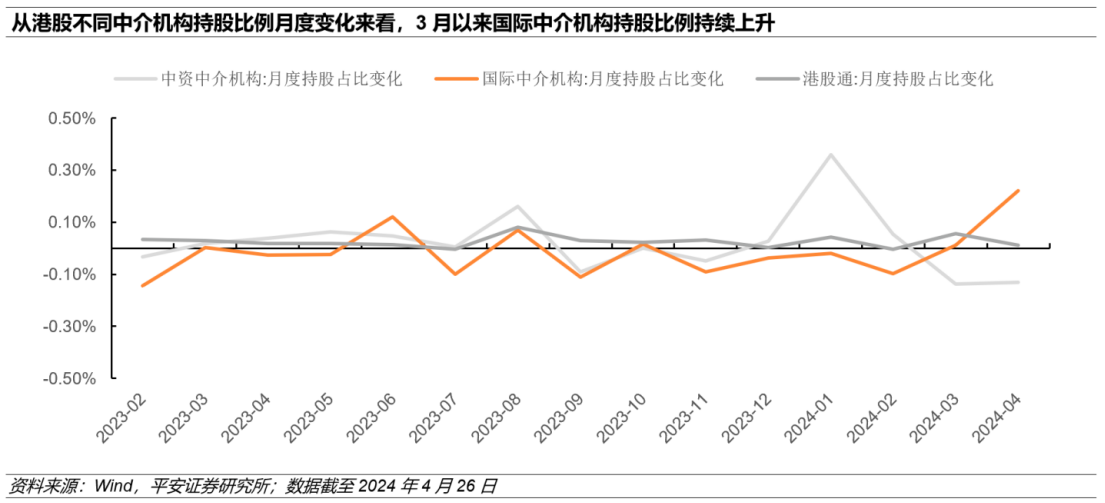

From the monthly changes in the shareholding ratio of different intermediaries in Hong Kong stocks, the rise in the shareholding ratio of international intermediaries since February has been particularly rapid, indicating that international funds have turned their attention to the potential Hong Kong stocks.

At the same time, even during the International Workers’ Day holiday when southbound funds were absent, Hong Kong stocks continued to perform relatively strongly, which may once again confirm that this round of market is mainly driven by non-mainland funds such as local funds and foreign capital in Hong Kong.

2. Favorable policy catalysis

Since the beginning of this year, favorable policies to optimize the cross-border interconnection mechanism and promote the coordinated development of the two capital markets have been continuously implemented, further catalyzing the rapid rise of the Hong Kong stock market.

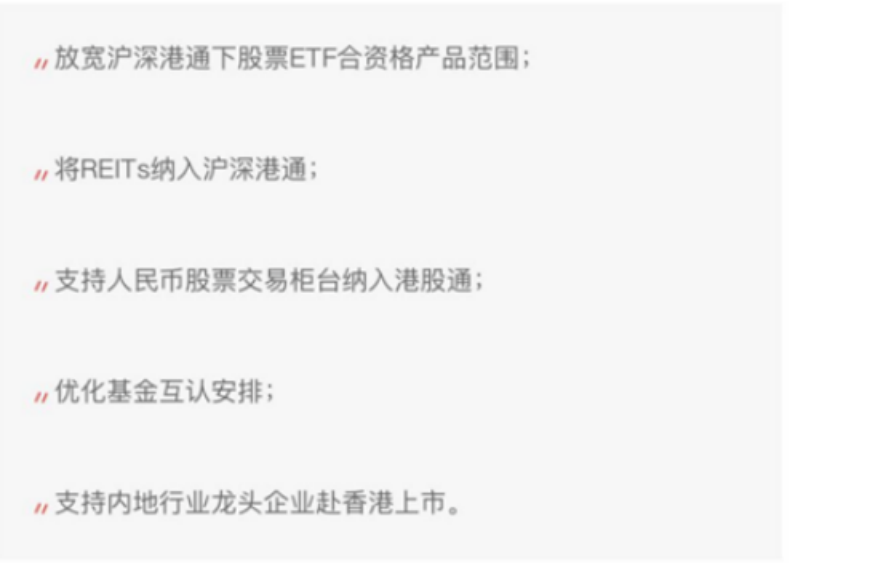

On April 19th, the Securities Supervision Commission issued five measures for Capital Markets cooperation with Hong Kong.

The first three are to relax the restrictions of the Shanghai-Shenzhen-Hong Kong Stock Connect, and the last one is to improve the financing effect of Hong Kong stocks. The policy directly targets the two major pain points of poor liquidity and financing difficulties in Hong Kong stocks.

Not only that, HKMA is also increasing liquidity with practical actions. On April 22nd and 23rd, HKMA injected 525 million Hong Kong dollars and 500 million Hong Kong dollars liquidity to banks through the discount window, injecting new vitality into the market.

3. Cheap valuation and high cost performance

Setting aside the recent rise, everyone is aware of the previous performance of the Hong Kong stock market. After experiencing a rapid rise recently, the Hong Kong stock market is still relatively cheap.

As of May 3rd, the historical valuation percentiles of Hang Seng Index and Hang Seng Technology Index were only 9.0% and 11.1% respectively. Compared to the valuation percentiles of major overseas stock indexes, the Hong Kong stock market is a valuation depression. The relatively “cheap” Hong Kong stock market provides investors with more cost-effective investment options, and investment enthusiasm is easily ignited.

So, how should I invest in Hong Kong stocks?

The editor suggests that investors choose investment channels that suit their risk preferences. You can try BiyaPay’s professional US/Hong Kong stock trading platform, which supports real-time online trading of US and Hong Kong stocks without the need for overseas bank accounts. If you have a brokerage account and an overseas bank account, you can use BiyaPay as a deposit and withdrawal tool for US and Hong Kong stocks. You can exchange digital currency (such as USDT) for US dollars or Hong Kong dollars, then withdraw the funds to your personal bank account, and finally inject the funds into the brokerage account. This method can be said to be fast, unlimited, without any deposit and withdrawal troubles, and you can also keep track of the market trends of US/Hong Kong stocks at any time.

How long can the new bull market of Hong Kong stocks go?

A few days ago, the Hong Kong stock market failed to continue its upward trend. Is this wave of market trend about to come to an end?

From historical data, compared to the previous market trend, there may still be room for Hong Kong stocks to rise.

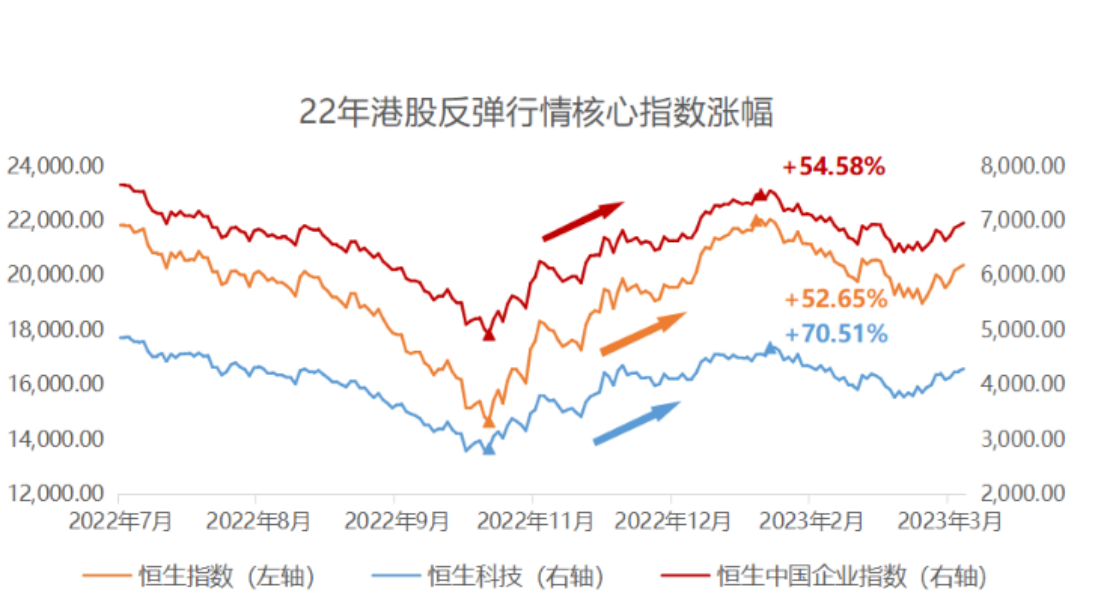

At the end of October 2022, influenced by favorable domestic policies, the Hong Kong stock index showed a significant upward trend. By January 27, 2023, it reached a phase high, with an increase of 52%. The Hang Seng Technology Index increased by more than 70%.

The current performance of the Hong Kong stock market is strong. If the market sentiment continues to warm up after favorable policies are introduced, the elasticity of the Hong Kong stock market is often greater, and the increase may be more significant.

Therefore, overall, there is still room for Hong Kong stocks to rise, but we cannot predict the market prospects. Short-term investors may wish to wait and see, while for long-term investors, as the value of Hong Kong stocks is gradually being rediscovered, it may be a good time for allocation!