- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The AI wave continues. Which of the two tech giants, Microsoft and Apple, is more worthy of investor

Investing in the market is a matter of doing comparative analysis and choosing the best investment against your investment goals given myriad options. Today, we are going to compare Microsoft Corporation (NASDAQ:MSFT) to Apple Inc. (AAPL). Both are tech giants and two of the largest companies in the stock market based on capitalization. Both stocks trade roughly 28 times forward earnings.

APPL、MSFT Market Trend, Chart BiyaPay App

However, Microsoft seems clearly the better stock to own over the near and medium term at current trading levels. Here are four core reasons for that assessment.

Growth Prospects:

Microsoft clearly has the better growth prospects, at least for the next couple of years. The current analysis firm consensus has Apple’s earnings growing 7.5% in FY2024 on revenue growth of just one percent. They predict profits improving by 9.5% on just over six percent sales growth. On the other hand, Microsoft is projected to clock in with 20% earnings growth in FY2024 on a 15% rise in revenues before adding earnings gains of 12.5% on just over 14% revenue growth in FY2025. Microsoft is the clear winner as far as growth comparisons are concerned.

Focus on AI:

As I noted in my recent article about Apple earlier this week, the current analyst consensus is that the tech giant from Cupertino is playing “catch up” in the artificial intelligence, or AI, space compared to its large rivals. This is important, as AI has the potential to be the biggest paradigm shift for the economy since the emergence of the Internet in the 90s. It has also been a huge driver of the gains in the market in recent quarters. Based on comments from the company’s recent fiscal Q2 earnings call, Apple management seems to be taking a “hybrid” approach to AI, which doesn’t involve major investments like building new data centers.

Microsoft, on the other hand, seems to be going more whole hog building out its AI capabilities. It is announcing a $3.3 billion investment to build out a new artificial intelligence data center in Wisconsin this week. The company invested $1 billion in OpenAI, creator of the ChatGPT chatbot, way back in 2019. It has extended and invested another more than $10 billion in this partner since. Microsoft seems to have the clear lead over Apple in AI.

Exposure :

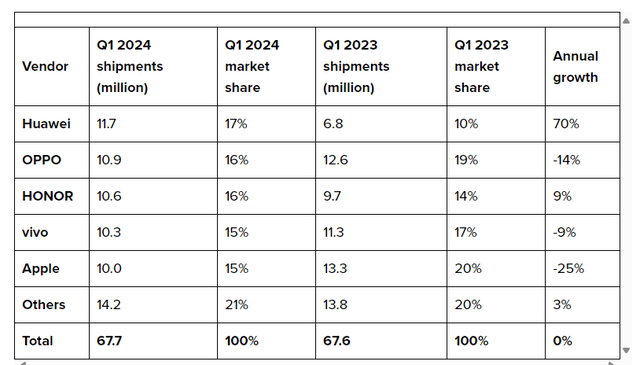

Apple outsourced a good portion of its manufacturing capacity to China more than a decade ago and has massive exposure in the country. It also did over $70 billion in sales in China in 2023. No tech company has more exposure to China than Apple. Apple’s market smartphone market share fell significantly in the first quarter of 2024, but still is at 15%.

The company has started to transfer some of its manufacturing business to India and other places, but in the foreseeable future, it will still have a huge business in China. However, the competition in the Chinese smartphone market is becoming increasingly fierce. Local brands such as Huawei, Xiaomi, OPPO, and vivo have gradually won the favor of consumers with their in-depth understanding of the local market and customized strategies. These brands have great advantages in product innovation, pricing strategy, and channel layout, which has brought huge pressure to Apple. Under the same conditions, Chinese consumers tend to prefer brands with lower prices and more local elements. The sales of Apple products in China have been affected, and the decline is more obvious.

Margins:

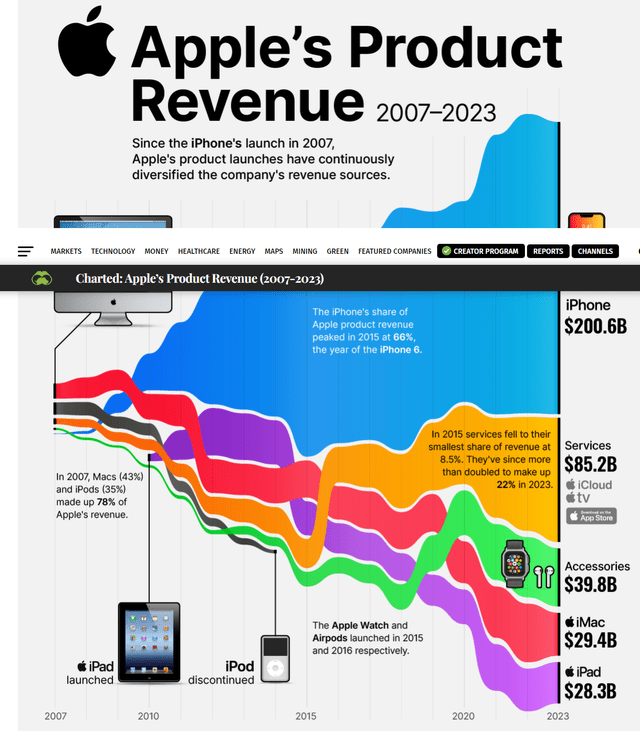

Microsoft is primarily a software company, while Apple is mostly a manufacturing company. Margins are historically higher for software, which is why the highest margin part of Apple is its large App Store/iCloud business.

That is unlikely to change for the foreseeable future, giving Microsoft a sustainable advantage when it comes to higher margins. To put in perspective, Apple had a gross margin of 36.6% in 1Q2024 for its product revenues. For Services? 74.6%.

Conclusion:

Given these four factors, although the current forward Price-To-Earnings Ratio valuations of Microsoft and Apple are roughly the same, Microsoft seems to be a better stock investment choice than Apple. If investors want to seize the wave of artificial intelligence and enter the stock market, they are currently in a wait-and-see state. They can focus on Microsoft, a stock with potential, and go to the multi-asset trading wallet BiyaPay to search for its stock code to monitor market trends. If there is a suitable opportunity, they can directly deposit U into the platform to exchange for US dollars, without the need for offshore accounts for direct investment. In addition, investors can also bind the offshore account of Jiaxin Wealth Management in BiyaPay, withdraw US dollars to Jiaxin for US stock investment, withdraw on the same day, and receive the money on the same day, without being caught up in the market.

Source: Seeking Alpha

Editor: BiyaPay Finance