- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

PDD stock price exploded by 120% in one year! Can I still enter now? Where are the risks?

Summary

-

PDD Holdings is up more than 120% in the past year, as its SA Quant Rating has continued to rise, driven by improved Momentum and EPS Revision factor grades.

-

PDD revenue TTM has grown almost 90% YoY, EBIT +93%, and EPS +87% while levered FCF margin is at 33% and ROE of ~40%.

-

PDD crushed earnings seven out of the last eight quarters, showcasing monster profitable growth, with EPS projected to rise 48% YoY in Q124 and revenue +98%.

-

Although PDD is a fast-growing company, its stock price is stable, evidenced by a 60M beta of 0.68, significantly less volatile than the market.

-

PDD Holdings’ robust profit margins, excellent earnings growth potential, strong balance sheet, solid momentum, and stability make it an SA Quant Team Strong Buy.

-

I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.

PDD Holdings Inc. (NASDAQ:PDD) is a rapidly growing cash-rich profit-making juggernaut, up more than 120% in the last year, with consensus earnings targets continuing to rise.

PDD’s Strong Buy Quant Rating increased from 4.61 to 4.95 since reporting earnings and being named a top Chinese stock by SA’s Quant Team on 3/20/24. Driven by Momentum and EPS Revision factor grades increases, PDD has surged nearly 20% in the past month, crushing the S&P 500 and the Consumer Discretionary select sector index (XLY).

Revenue grew almost 90% in the trailing twelve months, EBIT +93%, and EPS +87%. EPS is expected to rise 30% in FY24 and revenue nearly 50%, according to consensus estimates. Due to continuing strong momentum, in addition to mind-boggling growth at every level, and strong long-term earnings potential based on key forward quant metrics and consensus estimates, the SA Quant Team reiterates its Strong Buy rating.

PDD Holdings, Inc.

-

Market Capitalization: $192.54B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 5/7/24): 4 out of 516

-

Quant Industry Ranking (as of 5/7/24): 1 out of 30

PDD operates Pinduoduo, a Chinese e-commerce platform that offers products in various categories, including agricultural produce, apparel, electronic appliances, furniture, personal care items, and auto accessories, among others. PDD also owns Temu, an online marketplace and mobile app founded in 2022.

PDD is #1 among quant-rated Broadline Retail stocks and #4 in the Consumer Discretionary sector, up more than 120% in the past year and ~+18% in the past 30 days.

SA Quant Ratings aim to provide an instant stock characterization by comparing over 100 metrics vs. the sector and grading them across five factors: Valuation, Growth, Profitability, Momentum, and EPS Revision. PDD’s Strong Buy Quant Rating has grown from 4.61 to 4.94 in the past 60 days, driven by improving momentum and earnings revisions.

PDD has A’s in Growth, Profitability, Momentum, and EPS Revisions and a ‘D+’ in Valuation. PDD has a Buy rating from SA Analysts, a Strong Buy rating from 34 of 43 sell-side analysts, and a Wall Street average price target implying ~30% upside.

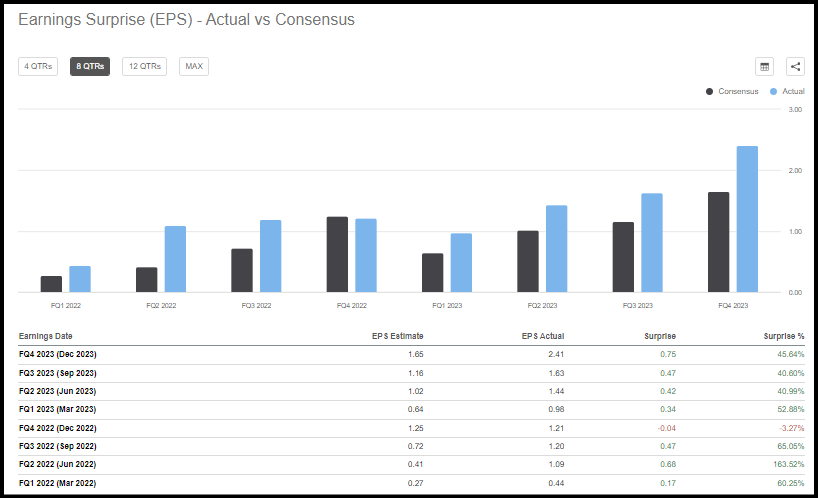

PDD Earnings Performance & Projections

PDD crushed earnings expectations in seven of the last eight quarters. In Q423, PDD EPS of $2.41 beat by $0.75, and revenue of $12.35 billion (+113.26% YoY) beat by $1.50 billion. 62% of PDD revenue in FY23 derived from online marketing services and 38% from transaction services.

PDD Earnings Surprises

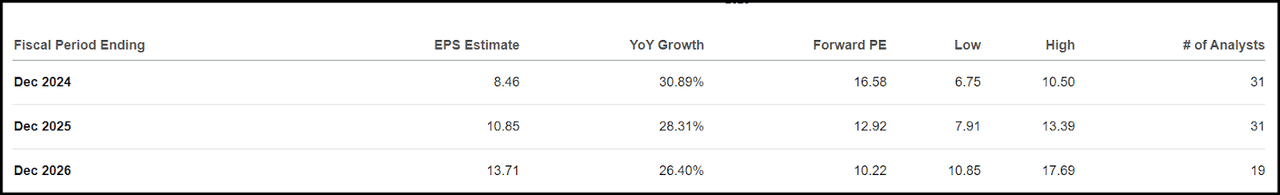

PDD reports Q124 earnings on 5/29/2024, and expectations are high, with consensus estimates projecting EPS to grow 48% YoY. PDD’s EPS is expected to rise 30% in FY24 to $8.46 and revenue nearly 50% to $51.41 billion, according to consensus estimates.

PDD Consensus EPS Targets

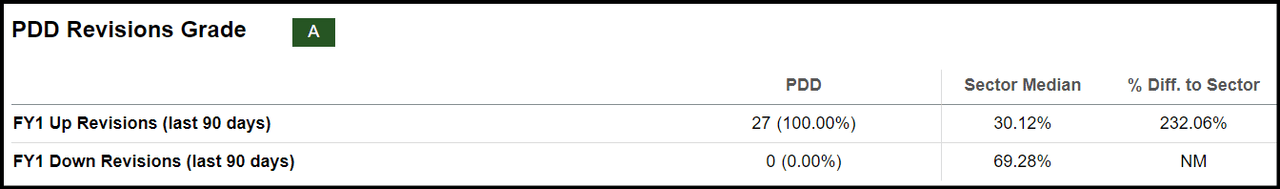

PDD has 27 up revisions and no down revisions in the last 90 days, with the EPS target for FY24 revised upward by 15% during the same 3-month period.

PDD EPS Revisions Grade

PDD Stock Profitability & Growth

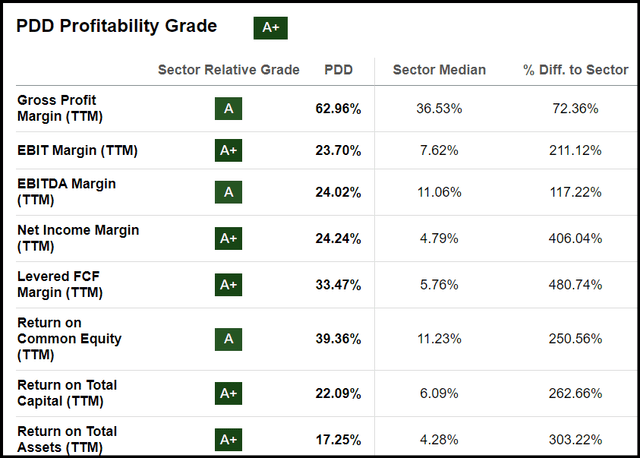

PDD blows away the sector in Profitability with an ‘A+’ Factor Grade, showcasing ~62% gross margins, 23.7% operating margins, and a net income margin of 24%. From a relative standpoint, even more impressive is the levered FCF margin of 33%, more than 480% above the sector median. PDD also outperforms the sector in ROE (39%), ROTC (22%), and ROA (17%), indicating efficient use of shareholder equity and effective deployment of total capital.

PDD Profitability Grade

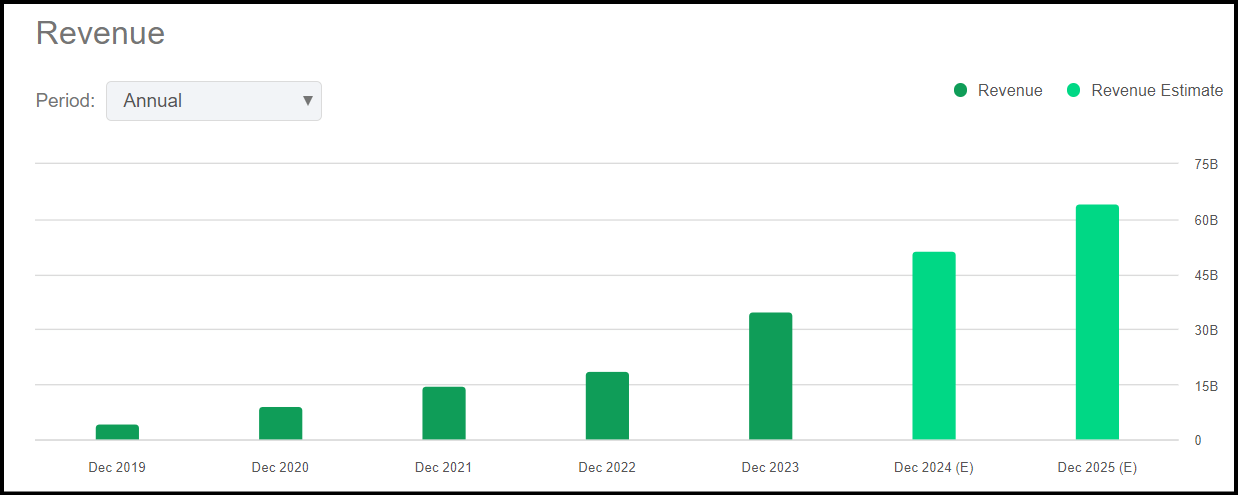

PDD has exhibited profound growth at every level and has strong long-term potential upside based on key forward quant metrics. PDD’s annual revenue boomed by a factor of eight since 2019, from $4.33 billion to $34 billion, while consensus targets project annual sales to reach $64 billion in 2025.

PDD Annual Revenue 2019-2025

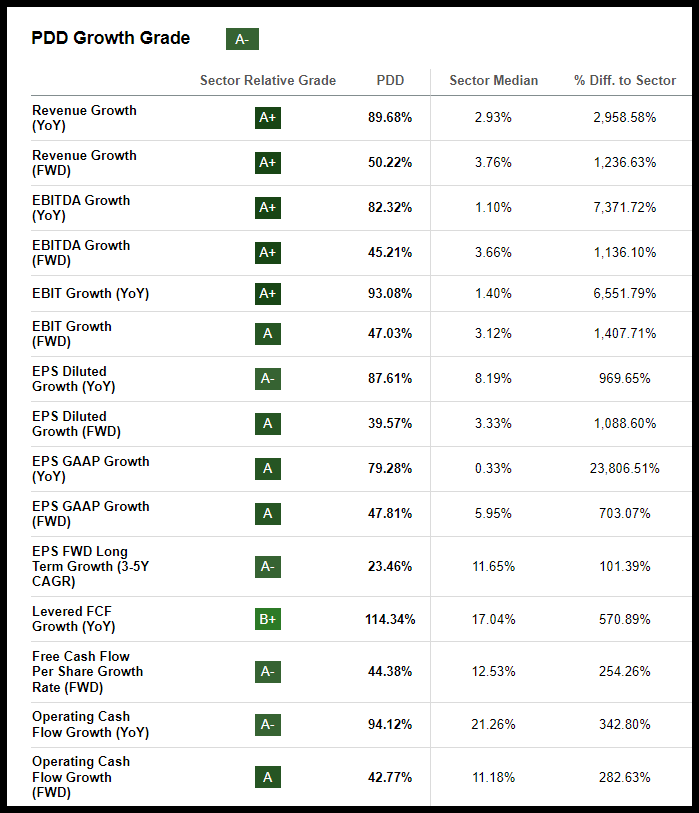

Levered FCF grew an amazing 114% YoY, FCF per share growth rate FWD is at an astounding 44% vs. 12% for the sector, and operating cash flow growth FWD is 42%. EBIT is up 93% YoY vs. the sector’s 1.5%, and forward growth is at 47% vs. 3% for the sector. YoY EPS growth is 87%, growth FWD almost 40%, and EPS long-term growth FWD (3-5Y CAGR) is 23%. PDD has a D+ in Valuation, but PEG FWD ratio of 0.70 is at a 54% discount to the sector median.

PDD Growth Grade (SA Premium)

PDD Stock Risk Factors

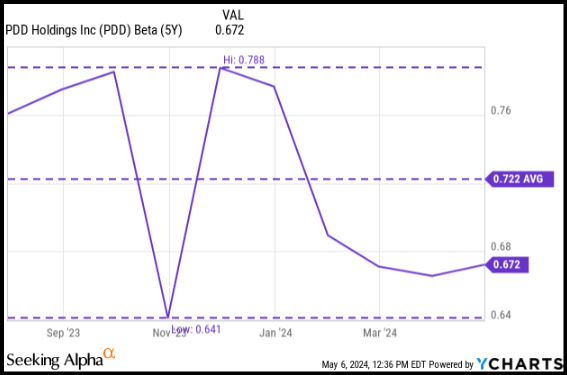

The overall SA Quant Rating also takes into account a stock’s risk, in addition to size, which are not included among the five factor grades. PDD’s 60M beta of 0.68 and 24M beta of 0.44 indicate the stock price is significantly less volatile than the market. PDD’s 60M beta has not exceeded 0.78 in the past five years, with an average of 0.72.

PDD 60M Beta - 5Y History

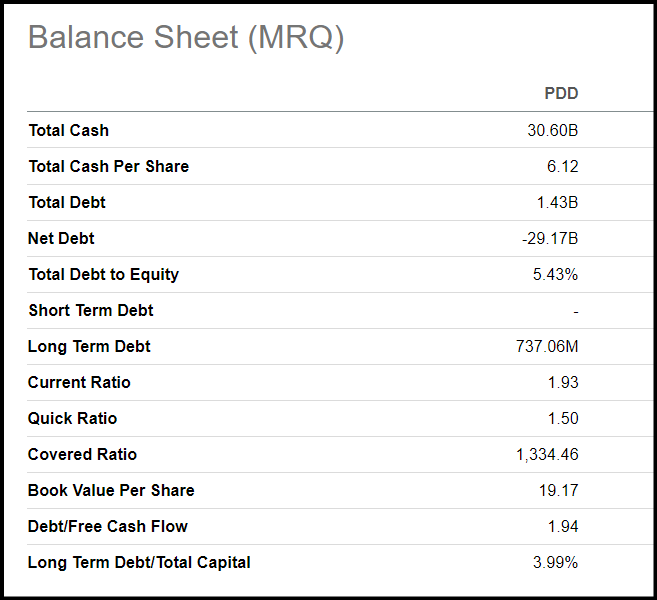

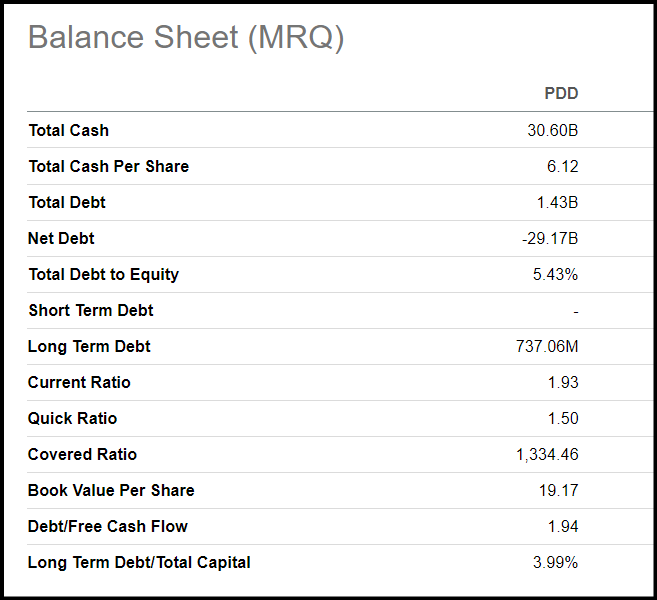

PDD has over 28.5 million shares sold short, ~2% of 1.39 billion total shares outstanding, less than the select sector average of 5.43% in Q124, according to an analysis by S&P Global Market Intelligence. PDD has a strong balance sheet with total cash of $30 billion vs. $1.43 billion in total debt. PDD has a D/E ratio of 5%, long-term debt to total capital ratio of almost 4%, and a mind-boggling covered ratio of 1,334 (operating income to debt payments). PDD’s Altman Z score, calculated based on profitability, leverage, and liquidity metrics, of 5.24 indicates PDD is in sound financial health and unlikely to go bankrupt.

PDD Balance Sheet

Holders of American Depositary Shares (ADS) face the risk of U.S. regulators delisting PDD for failing to meet SEC requirements, including the ability to inspect auditors based in China, according to PDD’s annual filing. PDD Holdings Inc. conducts business through a variable interest equity (VIE) structure with respect to company operations based in China. PDD does not own the VIE or its subsidiaries but operates through contractual arrangements that could be restricted or disallowed by Chinese authorities, which would have an adverse impact on PDD’s financial condition. The VIE and its subsidiaries accounted for 45.7% of PDD total revenues in 2023. PDD’s global operations are also exposed to currency exchange rate fluctuations, compliance with local laws, technology failure, and potential supply chain disruptions resulting from natural disasters and geopolitical conflict.

Concluding Summary

Concluding Summary

PDD Holdings has demonstrated explosive momentum and profitable growth and has strong earnings potential based on key quant forward metrics and consensus estimates.

The stock is up more than 120% in the past year, revenue is up almost 90% YoY, EBIT +93%, and EPS +87%, while LFCF, net income, and operating profit margins TTM crushed the sector. Showcasing 'A’s in growth, profitability, momentum and EPS revision quant factor grades, and a PEG FWD ratio of 0.70, the SA Quant Team rates PDD as a Strong Buy. If you’re seeking a limited number of monthly ideas from the hundreds of top quant Strong Buy rated stocks, the Quant Team’s best-of-the-best, consider exploring Alpha Picks.It is recommended that you use the multi-asset trading wallet BiyaPay - a multi-asset trading tool that can invest in US stocks/Hong Kong stocks and also supports buying and selling cryptocurrencies. Search its stock code PDD to monitor the market trend (as shown in the picture below), and choose the right time to get on board. . You can also deposit digital currencies, such as USDT, to BiyaPay, and then withdraw fiat currencies to other securities to invest in US stocks.

BiyaPay

Source: Seeking Alpha

Editor: BiyaPay Finance