- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Nvidia drives AI stocks sky-high, ETFs rake in cash, and this AI ETF stock deserves investor attenti

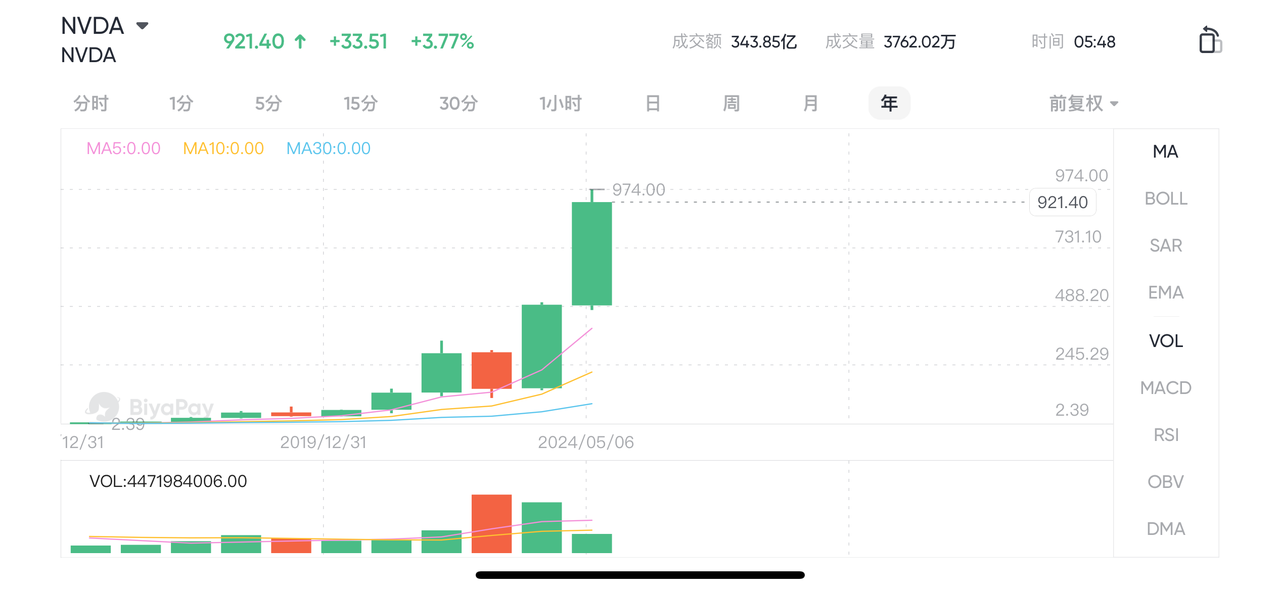

The importance of generative AI is increasingly significant, and Nvidia’s stock price has surged

The AI wave is heating up. Not long ago, people had limited exposure to this technology. Now, it seems omnipresent. It’s almost certain that the presence of generative AI in our lives will continue to grow. In fact, many experts predict that this growth will accelerate significantly. Business intelligence firm Markets and Markets predicts that by 2024, the generative AI market will reach about $21 billion and, by 2030, will skyrocket at a 37% compound annual growth rate (CAGR) to $137 billion.

As a leader in graphics processing units (GPUs), Nvidia assists data centers in handling the immense computing demands that generative AI platforms impose. Eager to benefit from the growth of generative AI, investors have flocked to Nvidia stock. Over the past three years, as investors have rushed to invest in the artificial intelligence (AI) sector, Nvidia’s stock (NASDAQ: NVDA) has soared by 467%.

NVDA stock performance trends,BiyaPay App

Chasing the AI wave fervently is not the only option

Currently, Nvidia’s stock is at a high, and those looking to add AI exposure to their portfolios might feel they have missed the best time to invest in it. Meanwhile, they may feel overwhelmed by the variety of other available options.

However, buying Nvidia stock is not the only option for investors looking to dive into the artificial intelligence sector and catch the wave of technological advancement. For many investors, especially those who feel they missed the best timing to invest in Nvidia, there are various other options available.

Today, there are numerous ETFs centered around artificial intelligence on the market. These AI ETFs come in many types, covering a wide range from investing in the biggest winners in artificial intelligence to more complex themes like robotics technology and voice generation. Choosing a promising AI ETF can also satisfy investment needs and achieve asset appreciation.

I recommend the Roundhill Generative AI & Technology ETF (NYSEMKT: CHAT), which covers all the bases needed by these investors. Besides holding a substantial position in Nvidia, it also includes many other AI-focused companies that stand to benefit from the growth in generative AI, machine learning, and large language models.

NVDAstock performance trends,BiyaPay App

This AI ETF has broad prospects

The Roundhill Generative AI & Technology ETF is heralded as the “world’s first ETF focused on generative AI.” While there are many AI-themed ETFs available, Roundhill Investments claims that CHAT is the first to specifically invest in companies related to generative AI. CHAT targets several sectors associated with generative AI, including software, cloud infrastructure, network infrastructure, and services. Citing research from Goldman Sachs, Roundhill Investments estimates that AI could contribute $7 trillion to global economic growth over the next decade, with a potential market size of $120 billion for generative AI enterprise software alone.

The fund consists of 46 holdings, providing investors with broad exposure to leading companies poised to advance generative AI. Nvidia plays a significant role in the ETF with a 10.1% weighting, making it the largest holding. This provides some exposure for those cautious about investing directly in Nvidia stock. Additionally, Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) are the second and third largest holdings, respectively.

Nvidia’s GPUs support generative AI computing, while Microsoft develops AI solutions like Copilot, an AI assistant integrated with various Microsoft products. The company’s influence in AI is further expanded through its multibillion-dollar investment in ChatGPT. Similarly, Google incorporates AI into products like Gemini, a generative AI chatbot, and operates the DeepMind Lab to explore the development of artificial general intelligence.

Adobe (NASDAQ: ADBE), ranked fourth, has its generative AI application Firefly, which is usable across various Adobe products like Express, Photoshop, and Illustrator. Meta Platforms (NASDAQ: META) holds the fifth position with its Llama 3 large language model, which can be developed into generative AI applications.

These companies, leading the AI field, continuously innovate and seize opportunities in AI development, committed to driving transformation in the AI sector with promising future prospects.

Is CHAT worth buying for investors?

Undoubtedly, given Nvidia’s solid position as a GPU developer, its stock is currently very attractive, but it is not the only generative AI option on the market. Moreover, with its recent rise, Nvidia’s price-to-operating cash flow (OCF) ratio has reached 69 times, which may not be appealing to those investors looking to avoid high valuations.

For investors who are aware of this and seeking comprehensive exposure to the industry while in a state of indecision, the Roundhill Generative AI & Technology ETF is indeed a good choice. It offers a unique opportunity for broad exposure to generative AI and somewhat mitigates the risk of Nvidia’s high valuation.

Seeing this, if you are interested in this AI ETF, you can head to the multi-asset wallet BiyaPay, where you can regularly monitor stock trends on the platform and jump in at the right time. At BiyaPay, you can deposit funds in USD without needing an offshore account to directly invest on the platform; additionally, investors can link their Charles Schwab offshore accounts to BiyaPay, allowing for USD withdrawals to Charles Schwab for investment, with same-day withdrawals and deposits without missing the market trend.

Finally, a reminder that all investments carry risks, so investors should consider carefully and hopefully everyone will see favorable investment returns!

Source: Finance Yahoo

Editor: BiyaPay Finance