- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

As one of the seven giants of the US stock market, is Google still worth investing in?

Google is one of the world’s major internet companies. Its business scope covers the world. It has developed from a search engine to cover multiple computer fields such as search, email, cloud storage, AI, video, and gaming, and has also developed into investment, health, and automotive industries. Its namesake search engine is the world’s largest search engine, occupying the vast majority of the market share. On February 16, 2024, Google announced the launch of Gemini 1.5. In 2022, Google ranked 17th on the Fortune 500 list and 11th on the Forbes Global 2000 list. According to data released in 2016, on average, people on Earth search on Google 5.40 billion times a day.

On Friday (3rd) Eastern Time, the three major US stock indexes collectively rose. As of the close, the Dow Jones Industrial Average rose 1.18%, the Nasdaq rose 1.99%, and the S & P 500 rose 1.26%. With the full surge of US stocks, is Google, as one of the seven giants, still worth investing in?

Financial report released

Alphabet Inc. is the holding company of Google and its subsidiaries, which was restructured and established in 2015. Google was founded in California on September 4, 1998 and re-registered in Delaware in August 2003. Alphabet is involved in various fields, including technology, life sciences, capital investment, and research.

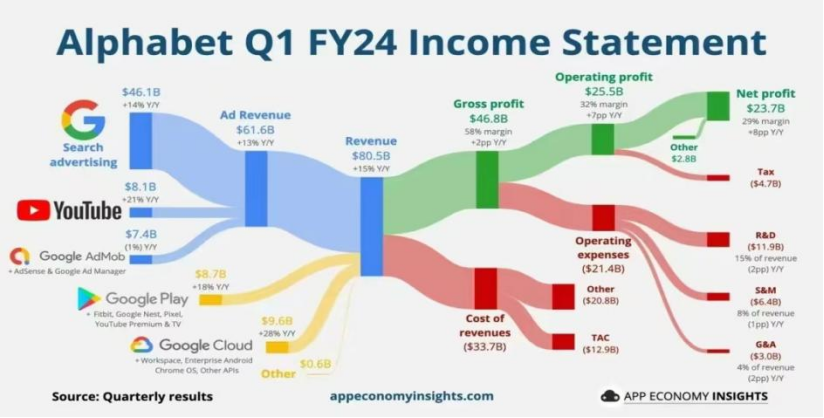

Google’s parent company Alphabet released its Q1 financial report, with revenue and Net Profit exceeding market expectations. According to the data, Google’s Q1 2024 revenue was $80.54 billion, expected to be $79.04 billion; Net Profit was $23.662 billion, expected to be $19.60 billion. Google Cloud, Google Ads, and YouTube Ads revenue all exceeded expectations. Google Cloud revenue was $9.57 billion, expected to be $9.37 billion. Google Ads revenue was $61.66 billion, expected to be $60.18 billion. YouTube Ads revenue in Q1 8.09 billion, expected to be $7.33 billion. After the release of the Q1 2024 financial report, Google rose more than 10% after hours, finally joining the “$2 trillion club”. It exceeded the expectations of Wall Street analysts such as FactSet Research and accelerated growth for four consecutive quarters.

Google’s existing businesses can be divided into three categories: Google Services, Google Cloud, and Innovative Business. Advertising and search are still the main components of revenue. Since transitioning to AI, Google has been using its “high market share, low growth rate” advertising cash cow business to nurture its “low market share, high growth rate” cloud and AI businesses.

Google released its Q1 financial report after hours, which can be said to have swept away the shadow of the stock price a few days ago, greatly boosting the market’s confidence in it. The financial report data shows that Google’s Q1 revenue was $80.54 billion, not only exceeding the market’s expected $79.04 billion, but also achieving the fastest growth rate since early 2022 with a year-on-year growth of 15%. The earnings per share were $1.89, exceeding the market’s expected 25%.

The most crucial advertising business also seems to have not been impacted by similar AI products, achieving $61.66 billion in revenue, a year-on-year increase of 13%, far higher than the expected value of $60.18 billion. YouTube’s advertising revenue has returned to the positive growth range, with YouTube’s advertising revenue at $8.09 billion, a 21% increase from $6.693 billion in the same period last year, higher than the expected $7.73 billion.

In the search business, Google still maintains an absolute user base and scale advantage. Google’s search engine SGE, released in 2023, can provide content overview through generative AI, give 3-5 recommended results, and actively propose suggestions to customers. The addition of AI further expands the types of search, providing more diverse search methods on the user side and enabling search engines to recognize and respond to more types of complex questions on the application side.

With the boost of generative AI, Google Cloud continues to maintain a high growth rate of 28%, recording $9.57 billion in revenue, which is higher than the expected $9.37 billion. Currently, Google Cloud has gradually developed into Google’s second business growth curve. Its operating profit has more than quadrupled from $190 million in the same period last year to $900 million, which also helps to diversify the business risk of Google’s advertising dominance. At the Google Cloud Next '24 conference held in Las Vegas from April 9th to 11th, 2024, Google demonstrated the changes brought by AI to its cloud business: “Google Cloud announced new Cloud TPU v5p, A3 Mega computing instances, confidential computing A3 VM series, Chrome Enterprise Premium and other updates, which are infrastructure and security enhancements brought by AI.”

Despite repeated setbacks in AI, Google’s investment in AI has not slowed down. In Quarter 1, Google’s capital expenditure was $12 billion, 1.70 billion more than expected. Within Google, the integration of departments is underway to serve the development of AI. Last week, Google announced a restructuring of its finance department to invest more resources in the field of artificial intelligence. At the same time, Google Research’s AI model development team will also be integrated into Google DeepMind to further accelerate the efficiency of AI development.

Stock price analysis

In addition, Alphabet announced that the board of directors approved the launch of a cash dividend of $0.2 per share, authorizing the repurchase of no more than $70 billion of stock.

On May 3rd, 2024, interactive media and service company Google A (GOOGL) had a trading volume of $5.754 billion, ranking 9th in the US stock market on that day. The trading volume increased by 42.85% compared to yesterday, and the trading volume on that day was 34.6624 million. Google A (GOOGL) rose by 0.37% to $167.24 on May 3rd, 2024. The stock has fallen by 2.74% in the past 5 trading days, and has risen by 2.74% throughout May, 19.72% since the beginning of the year, and 58.42% in the past 52 weeks.

In addition, Google announced its first dividend since its establishment, approving a cash dividend of 20 cents per share to shareholders registered as of June 10th on June 17th, stating that it will “continue to pay quarterly cash dividends in the future”. In addition, it announced a $70 billion stock buyback plan. Under the dual effect of impressive performance and dividend news, Google’s stock price soared after hours, rising nearly 16% at one point, and its market value increased by $300 billion, breaking through the 2 trillion market value mark.

As one of the seven giants in the US stock market, Google’s development trend is still relatively good under the promotion of AI. Judging from Google’s Quarter 1 performance and its stock price trend, it is still worth buying. However, as a US stock enthusiast, how to buy Google’s stock?

We can choose a more reliable securities firm for investment, such as Jiaxin Wealth Management, which is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, we can obtain a bank account with the same name. We can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment in US stocks. We can also search for its code on the platform to make purchases. At the same time, investors can monitor stock prices regularly according to their investment strategies and buy or sell stocks at the appropriate time.

As a pioneer and former top student in the AI field, Google has encountered some challenges, but its foundation is good and its advantages still exist. It is making every effort to catch up, and anything is possible in the future!