- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Musk announces future plans, Tesla's stock price soars, what will be the direction of the stock in f

As of now, Tesla’s (NASDAQ: TSLA) stock price has fallen by 35% this year, and its business performance has been declining due to challenges such as high interest rates and weak demand for electric vehicles (EVs). However, investor sentiment seems to have improved after the company’s Quarter 1 earnings call, when CEO Elon Musk outlined his vision for the future.

Will this controversial billionaire overstate and fail to keep his promises? Or is this the beginning of another sustainable bull market? Let’s explore the trend of Tesla stock in more depth over the next five years.

Tesla Failed to Meet Expectations in Quarter 1

Tesla encountered a series of significant economic upheavals in Quarter 1 this year.

According to the latest financial report, the company’s revenue has experienced a decline, with a year-on-year decrease of a full 13%, and the number has dropped to $561.50 billion. More importantly, the decline in gross profit margin has plummeted from 354% in the same period last year to 174%. The situation of Net Profit is even more bleak, with a sharp decline of 55%, only recording $33.10 billion. At the same time, the company’s free cash flow has also been compressed, even reduced to - $253.10 billion, which undoubtedly exposes the company’s cash flow dilemma.

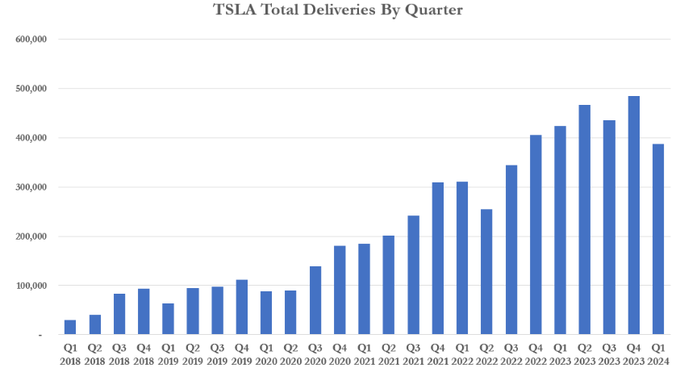

Not only that, Tesla’s car deliveries in the first quarter also suffered a heavy blow, compared with the same period last year, from 42.25 million cliff-like decline to 38.68 million, a month-on-month drop of 202%.

This series of disappointing financial data reflects Tesla’s current profit dilemma like a mirror. Operating Profit in the first quarter was only $117.10 billion, a significant decrease of 56% year-on-year, indicating that the company’s profitability has been severely weakened. Especially the gross profit that once made Tesla proud, the “barometer” reflecting the company’s production and operation efficiency, unexpectedly fell to the lowest point in two years in the first quarter, only $369.60 billion. Although the overall cash and equivalents at the end of the quarter reached $2.6863 trillion, an increase from the same period last year, it also shrank by 77% compared to the previous quarter.

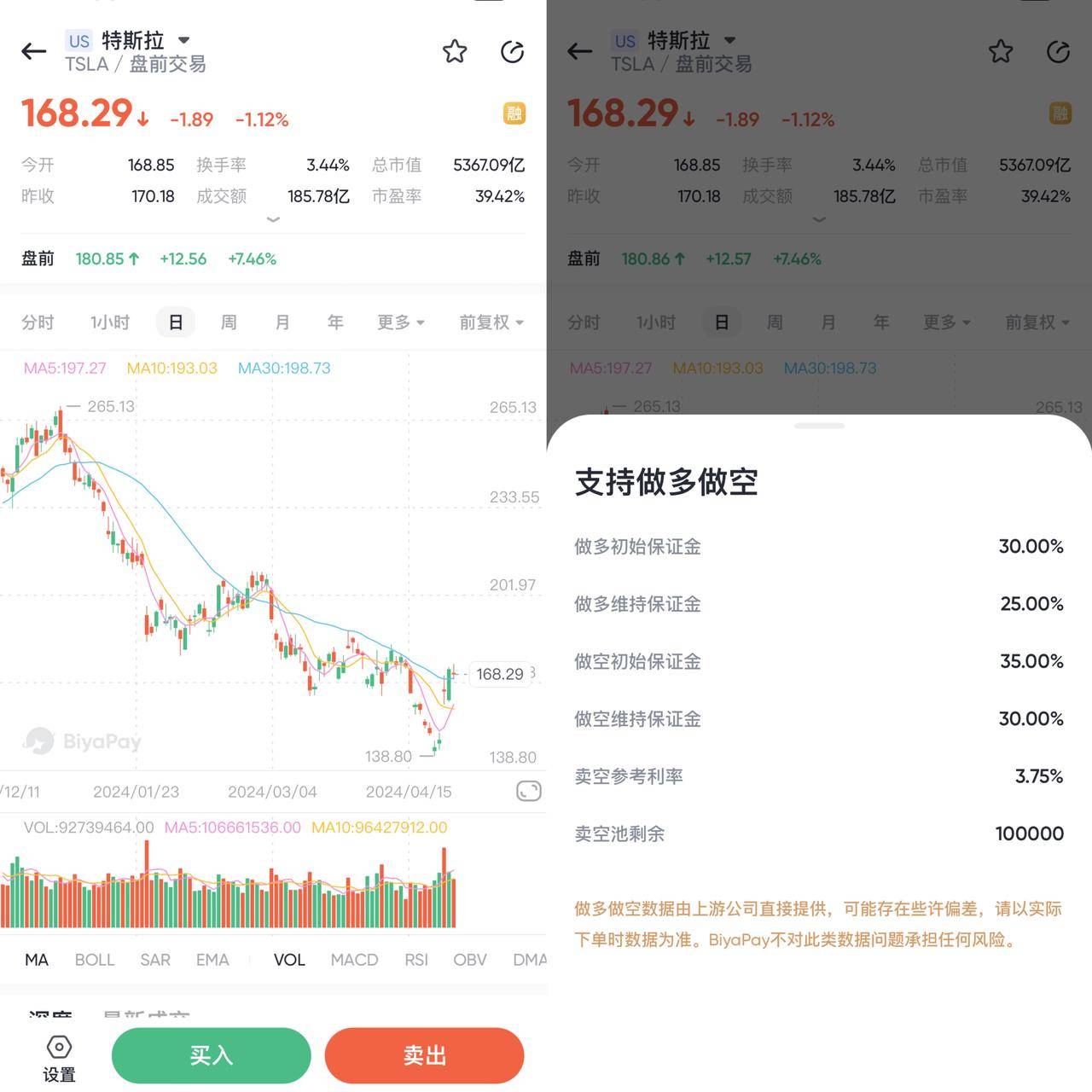

However, even with such an unsatisfactory financial report, Tesla’s stock price began to rise after hours, with a maximum increase of 13.33%, the first increase since the stock price fell continuously on April 11th. This seems to be conveying a signal: the market still holds a glimmer of hope for Tesla’s future development.

TSLA market trend chart, BiyaPay APP

The biggest reason for its rise is that Musk threw out a series of exciting future plans at the financial report meeting. The editor can only say, “This one has revealed all the cards.”

Musk unveils Tesla’s future plans

According to the information revealed by Musk, Tesla’s future plans can be divided into three categories: new models, new hardware, and Optimus robot.

As we all know, Tesla has been planning to launch cheaper new models and RoboTaxi for a long time. Recently, there was news that Tesla would cancel the plan to launch cheaper models. However, this news has been refuted by Musk. In the financial report released this time, Tesla officials further clarified that the plan has not been cancelled, but has been adjusted. His statement seems to tell the world that he is full of confidence in the company’s future development, which undoubtedly injects a shot in the arm into the market’s optimistic expectations for Tesla’s stock price.

During the conference call, Musk also emphasized Tesla’s new passenger car models, which not only include new models with lower costs, but also the planned schedule for production in the second half of 2025 has been advanced, accelerating the launch of new models. Moreover, these new models will combine the technology of the next generation platform and existing platforms, and can be produced on Tesla’s existing production lines without the need for new production lines.

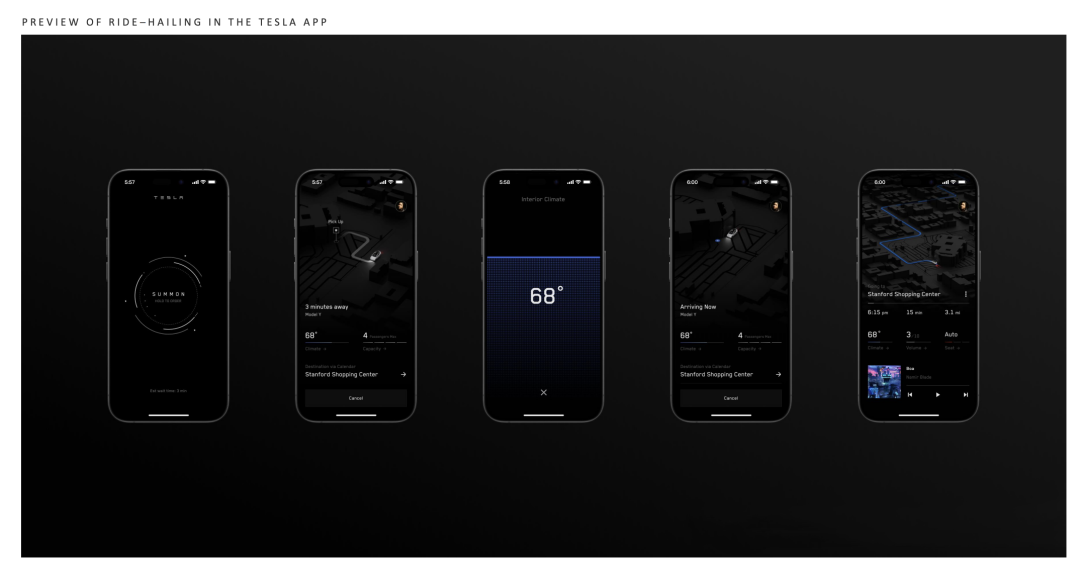

At the same time, Musk emphasized Tesla’s potential in the field of autonomous driving. He plans to launch RoboTaxi in August, which Musk calls “Cybercab” and will be equipped with hardware designed specifically for autonomous driving. After the launch of Cybercab, Tesla will form its own autonomous driving taxi team, operating in a manner similar to Airbnb and Uber. The ride-hailing service is likely to be integrated into the Tesla App, and the financial report also shows a rough rendering graph.

Some analysts predict that the market for self-driving taxis could be worth as much as $2 trillion by 2030.

However, the new RoboTaxi will use a new production line, which is the “unboxed” production line demonstrated at last year’s investor day.

And HardWare 5.0 is coming. Musk said that HW 5.0 has completed the basic design and should be on board by the end of next year. Previously, there were reports that HW 5.0 will use a 4nm process, support L5 level fully autonomous driving, and be produced by Samsung. As for FSD, the company has developed some models for internal use only to predict and test the functions of future FSD. The company’s strategic focus is also shifting towards achieving autonomous driving technology.

Musk pointed out that no matter what, Tesla will solve the problem of autonomous driving. And Tesla’s goal is to produce 5 million - 7 million cars that can drive themselves. The company has also contacted a large car company with the current FSD system and has the opportunity to deploy FSD in its models.

In addition, Tesla’s humanoid robot Optimus has made rapid progress and is currently capable of performing simple tasks. Tesla will attempt preliminary production this year for internal use within the company, such as in laboratories and factories. Musk also stated that Optimus may be sold externally by the end of next year. Although production is limited, “Optimus will be more valuable than anything else combined.”

New cars, RoboTaxi, autonomous driving technology, humanoid robots… Although Tesla is often compared with various car companies, its Line of Business is no longer limited to cars. Musk once said that Tesla is not just a car company, but more like an artificial intelligence company.

Although cars accounted for about 86% of Quarter 1 sales, business units such as energy storage and services also showed moderate growth rates (7% and 25% respectively). Moreover, Musk emphasized that Tesla will not give up anything important, and this year’s sales will be higher than last year, and the future will be very bright.

What does it mean? Tesla is not a car company?

You could say that. But the editor thinks that Tesla is more like experiencing an intelligent transformation journey beyond cars.

Tesla has built a powerful infrastructure in the field of artificial intelligence, including the Dojo supercomputer, which provides strong underlying technical support for Tesla’s autonomous driving and robotics businesses. In terms of performance, under the same cost, the Dojo supercomputer can achieve 4 times the performance and 1.3 times the energy consumption ratio compared to the NVIDIA A100. According to previous Morgan Stanley data, Dojo has saved Tesla up to $6.50 billion in costs, and its huge potential for empowering artificial intelligence technology development will bring Tesla a market value increase of up to $500 billion in the future.

Musk has repeatedly emphasized that Tesla is committed to using AI to liberate productivity and enable humans to do more valuable things. In Tesla’s products, artificial intelligence technology has been widely used, especially in driving assistance systems, involving multiple key areas such as autonomous driving, data prediction and analysis, significantly improving the performance, efficiency and User Experience of cars.

If Musk’s goal is the sea of stars, Tesla is the most down-to-earth breakthrough point for Musk to achieve this goal.

So, what kind of development will Tesla have in the next five years? How will its stock trend be?

Tesla has always been at the forefront of technological innovation in the industry. Its electric vehicles have advantages such as long range and fast charging, as well as intelligent and automated driving functions. Tesla has conducted a lot of research and innovation in battery technology, electric drive technology, autonomous driving technology, etc., continuously improving product performance and User Experience.

Tesla’s future development plan includes continuing to promote the global transition to sustainable energy, expanding its product line to cover four directions including major ground transportation forms, autonomous driving, and sharing, and accelerating the global transition to sustainable energy.

But Tesla’s history also teaches us a very clear lesson: in the long run, don’t rebel against Elon Musk. Under his visionary leadership, the company’s return on investment exceeded 900%, and he doesn’t seem to be slowing down in the short term.

If it were you, do you have confidence in the future development of Teslai? What is the trend of its stock?

Although Tesla’s first-quarter performance “collapsed”, the stock price soared under the influence of Musk, which can be said to be full of firepower and the return of the king.

Analysts at US Bank have upgraded their rating on the stock from “neutral” to “buy”, but maintain their target stock price of $220. The reasons are the slowdown in sales growth, narrowing profit margins, concerns about product launches, recent layoff news, and high inventory issues. The return to the growth narrative and positive catalysts, such as the acceleration of production plans, the plan to launch driverless taxis in August, cost-cutting measures, and potential licensing opportunities. It is undeniable that the combination of these factors may not change Tesla’s long-term momentum, but the short-term news is beginning to improve.

The editor thinks that although Tesla faces many challenges, we cannot ignore its potential and future possibilities. If it can make good progress in FSD fully autonomous driving taxis and humanoid robot robots, it can regain the valuation that technology companies deserve, and the stock price can increase by 10 times. Therefore, we recommend a highly credible platform for investment. Search for its code directly on the multi-asset trading wallet BiyaPay, and then monitor the stock price regularly according to your investment strategy, and buy or sell Tesla stocks at the appropriate time. Alternatively, you can choose to only use BiyaPay as a deposit and withdrawal tool, deposit digital currency (U) into BiyaPay, and then withdraw fiat currency to Jiaxin Securities for US stock investment.

With Tesla’s layout improvement and integration innovation in multiple fields such as “electric vehicles, energy storage, and AI”, it has shown growth potential that can disrupt the industry and change human lifestyles. It can be said that Tesla’s long-term value should not be underestimated, and it is also a potential leader in the field of artificial intelligence.

Source: MSN

Editor: BiyaPay Finance