- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Investing in US Stock Financial Report Season - A Complete Guide to Option Strategies

It’s the fourth financial report season of the year again, which is also the most exciting and active period for option traders. This financial report season is even more exciting and full of good shows. Just this week, 178 S & P 500 index Constituent Stock companies announced their performance, accounting for 40% of the total market value, including four of the seven giants, Tesla, Meta, Microsoft, and Google. Among them, Tesla and Google’s stock prices soared, while Meta’s stock price plummeted, causing some investors to be happy and some to be sad.

Due to the large fluctuations in company stock prices before and after financial reports, many option enthusiasts take advantage of these fluctuations to trade and try to earn substantial profits in the short term. Today, let’s talk about the commonly used option strategies during financial report season, the factors and precautions to consider when using these strategies to gamble on financial reports.

Listed Companies in the United States will release financial reports to the SEC and investors every quarter, hold financial report meetings, release forecast guidance for the company’s future performance based on the previous quarter or fiscal year’s performance, and answer questions from investors and analysts. The financial report includes Income Statement, Balance Sheet, cash flow statement, and management discussion analysis to further analyze and explain the company’s financial report, and further explain the risks and opportunities faced by the company in the future.

Due to the significant changes in the company’s stock price after the financial report is released, many people bet on the direction of the company’s stock price by buying bullish or put options. The disadvantage of this strategy is that once the direction is guessed wrong, it will inevitably cause significant losses. Some investors may find that even if the direction is guessed correctly, if the stock price changes little or the expiration date of the purchased option is too strong, it will still cause losses or lower-than-expected returns.

Due to the fact that no one can accurately predict the results of financial reports, and the market’s reaction to financial reports is even more difficult to predict, relying solely on betting on direction and long options is a relatively low success rate strategy. Next, I will provide you with several option strategies that can profit in the financial report season without guessing the direction, as well as the risks that need to be paid attention to when using these strategies.

The price of options reflects the market’s anticipation of the future price of the investment target. As the financial report date approaches, the market’s uncertainty about the financial report will be transformed into options, especially for options that are about to expire, that is, the price of doomsday options will rise. Using the price of options, we can simply estimate the market’s expectation of stock price fluctuations after the financial report.

Basic concept of options

First, let’s understand the basic concepts related to options. Options are a type of financial derivative product that gives the buyer the right (rather than the obligation) to buy or sell a certain amount of underlying asset at a predetermined price (called the strike price) at a certain time in the future. The purchase of this right requires payment of a fee called “premium”.

Here are some basic concepts in options trading:

1.Bullish option (Call Option): This option gives the holder the right to purchase a certain amount of underlying asset at a predetermined price at a specific time in the future (expiration date). Investors holding bullish options usually expect the price of the underlying asset to rise in the future.

2.Put Option: This option gives the holder the right to sell a certain amount of the underlying asset at a predetermined price at a specific time in the future. Investors holding put options usually expect the price of the underlying asset to fall in the future.

3.Strike Price: The strike price is the price agreed upon in the option contract for buying or selling an asset. The buyer of a bullish option hopes that the market price of the asset exceeds the strike price, while the buyer of a put option hopes that the market price is lower than the strike price.

4.Expiration Date: The expiration date is the last effective date of the option contract. On this day, the option holder must decide whether to exercise their buy or sell rights.

5.Premium: Premium is the fee that needs to be paid when purchasing options. This fee is charged by the option seller for bearing possible future risks. The level of premium is affected by various factors, including asset volatility, option exercise price, expiration time, etc.

6.ntrinsic value and time value:

-

Intrinsic value: If the current market price makes the option profitable immediately, then the option has intrinsic value. For example, a bullish option with a strike price of 50 dollars has an intrinsic value of 5 dollars if the current market price is 55 dollars.

-

Time value: The part of the total value of an option minus its intrinsic value is called time value, which reflects the potential profit of the option due to market price changes in the future.

The use of options can provide investors with various strategies, such as speculation (using market price fluctuations to earn price differences), hedging risk (protecting held stocks from price drops), or obtaining additional income by selling options. These strategies can be adjusted according to investors’ risk tolerance and market expectations.

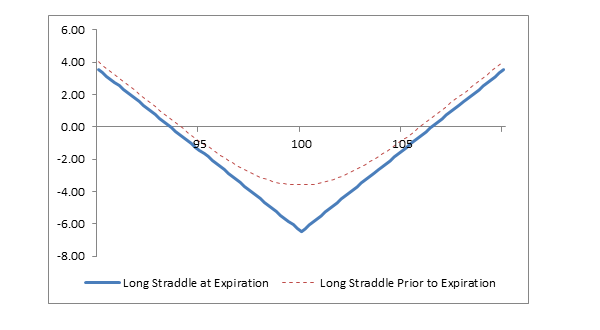

Estimation method for post-financial report volatility expectations: parity Straddle option portfolio

The estimation method is very simple, which is to look at the price of the “parity straddle” on the first option expiration date after the financial report. The so-called “parity Add Money Struddle” means buying both add money put and add money call at the same time. Because the Payoff curve of this new combination expiration date is very similar to a saddle, it is named struddle.

An institution once conducted a study. In the past 10 years, they selected 40 stocks from different industries, with a total of 1,546 financial reports. The probability of the stock opening and closing prices falling into the market’s expected volatility on the next day is 71% and 64%, respectively, which is a high probability event. If the stock price exceeds the expected volatility, it will exceed the range by about 35%. Therefore, the market’s expected volatility of the stock price after the financial report is an important factor to consider when using options to bet on financial reports.

-

10 years, 40 stocks, 1546 financial reports released

-

The stock opening price on the second day of the financial report fell into market volatility expectations 1,100 times (71%)

-

64% of the stock closing price on the second day of the financial report fell into market volatility expectations

-

If the opening/closing price exceeds the expected volatility, the average excess range is 35%

Buyer strategy: Actual volatility > Expected volatility

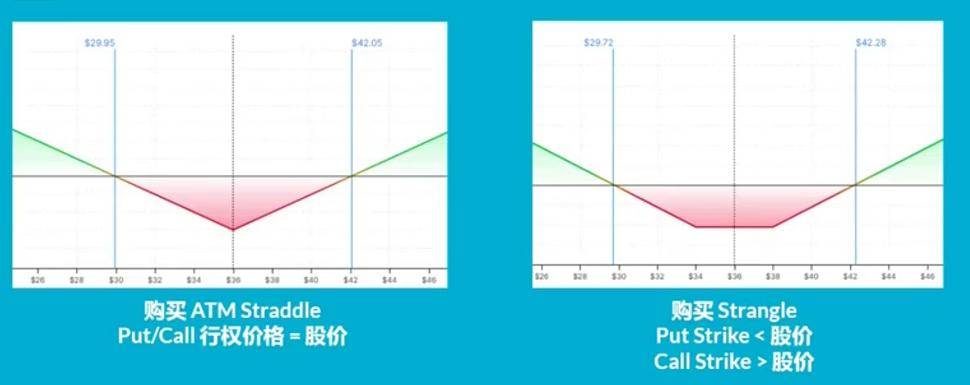

If you believe that the stock price fluctuation after the financial report will exceed market expectations, you can choose to use a buy-side strategy, such as buying “parity Straddle”. If you think the stock price fluctuation will be very large, you can also choose a more aggressive Strangle strategy, which is to buy out-of-the-money put and call, which can make small bets and higher risks.

At the same time, you should consider buying options with an expiration date one week or even longer after the financial report, because after the financial report, the market’s uncertainty about the company in the short term is greatly reduced, so the external value of the options in the short term will also rapidly decrease, which is what we often call implied volatility crush. Taking Twitter as an example, after 11 financial reports in the past three years, Twitter’s implied volatility has significantly decreased. As mentioned earlier, 90% of financial reports will experience IV crashes. Assuming you buy doomsday options that expire immediately after the financial report, if the stock price volatility is not as expected, these options are likely to quickly become worthless.

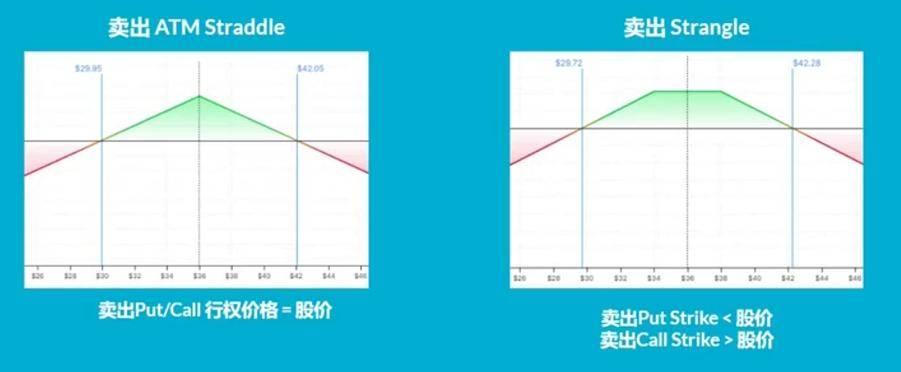

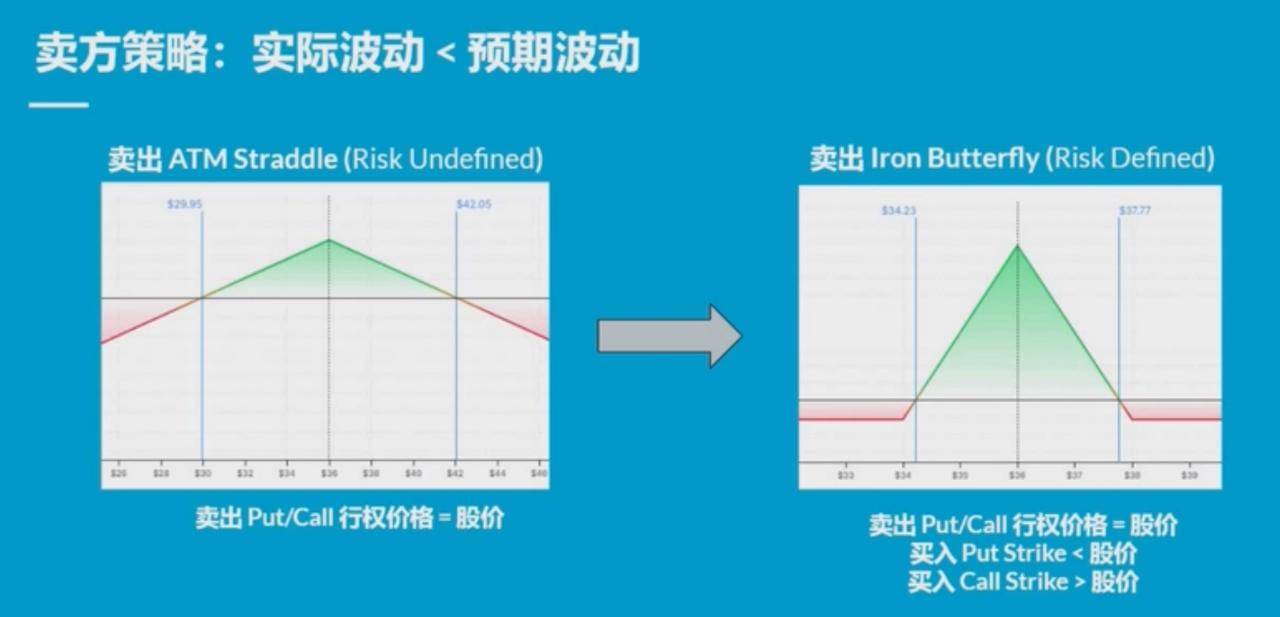

Seller’s Strategy 1: Actual Volatility < Expected Volatility

If you think that the stock price fluctuation after the financial report is unlikely to exceed market expectations, then the strategy of selling and collecting equity is more suitable for this situation. You can choose to sell Struddle or Strangle, but these naked selling options strategies also have great risks. Once the stock price undergoes drastic changes, you may suffer significant losses.

Seller Strategy 2

Therefore, for novice players, using risk-defined strategies can prevent this situation from happening. For example, the strategy of selling iron Butterfly mentioned here is actually buying an out-of-the-money put and call option separately on the basis of selling the parity Struddle. This way, even if the stock price fluctuates beyond expectations, you can set your maximum loss in advance and not bear unpredictable additional losses. In contrast to the buyer, the seller strategy should choose options with a closer expiration date for operation, fully utilizing IV Crush to profit for yourself. The above are several commonly used option strategies during the financial report season, as well as matters needing attention in use. I hope these contents can have defining value for your operation.

Options trading platform

When choosing a stock investment platform, it is very important to understand the advantages of each platform. Below, I will explore the main advantages of traditional stock trading platforms and platforms that support the use of digital currency to invest in US stocks.

Traditional stock trading platform

For example, Interactive Brokers, Tiger Brokers, Futu Securities, and Charles Schwab

Advantages:

1.Comprehensive market access: These platforms typically offer trading of a variety of investment products, including stocks, bonds, options, foreign exchange, etc., to meet the needs of various investors.

2.Highly regulated: Strictly regulated by important financial regulatory agencies such as the US Securities and Exchange Commission (SEC) to ensure the safety of investors’ funds and the fairness of transactions.

3.Advanced trading tools: Provide professional trading software and platforms, including real-time data, chart analysis, investment strategy generation tools, etc., to help investors make scientific decisions.

4.Rich educational resources: Provide various educational resources and research reports to help investors continuously learn and understand market trends.

5.Client Server: Provide comprehensive customer support, including online, telephone, face-to-face consultation and other forms, to solve investors’ questions and issues.

Platform for investing in US stocks using digital currency

Such as BiyaPay

Advantages:

1.Innovative payment options: Supports transactions between traditional currencies and digital currencies (such as USDT), providing global users with more diverse fund deposit options.

2.Fast cross-border transactions: Using digital currency can achieve fast cross-border fund transfers, reducing the waiting time for traditional bank transfers.

3.Low transaction costs: In some cases, using digital currency for transactions may reduce transaction fees and transfer fees.

4.Attracting cryptocurrency investors: Provides a platform for investors interested in cryptocurrency to invest cryptoassets in traditional Financial Marekt.

5.Convenient fund management: By using digital currency, users can more easily manage and transfer funds between different investment platforms and assets.

6.BiyaPay provides the function of exchanging digital currency USDT into US dollars and withdrawing funds, which greatly facilitates the process of directly transferring funds to Jiaxin Securities. Thanks to the bank account provided by Jiaxin Securities for each successful account opening user, users can directly transfer funds from BiyaPay to their Jiaxin bank account, greatly simplifying the processing of funds. Although other securities firms do not support this direct deposit method, BiyaPay can still transfer funds to the bank account under the personal name of US stock investors. Investors can then transfer these funds to their own securities account for investment operations. BiyaPay’s flexible fund transfer method not only ensures the liquidity of funds, but also provides significant convenience for US stock investors.

Each of these platforms has its own characteristics and advantages, suitable for different types of investors. Traditional stock trading platforms are known for their comprehensive market access and strict regulatory environments, while platforms that use digital currency to invest in US stocks provide innovative ways of fund flow and low-cost cross-border trading options. Choosing the right platform will help investors achieve their investment goals more effectively.