- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The semiconductor market is gradually recovering and will face a major rebound. Which US stocks are

The market is improving

The overall earnings for the semiconductor industry this earnings season are expected to be better than the year-ago quarter. After a challenging period marked by economic headwinds and disruptions in the supply chain, semiconductor stocks appear to be on the brink of a significant comeback, fueled by a steady increase in sales.

The semiconductor market grappled with challenges arising from pandemic-induced disruptions in the supply chain and the Federal Reserve’s stringent monetary policies, which subdued demand and led to a decline in sales. However, with the easing of inflationary pressures and a gradual recovery in demand, the industry has been on an upward trajectory since the second quarter of 2023.

The advent of generative AI has further attracted investments. The technology has already proven beneficial across a variety of industries, including marketing, advertising, customer service, education, content creation, healthcare, automotive, energy and utilities and video game development.

The growing proliferation of generative AI has boosted the demand for chips, benefiting semiconductor sales. According to the latest data released by the Semiconductor Industry Association, global semiconductor sales grew 16.3% to $46.2 billion in February 2024. This year-over-year growth trend has persisted for four consecutive months, signifying a decent recovery.

How to Make the Right Choice?

With the presence of several industry participants, finding the right tech stocks with the potential to beat on earnings can be daunting. However, our proprietary methodology makes this task fairly simple.

You could narrow down your choices by looking at stocks that have the perfect combination of two key elements — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

Earnings ESP is a proprietary methodology used to determine the stock most likely to exceed expectations in the next earnings announcement. It is the percentage difference between the most accurate estimate and the Sachs consensus estimate. Investors can use the Earnings ESP filter to discover the best stocks to buy or sell before the report, and then search for the stock in the multi-asset trading wallet BiyaPay App for direct trading. They can also deposit digital currency (U) into BiyaPay, and then withdraw fiat currency to invest in other securities.

Here, I have selected four semiconductor stocks that meet the standards through the multi-asset trading tool BiyaPay App for reference.

1.Advanced Micro Devices, Inc. AMD is scheduled to report first-quarter 2024 results on Apr 30. The stock carries a Zacks Rank #2 and has an Earnings ESP of +28.33% at present. The Zacks Consensus Estimate for Advanced Micro Devices’ revenues is pegged at $5.42 million, which indicates a 1.2% increase from the year-ago quarter. The consensus estimate for the bottom line has been revised upward by a penny to 60 cents per share over the past seven days. Estimates for first-quarter earnings signify flat growth on a year-over-year basis.

Advanced Micro Devices, Inc. Price and EPS Surprise

2.Skyworks Solutions, Inc. SWKS is slated to report second-quarter fiscal 2024 results on Apr 30. It carries a Zacks Rank #3 at present and has an Earnings ESP of +0.73%.

The Zacks Consensus Estimate for Skyworks Solutions’ second-quarter earnings has remained unchanged at $1.52 per share in the past 30 days, which indicates a year-over-year decline of 24.8% from the year-ago quarter’s earnings of $2.02. The consensus mark for revenues is pegged at $1.05 billion, which implies a year-over-year decrease of 9.3%.

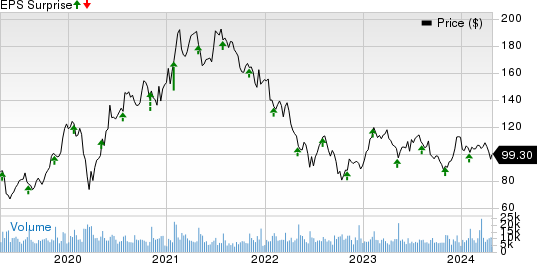

Skyworks Solutions, Inc. Price and EPS Surprise

3.Applied Materials, Inc. AMAT is expected to release second-quarter fiscal 2024 results on May 16. At present, the stock carries a Zacks Rank #2 and has an Earnings ESP of +0.31%.

The Zacks Consensus Estimate for Applied Material’s second-quarter earnings has remained unchanged at $1.96 per share in the past 30 days, which suggests a year-over-year decline of 2% from the year-ago quarter’s earnings of $2. The consensus mark for revenues is pegged at $6.51 billion, which indicates a year-over-year decrease of 1.8%.

Applied Materials, Inc. Price and EPS Surprise

4.NVIDIA Corporation NVDA is slated to report first-quarter fiscal 2025 results on May 22. The stock currently carries a Zacks Rank #2 and has an Earnings ESP of +2.50%.

The Zacks Consensus Estimate for NVIDIA’s first-quarter earnings has been revised upward by a penny to $5.49 per share in the past seven days, which calls for a year-over-year improvement of 403.7% from the year-ago quarter’s earnings of $1.09. The consensus mark for revenues is pegged at $24.17 billion, which implies a year-over-year increase of 236.1%.

NVIDIA Corporation Price and EPS Surprise

The four stocks mentioned above are provided only as references. Investing requires caution. Interested investors should pay attention to the detailed information of the relevant stocks, think carefully, and then make a decision.

Source: Zacks

Editor: BiyaPay Finance