- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

U.S. Stocks Continue to Decline, Market Pressure Mounts, How Should Investors Respond?

As of the close on April 17, the three major U.S. stock indexes collectively fell, with both the NASDAQ and S&P 500 falling for the fourth consecutive day, marking the longest streak since January this year. In fact, the performance of U.S. stocks in 2023 exceeded expectations, but since entering April this year, they have been continuously declining.

Continuous Decline in U.S. Stocks

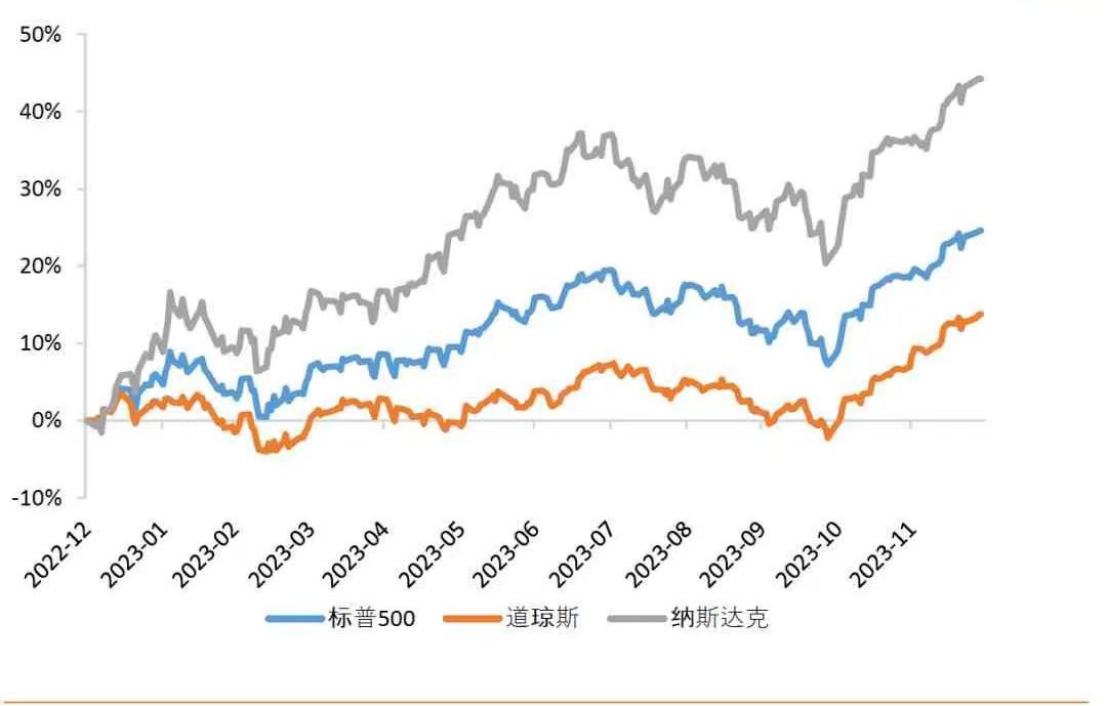

In 2023, U.S. stocks performed beyond expectations, with the S&P 500, NASDAQ, and Dow Jones increasing by 24.2%, 43.4%, and 13.7%, respectively. However, stock prices hit new lows in April this year.

According to data, the three major U.S. stock indexes collectively declined. As of the close on Friday, the Dow Jones showed a weekly gain of 0.01%, the NASDAQ saw a weekly decline of 5.52%, and the S&P 500 dropped by 3.05%. The Dow ended the week with a mixed trend of gains and losses, the NASDAQ concluded the week with a five-day losing streak, and the S&P 500 also ended with five consecutive losses, exacerbating the severe volatility in the global capital markets.

Popular tech stocks tumbled: Tesla fell more than 5%, Apple, NVIDIA, Meta, and Netflix all fell more than 2%, Microsoft nearly 2%, and AMD, Amazon, and Google each dropped more than 1%. AI giant NVIDIA plummeted by 10%, erasing over $210 billion overnight, equivalent to nearly two Ningde Times, with Supermicro being the primary initiator of the tech stock crash, plummeting 23.14%.

The primary cause of the tech stock collapse is Supermicro, and as of local time on April 19, Supermicro’s financial results had still not been released, which is seen as a negative signal, indicating that its quarterly performance may be below market expectations. Another phenomenon: A month ago, Supermicro issued $1.75 billion in new shares to institutions at a price of $875 per share, also granting underwriters the option to purchase up to 300,000 additional shares at this issue price (minus underwriter discounts and commissions) within 30 days. However, institutions did not exercise this option, leading to investor doubts about their valuation of Supermicro.

Under the dual impact, Supermicro brought down AI giant NVIDIA, triggering severe fluctuations in AI tech stocks and intensifying market volatility, driving a general downturn in AI tech stocks, with ADM’s share price plummeting 5.40%, ARM’s nearly 17%, Taiwan Semiconductor over 3%, and Micron Technology 4.60%. Therefore, investors interested in investing in tech stocks should still wait and see.

Tensions Impact U.S. Stocks

Due to tensions in the Middle East and concerns about the interest rate outlook, the U.S. stock market experienced significant sell-offs on Friday, with tech stocks recording the largest single-week drop in 17 months.

The S&P 500 index fell 0.9%, marking its sixth consecutive trading day and third consecutive week of declines, more than 5% below its closing high on March 28. The NASDAQ 100 index fell 2.1% on Friday, marking its largest single-week drop since November 2022. Geopolitical and political uncertainties, along with inflation, interest rates, and the Federal Reserve, are putting pressure on the market, prompting rapid changes in market conditions and investor attitudes.

Inflation and U.S. bonds are also putting significant pressure on U.S. stocks.

According to data, on the previous Wednesday, the U.S. reported a March core CPI month-over-month increase of 0.4%, exceeding economists’ general expectation of 0.3%. The year-over-year rate remained steady at 3.8%, equal to the previous month, and has exceeded economists’ general expectations for three consecutive months. At the same time, U.S. retail sales in March were 0.7%, exceeding market expectations of 0.3%, reaching a new high since last September, with the previous value revised from 0.6% to 0.9%. Investors’ expectations for rate cuts are still quite high, but given the current situation, the continued high inflation is making the Federal Reserve more cautious about cutting rates. This change not only affects expectations for market liquidity but also exacerbates investors’ concerns about future economic trends.

After the retail sales data was released last Monday, U.S. Treasury yields reached a new high for the year, with the 10-year U.S. Treasury yield rising 11.9 basis points to 4.618% after the retail sales data was released, the highest level since November 14 last year. The U.S. 2-year Treasury yield rose 11.1 basis points to 4.993% on the same day. Given the ongoing inflation pressure and the changes in U.S. bond yields, the trajectory of the U.S. stock market may also be affected.

Invest with Caution

According to the Federal Reserve’s financial stability report, ongoing inflation is the greatest financial risk. In the context of continued inflation, higher-than-expected interest rates are the greatest threat to financial stability. Although since the last report was published in October last year, “the banking sector overall remains robust and resilient, with most banks reporting capital levels well above regulatory requirements,” inflation and U.S. bond yields are still putting significant pressure on the U.S. stock market.

Wells Fargo’s Tim Quinlan and Shannon Grein stated in the report that higher-than-expected retail sales in the U.S. show that the economy is still robust, “Core spending indicators have reached the largest increase in a year or more, which does not indicate a price drop, adding upward risk to our forecast of a 2.3% increase in consumer spending in the first quarter.” Retail sales increased by 0.7% in March, with February retail sales revised from 0.6% to 0.9%. Quinlan and Grein noted that Easter sales came earlier than usual, which might “bring some pullback in April.”

Despite various challenges and uncertainties, the U.S. stock market still possesses certain resilience and attractiveness. Any investment decisions should be based on comprehensive analysis and rational judgment.

Only three of the 11 industry sectors covered by the S&P 500 index rose this week. The utilities sector performed the best, up 3.19% since the beginning of the year. The communications services sector has performed the best this year, rising 14.02%.

Meta also launched the latest artificial intelligence model, Llama3, to support chatbots. Meta Platforms Inc., the parent company of Facebook, has released a powerful new version of the Llama artificial intelligence model, marking the company’s latest effort to keep pace with similar technologies from OpenAI and Alphabet Inc.'s Google. Meta’s U.S. stocks are still worth considering.

If investors are looking for the right time to buy U.S. stocks, it is recommended to use the new multi-asset trading broker, BiyaPay, to follow its stock code for monitoring market trends. Once the opportunity arises, you can directly invest by converting funds into U.S. dollars on this platform without needing an offshore account; additionally, you can link a Charles Schwab offshore account to BiyaPay for investment. Withdrawals are processed on the same day they are requested, ensuring timely market transactions.

Investors are reminded that when making investment decisions, they should consider their own risk tolerance and investment goals, make reasonable asset allocations, and follow individual stock trends through the BiyaPay App to maintain independent thinking and avoid blindly following trends.