- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

AI Boom Fizzling Out? Super Micro Plummets 23% Among 'Tenfold Stocks in One Year': What Should Inves

Last Friday, the “tenfold stock in one year” Super Micro Computer (SMCI) plummeted over 23%, hitting a new low for the past two months. Alongside it, Nvidia also fell by 10%, sparking a panic sell-off in AI stocks.

BiyaPay App

Investors familiar with Super Micro know that the company primarily provides complete rack solutions for data centers, including servers, motherboards, cases, network cards, switches, etc. The company works closely with AI chip companies like Nvidia and AMD to offer users solutions from chips to complete AI servers. Its main clients include large tech companies such as OpenAI, Google, Microsoft, and Meta.

In recent years, Super Micro’s stock price has soared, mainly due to the strong market demand for its servers (the infrastructure for AI chips). For Super Micro, it does not matter who wins the artificial intelligence race. Because if you buy an AI chip, whether from Nvidia or another company, you will need to connect and cool the chip—this is where Super Micro comes into play.

As one of the most outstanding tech stocks in 2022 and 2023, it surged by 246% last year, and even the year before, it saw an 87% increase. Super Micro’s sharp drop on Friday made it the company with the largest decline among the S&P 500 index constituents that day, having just joined the S&P 500 index last month. However, Super Micro also dragged down a host of tech stocks, including Nvidia, with semiconductor giants experiencing unprecedented declines.

Last August, Super Micro’s single-day plummet of over 23% brought down the entire semiconductor sector and also contributed to Nvidia’s nearly 5% fall on the same day.

Unexpectedly, the same thing is happening again today.

As the current powerhouse sector of the U.S. stock market, their sharp declines severely affected market sentiment, dragging down other industries.

Why the sudden change of face, after reaching new highs not long ago?

So, is there still hope for this track? Is Super Micro still worth investing in?

Is a storm coming?

Some say last night’s AI giant crash was led by Nvidia, others blame the highly speculative stock Super Micro, but in reality, it was a “no snowflake in an avalanche ever feels responsible.”

On April 19th, Super Micro announced that it would publish its fiscal third quarter 2024 earnings on Tuesday, April 30th, 2024, with a conference call scheduled for 5:00 PM Eastern Time. Beyond this, no further details of the earnings report were provided.

However, in recent quarters, Super Micro has usually disclosed its impressive sales and profit performance in advance. For example, in January this year, the company disclosed its preliminary performance for the second quarter of the fiscal year 2024, 11 days before the official earnings data was released.

Yet, this time, Super Micro broke its usual practice. Analysts pointed out that its lack of a positive preliminary statement and the absence of crucial AI data could be seen as a negative signal. Some analysts even suggested that Super Micro’s failure to issue a preliminary revenue report as usual might indicate weaker-than-expected quarterly results. This sparked investor concerns about poor performance, leading to frantic selling of the stock.

Actually, there was another trigger for the crash in Super Micro.

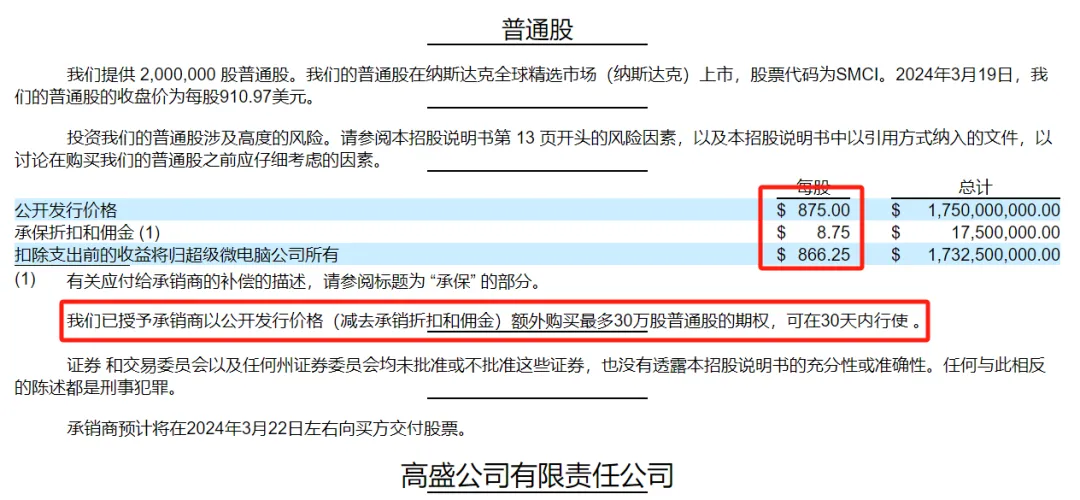

A month ago, Super Micro issued $1.75 billion in new shares to institutional investors at a price of $875 per share, also granting underwriters an option to buy up to an additional 300,000 ordinary shares at the issuance price (minus the underwriting discount and commission), exercisable within 30 days.

But today, a month later, the institutions did not exercise this option. This led investors to be more certain that institutions do not recognize the current valuation of Super Micro.

The coincidence of these two negative events together led to a complete collapse of Super Micro.

As an investor, how should one view whether the “top AI stock” Super Micro is still worth continuing to invest in?

I would like to analyze this using the CANSLIM principle.

CANSLIM is an investment strategy system by American investor William O’Neil. This principle posits that all historical bull stocks will show seven characteristics before they surge, namely C—Current quarterly earnings and sales should be accelerating, A—Annual earnings growth, N—New products, new companies, new management, etc., S—Supply and demand, L—Leader or laggard in its industry, I—Institutional sponsorship, and M—Market direction, summarized as CANSLIM.

To date, Super Micro has surged nearly 300%, and its shareholders have reaped substantial returns. Yet, if investors measure using the CANSLIM principle, the stock’s potential rise might be far from over.

Does Super Micro meet the CANSLIM standards?

Firstly, measuring by the C characteristic, Super Micro belongs to the category of companies with strong and consistently growing earnings.

The most recently released earnings report shows that Super Micro’s earnings growth is exceptionally strong. Annual data shows that the company’s earnings per share increased by 118.2% year-over-year (from $5.54 in 2022 to $12.09 in 2023). If measured quarterly, the company’s earnings per share for the quarter ending December reached $5.47, up 65.3% from the same period last year ($3.31).

Although next quarter’s earnings per share are projected to be between $5.40 and $5.55, only a 0.1% increase at the midpoint, considering the overall growth of the artificial intelligence market, the final results are still very likely to exceed expectations. Most importantly, the company has a history of exceeding expectations.

Super Micro also meets the A characteristic, with significant revenue growth.

The company’s financial report shows that in 2023, revenue increased by 29.9% year-over-year (from $71.135 billion in 2022 to $92.528 billion in 2023), and quarterly, it increased by 103.2% (from $18.032 billion in the same quarter last year to $36.649 billion in December 2023).

Looking ahead to the next quarter, the company expects net sales to be between $37 billion and $41 billion (midpoint $39 billion), an approximate 6.5% increase from the first quarter, and a 204% increase year-over-year (from $12.833 billion in the same period last year).

Similarly, Super Micro meets the N standard.

Kevin Connors, Vice President of Global Partners at Nvidia (NVDA), previously mentioned the launch of the company’s first data center GPU, noting that Super Micro is one of the main partners, and the two companies have developed a working system together. According to Kevin, the relationship between the two remains “solid.”

Super Micro provided evidence of this close relationship in its latest quarterly report, stating, “Ongoing development with NVIDIA GH200 Grace Hopper and Grace Superchips allows it to hold a market-leading position.”

Furthermore, Super Micro has established solid relationships with Intel (INTC) and AMD (AMD). It is worth mentioning that the company is developing “the next-generation AI designs for NVIDIA H200/B100, AMD MI300X, and Intel Gaudi3.”

S, or the demand side, Super Micro undoubtedly has strong market demand.

At the current juncture, the application of artificial intelligence in many areas is driving demand for data center GPUs. Reports suggest that by 2034, the annual compound growth rate of demand for data center GPUs will reach 32.2%.

Given Super Micro’s good relations with market leaders, it is reasonable to expect that the company’s growth trajectory will align with that of Nvidia. Additionally, as suggested in the quarterly report, due to its connections with the other two players in the GPU industry, the company is poised to gain additional business. Most importantly, the revenue growth displayed in the quarterly report indicates strong demand for the company’s products.

L, or leadership in the market.

According to Super Micro’s website, Charles Liang founded the company in 1993 and has served as President, CEO, and Chairman of the Board ever since. For investors, this is an excellent plus. Additionally, other well-known figures have worked at the company for a long time, such as Wally Liaw. Having been in the industry for over 30 years, Liang and Liaw are well-versed in the industry. Clearly, both are veterans of the industry and have proven their ability to detect changes in the wind, as evidenced by Super Micro’s current position in the industry.

Lastly, significant insider stock ownership is always a positive signal. In the case of Super Micro, insiders hold 33.09% of the outstanding shares.

On the I front, institutional investors have also recognized Super Micro.

It is estimated that institutional investors own about 62.14% of Super Micro’s shares. This means a significant portion of the company’s ownership comes from investment institutions, pension funds, and hedge funds, among others.

Boosting the stock further, at the beginning of this month, the S&P Dow Jones Indices announced that Super Micro would be included in the S&P 500 Index, a change that will take effect before the market opens on Monday, March 18th.

It should also be noted that retail investors still hold a very low proportion of the company’s shares, only 4.77%.

Lastly, from the M, or market performance perspective, the industry in which Super Micro operates remains healthy.

Countless estimates indicate that the application of artificial intelligence in many industries will grow significantly. Super Micro’s output will continue to grow for a long time to come, which needs no further explanation. As Nvidia CEO Jensen Huang said,artificial intelligence is at a turning point, meaning that from this moment on, enterprises will adopt AI tools at a faster rate.

Super Micro’s valuation is worth considering for investors

While many valuation metrics for Super Micro indeed give investors pause, the fact is that there are quite a few other data supporting the company.

One such ratio is the debt-to-equity ratio, which is only 12.2%. The extremely low level of debt indicates that the company is in good financial health and will be able to expand production and R&D in the future, potentially delivering returns to shareholders.

Finally, a ratio worth noting is the price-to-sales ratio. This ratio represents the amount investors pay for each dollar of the company’s sales. Generally, a lower number means that the company is undervalued. This is because it indicates that investors are paying a lower price per dollar of sales, which could mean a buying opportunity. After all, Super Micro is cheaper than Nvidia.

Investors can choose a reputable broker to invest with, like Charles Schwab, a globally renowned investment broker. Opening an account with Charles Schwab also gives you a bank account in the same name, allowing you to deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Charles Schwab to invest in U.S. stocks. You can also search for its ticker on the platform and make a purchase.

Investors can also regularly monitor this stock according to their investment strategy to see if there are any risks, as the current P/E ratio is far above the industry median of 23.12 and the stock’s 5-year average of 15.77. Moreover, the news of Super Micro being included in the S&P 500 index has been public for some time, and many investors and institutions believe that the positive factors have been fully digested.

However, if one adheres to the CANSLIM rule of picking stocks, i.e., investing in high-growth stocks and selling at the peak, then, it is believed that Super Micro still has significant upside potential before artificial intelligence reaches saturation.

Finally, wishing everyone an early fortune~