- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

U.S. March CPI Increase Exceeds Expectations: What Should Retail Investors Do?

The economic data for March in the United States, including the Consumer Price Index (CPI), grew faster than expected.

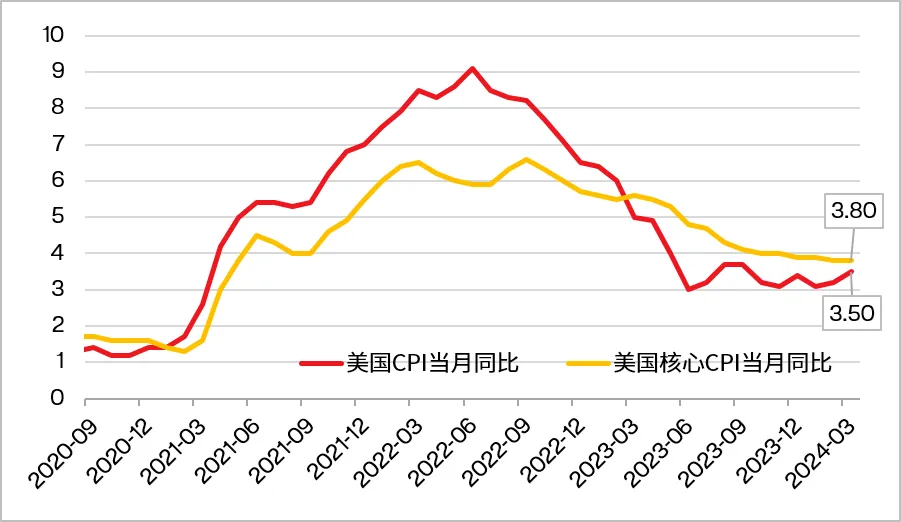

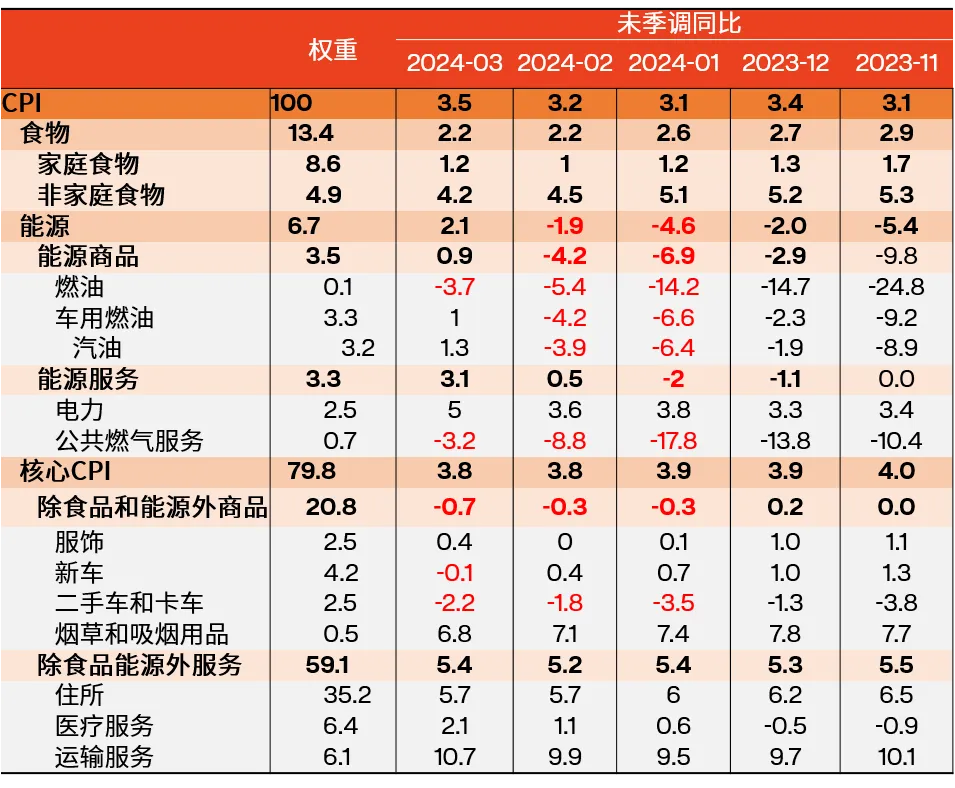

On April 10th, local time, the U.S. Bureau of Labor Statistics released data showing that the March CPI rose by 3.5% year-over-year, marking a new high since September 2023, with expectations at 3.4% and the previous value at 3.2%; excluding the volatile food and energy prices, the core CPI in March rose by 3.8% year-over-year, as expected at 3.7%, with the previous value also at 3.8%.

Core CPI, which measures changes in the prices of goods and services excluding food and energy from a consumer perspective, is an important method for measuring changes in purchasing trends and inflation. If the indicator is higher than expected, it should be considered a sign of U.S. dollar strength/rising, and vice versa for weakness/falling.

The reason for the CPI exceeding expectations in March is mainly due to the rebound in energy prices for two consecutive months, leading to a faster year-over-year increase in both energy goods and services. On the other hand, the pressure in core services prices remains significant, with transportation, medical, and other personal services also stronger month-over-month, hindering a decline in service growth rates. Additionally, the significant housing component, although moderated month-over-month, still remains sticky.

From a trend perspective, the rebound in commodity prices and a strong job market have provided periodic support for inflation. Going forward, these two factors may still pose short-term upward risks to inflation: one is the potential revival of the manufacturing sector and geopolitical conflicts driving up commodity prices, and the other is the slow narrowing of the supply-demand gap in the U.S. labor market pushing up service prices. However, leading indicators in housing, such as Zillow’s new lease prices and the new tenant rent index, have both declined, suggesting that residential prices are likely to slowly decline. Moreover, in the medium term, the fiscal deficit in an election year in the U.S. may be difficult to reduce, which also provides momentum for the rise of the inflation core.

After the March CPI data was released, U.S. stocks and gold fell, while the U.S. dollar and U.S. bond yields rose, significantly cooling expectations for a rate cut. Previously, although the Federal Reserve’s March interest rate decision announced to keep the benchmark rate unchanged, the dot plot also showed no changes, which kept the market optimistic about rate cuts this year. We have mentioned that Fed policymakers will remain cautious about rate cuts and rely more on data observation. Changes in economic growth, inflation, and unemployment data will all influence the Fed’s subsequent decisions. After the Fed’s March interest rate meeting, data such as March PMI, non-farm payrolls, and CPI were sequentially released and all exceeded expectations, undoubtedly intensifying the Fed’s concerns about the inflation outlook, thus it is not advisable to be overly optimistic about rate cuts at this time.

CPI’s Impact on the Economy

The Consumer Price Index (CPI) is a macroeconomic indicator that reflects changes in the general price level of consumer goods and services purchased by residential households. It is comprised of prices of goods and services closely related to our lives and represents the degree to which prices are generally rising.

A higher CPI index indicates more significant price increases; a lower or even negative CPI index means prices are falling.

If the CPI index grows too rapidly, exceeding the growth rate of residents’ income, it will increase the burden on their lives; but too low a CPI can lead to a decline in corporate profitability, resulting in reduced resident income and insufficient consumer motivation, among other social negative issues. Thus, changes in the CPI index affect the formulation of national economic policies, indirectly impacting the performance of the investment market, so investors must pay close attention to the CPI index.

When CPI is high, it means that price levels are rising, and consumer purchasing power is declining.

High CPI usually prompts the central bank (such as the Federal Reserve) to raise interest rates to curb inflation. Rising interest rates increase borrowing costs, negatively affecting corporate profits and consumer spending power. Therefore, expected interest rate increases often lead to stock market declines, as investors worry about declining corporate profitability.

Rising inflation may weaken investors’ confidence in the economic outlook. As consumers and businesses face continuously rising prices, they may reduce spending and investment, directly affecting companies’ revenue and profits, and thereby affecting their stock prices.

High inflation leads to a decline in real purchasing power, and consumers may reduce their purchases of non-essential items, impacting the performance of companies reliant on consumer spending.

In an inflationary environment, investors may seek more stable or inflation-protected investment channels, such as bonds or gold, thereby reducing investment in the stock market.

Bear Market Underway

Thus, we can see a series of market reactions.

Last week, the Dow Jones Industrial Average closed at 38,904, and this week it has fallen to 37,983, a drop of about 1,000 points. Even the Nasdaq, bolstered by Nvidia, ended the week down.

On April 12th, local time, London gold saw a significant rise during trading, reaching a new historical high of $2,431.78 per ounce, but plunged at the close, ultimately settling at $2,343.28 per ounce, a decline of 1.25%; COMEX gold futures peaked at $2,448.8 per ounce but also turned from gains to losses, closing down slightly by 0.53% at $2,360.2 per ounce.

What Should Retail Investors Do?

In a high inflation market environment, retail investors can adopt some strategies to protect and grow their investment portfolios. These strategies are primarily aimed at combating the erosion of purchasing power by inflation and mitigating its potential negative impact on asset values.

On the one hand, retail investors may consider diversifying investments among stocks, bonds, real estate, and gold, among other asset classes.

Additionally, attention can be paid to stocks in inflation-resistant industries.

Some industry stocks belong to sectors that can effectively pass on costs, or where demand remains stable or even increases in an inflationary business environment. For example,

Consumer essentials, such as food, cleaning supplies, and personal care products. Even during high inflation, the demand for these items usually remains stable, thus related companies can more easily pass on cost increases to consumers.

During times of inflation, energy prices (such as oil and gas) tend to rise, benefiting companies operating in the energy sector, such as oil extraction and energy production companies.

The basic materials industry includes metals, mining, and chemical products. The prices of these industry products usually rise during high inflation, so related stocks may perform well.

Real estate investment trusts (REITs) may benefit from inflation because they can combat rising costs by increasing rent, and real estate is generally regarded as an asset that hedges against inflation.

The entertainment and leisure industry (such as Disney) may see consumers continue to spend during inflation, especially in a consistently growing economy.

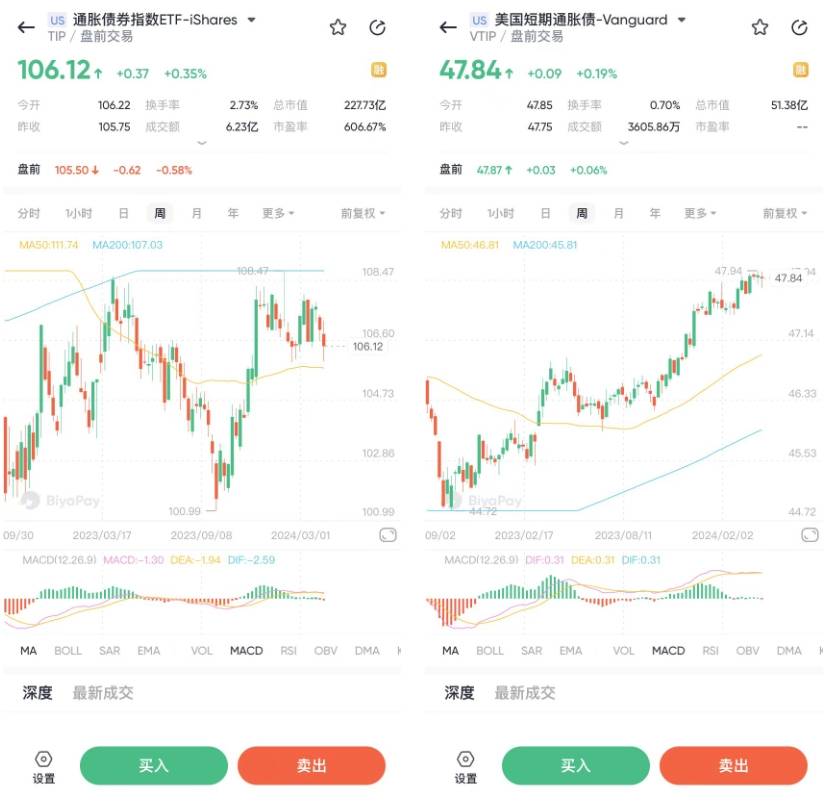

For example, if we open BiyaPay, click on the market button, and enter “inflation” in the search bar, we can see a range of related targets in the U.S. stock and bond markets. Among them are products with outstanding past performance.

For instance, the iShares Inflation-Linked Bond Index ETF (TIP) and Vanguard’s U.S. Short-Term Inflation-Linked Bonds (VTIP) issued by iShares.

All views mentioned are based on publicly available information and do not constitute any investment advice or recommendations.