- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

America Pours $50 Billion into the Chip Sector, These Three Stocks Could be the Big Winners!

Recently, as part of the United States Chips and Science Act, the U.S. government has been granting large subsidies one after another. This brings significant benefits to companies like Intel, GlobalFoundries, and TSMC, which have invested in local operations.

On February 19, the U.S. government provided $1.5 billion in funding to chip manufacturer GlobalFoundries, which will add new technology, build new fabs, and expand existing factories to increase output, expecting to raise wafer production to 1 million units per year.

Moreover, on March 20, President Biden announced $8.5 billion in direct funding support for Intel. In addition, the federal government plans to provide up to $11 billion in loans to Intel, aiming to incentivize domestic chip manufacturing.

After announcing an $8.5 billion subsidy to Intel, the U.S. will again provide a $6.6 billion subsidy for TSMC’s chip production in Arizona, supporting TSMC’s advanced semiconductor production in Phoenix, Arizona, and providing up to $5 billion in low-cost government loans.

Will these incentives change the global landscape of the U.S. semiconductor industry? How will TSMC, GlobalFoundries, and Intel utilize this investment to plan their development?

The CHIPS Act Benefits the U.S. Tech Industry

The CHIPS Act undoubtedly plays a significant role in the development of the U.S. semiconductor industry, positively impacting investments in the semiconductor sector, with companies announcing new fab projects, especially within the U.S. The decision to build fabs involves various factors, including company headquarters proximity, infrastructure, labor, and political stability. Government subsidies are one factor, but not the only decisive one.

The CHIPS Act plans to invest $174 billion in the high-tech sector over the next five years, focusing on cultivating a new generation of STEM (Science, Technology, Engineering, and Mathematics) workforce. By January 2027, an estimated $24 billion in investment tax credits will be used to stimulate growth in the private sector.

As global demand for chips continues to rise, the U.S. aims to maintain its leading position in the semiconductor field with this act’s support. If investors are interested in chip stocks, they should consider these three beneficiaries of the CHIPS Act.

TSMC

Although TSMC’s headquarters are not in the U.S., the company has made significant investments in Arizona, USA. In December 2022, TSMC announced a $40 billion investment to build its second semiconductor foundry in Phoenix, Arizona. On April 8, the U.S. Department of Commerce allocated $6.6 billion to TSMC under the CHIPS Act.

Despite the impact of earthquakes in Taiwan, TSMC’s core equipment, especially the crucial ultraviolet lithography machines, remained intact. TSMC is already mature in advanced chip manufacturing, and the recent earthquake might prompt the company to further diversify its operations and attract more investments.

In the past 30 days, TSMC’s stock price (TSM) has risen by 0.46%, accumulating a 42% increase this year. The 52-week low was $81.21, with the current stock price at $145.40, marking a 43% increase.

BiyaPay App

TSMC will release its Q1 2024 earnings report on April 18. Revenue for the quarter is expected to be between $18 billion and $18.8 billion, compared to $19.62 billion in the last quarter of the previous year.

Market analysts predict TSMC’s average target price for the next 12 months at $164.14, a 12% potential increase from the current price, with the highest estimate at $188 per share and the lowest at $133 per share.

GlobalFoundries

GlobalFoundries (GFS) received $1.375 billion in subsidies and $1.6 billion in preferential loans for its Malta, New York, factory, which will be used to expand the business scope and build new fabs. Additionally, the company received a $125 million grant to support its production base in Essex Junction, Vermont. The expansion of the Malta factory is expected to triple its chip manufacturing capacity.

Compared to reports in December about GlobalFoundries, the stock price has slightly decreased from $52 to $51.59, with the 52-week low at $48.12, indicating relatively stable market performance. However, investors are not satisfied with this modest performance.

BiyaPay App

Interestingly, GlobalFoundries’ net income in Q4 2023 was $278 million, compared to $668 million in the same period in 2022. However, as the inventory adjustment cycle peaks, the market expects a rebound in the second half of 2024.

On the other hand, the U.S. government trusts GlobalFoundries, and the stock has fallen 11% year-to-date, leading some to consider it a low-risk, long-term investment in semiconductors.

According to Nasdaq, analysts’ average target price for GlobalFoundries is $57.88, higher than the current $51.59, with a potential increase of 12%. The highest estimate is $63 per share, and the lowest is $48 per share.

Apart from GlobalFoundries, investors could also consider Microchip Technology (MCHP), another stable and steadily growing investment option. Microchip Technology also received $162 million in CHIPS subsidies from the U.S. government.

Intel

Facing intense competition from AMD, Intel’s (INTC) stock price has only risen by 17.5% over the past year, whereas AMD’s return rate was 78%. So far this year, Intel is still lagging behind AMD, which has continued to rise by 22%, while Intel’s stock has fallen by 20%.

However, Intel received a total of $8.5 billion in subsidies and $11 billion in loans for its four major bases in Hillsboro, Chandler, Rio Rancho, and New Albany, becoming the largest beneficiary of the CHIPS Act.

BiyaPay App

In Q4 2023, Intel performed steadily with revenue exceeding expectations at $15.4 billion, higher than the anticipated $15.15 billion. However, Intel’s outlook did not meet investors’ expectations.

Like GlobalFoundries, Intel also predicts a slowdown in sales of its PC and data center businesses. However, following Nvidia’s (NVDA) successful transition from a gaming GPU-focused chip company to a leader in the data center sector, Intel is also transforming into a global chip supplier, serving companies like Apple (AAPL), Meta (META), and Nvidia.

Recently, Intel introduced the Gaudi 3 chip, optimized for artificial intelligence (AI), with CEO Gelsinger stating that Gaudi 3’s performance would surpass Nvidia’s flagship AI chip H100. This indicates significant progress for Intel in the AI hardware competition.

Today, Nvidia’s stock price fell again, with a mid-session drop of nearly 5%, closing with a 2.04% decline. This suggests that investors may recognize Intel’s advancements in the AI accelerator field, viewing Gaudi 3 as a potential challenge to Nvidia’s market dominance, while Intel’s stock slightly increased by 0.92%.

In the short term, Intel’s transformation comes at a high cost, exemplified by the delayed $20 billion foundry construction project in Ohio in February. However, if any company is poised to become the U.S. equivalent of TSMC, it is likely Intel.

In chip manufacturing, Intel has made significant progress with its 14A process technology announced in February, potentially leading TSMC’s 3nm process with its 1.4nm chips. Considering the scarcity of skilled professionals in chip manufacturing and the trust and support from the U.S. government, investors have reason to believe in Intel’s vision: to become the world’s second-largest chip manufacturer by revenue by 2030.

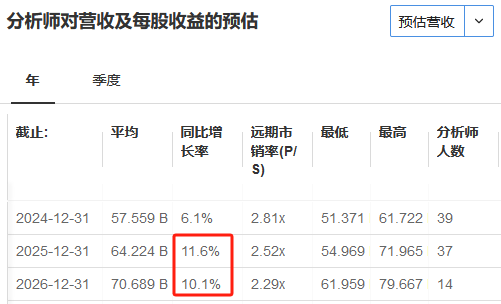

Market analysts forecast Intel’s revenue growth for 2024-2026 to reach double digits in 2025 and 2026:

Which of these stocks do you favor?

In U.S. stocks, mega-cap tech growth stocks are undisputedly leading the market, with artificial intelligence (AI) still dominating as the current market theme.

For many investors, these three stocks now present a good opportunity: TSMC’s technology in chip manufacturing, GlobalFoundries’ stable and steady growth, and Intel’s progress in AI hardware. In the coming years, I believe they will generate profits for many investors, including those of us far from becoming billionaires.

However, we can choose a credible broker for investment, such as Charles Schwab, a globally renowned investment brokerage. Opening an account with Charles Schwab gives you a bank account of the same name, allowing you to deposit digital currency (U) into the multi-asset wallet BiyaPay and then withdraw fiat currency to invest in U.S. stocks through Charles Schwab. You can also search for their codes on the platform and make purchases. Meanwhile, investors can monitor stock prices regularly according to their investment strategies and enter the market at the right time.

As the saying goes, “When the wind comes, even pigs can fly.” Given the current momentum in the chip industry, the wind is still blowing strong. If you want to seize the opportunity, then these stocks are essential holdings. So, it’s not too late to enter the market now.