- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

U.S. Stock Market April Strategy: Three Potential Stocks Poised to Reach New Highs!

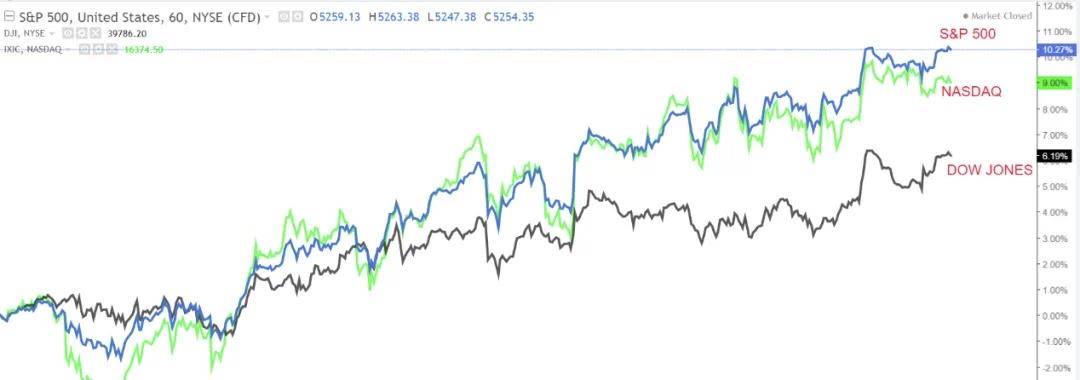

The S&P 500 index reached new highs, marking its best first quarter since 2019. As the broader market climbs higher, the upward prospects of individual stocks are put to the test.

In March, the S&P 500 index ended on a high note, achieving its best first-quarter performance in five years.

Driven by the enthusiasm for artificial intelligence (AI) stocks and expectations of a Federal Reserve rate cut this year, the three major U.S. stock indices rose strongly in March and the first quarter.

In March, the S&P 500 index increased by 3.1%, the Dow Jones Industrial Average by 2.1%, and the tech-heavy Nasdaq Composite by 1.8%, with all three indices rising for five consecutive months.

Looking at the quarter, the S&P 500 index rose approximately 10.2%, marking its best first-quarter gain since 2019, with the Nasdaq and Dow Jones indices increasing by 9.1% and 5.6%, respectively.

NVIDIA (NASDAQ:NVDA) was a major driving force behind the rise of U.S. stocks in March and Q1, now becoming the third-largest company by market value in the U.S. With AI showing no signs of slowing down, NVIDIA’s stock price rose 14.2% in March and surged 82.5% in Q4.

So, after the splendid performance in March, what stocks should be considered for April? The author has identified three stocks that not only have performed strongly year-to-date but also remain undervalued and are expected to rise further in April.

Amazon (NASDAQ:AMZN), ExxonMobil (NYSE:XOM), and Goldman Sachs (NYSE:GS) are poised for their upcoming quarterly earnings reports to act as catalysts, providing opportunities for performance in April.

1. Amazon

Year-to-date 2024: Up 18.7%

Market Value: $1.87 trillion

Amazon (NASDAQ:AMZN) closed last week at $180.38, not far from its all-time high of $188.65 in July 2021, with a market value of $1.87 trillion, making it the fifth-largest publicly traded company in the U.S.

Over the past 12 months, Amazon has significantly outperformed the broader market, with an approximate 80% increase.

Despite Amazon’s strong upward momentum, it is still considered undervalued according to analysts’ target prices. The average target price from 56 analysts is $206.69, suggesting around a 14% upside from the latest $180.97.

In April, Amazon will encounter a catalyst: its first-quarter earnings report, set to be released after market close on April 25th (U.S. Eastern Time), or early morning on April 26th (Beijing Time), with strong seller confidence.

The market generally expects Amazon’s earnings per share to reach $0.85, a more than 170% jump from the first quarter of 2023’s $0.31 per share. The company’s investment in innovation and automation is expected to improve operational efficiency.

Revenue is anticipated to grow by 11.9% from the same period last year to $142.5 billion, reflecting the continued strength of its cloud computing, e-commerce, and advertising businesses.

ProTips indicates that Amazon has a promising profit outlook, strong profit growth, and a favorable position in the e-commerce and cloud computing sectors, with a resilient business model.

Given this, Amazon may be one of the opportunities to watch in April, with its stock price potentially breaking new highs within the month.

2. ExxonMobil

Year-to-date 2024: Up 16.3%

Market Value: $461.2 billion

ExxonMobil (NYSE:XOM) closed last week at $116.24, nearing its historical high of $120.70 on September 28, with a market value of $461.2 billion. The company is not only the largest oil producer in the U.S. but also the 14th largest publicly traded company on the NYSE.

Since the beginning of 2024, the company’s stock price has risen by 16.3%, outperforming its competitors Chevron (+5.7%), Shell (+1.9%), and BP (+6.4%).

April Catalyst: ExxonMobil is scheduled to release its first-quarter earnings report on April 26th (Friday) at 6:30 AM U.S. Eastern Time (18:30 Beijing Time). Given Wall Street’s optimistic view of its financial report, the author believes ExxonMobil is one of the top stocks for April.

The market expects ExxonMobil’s earnings per share to reach $2.14, with revenue projected at $78.56 billion.

Additionally, ExxonMobil has a solid financial position, a robust balance sheet, ample free cash flow, and a relatively low valuation. The company has increased its annual dividend for 41 consecutive years, reflecting its commitment to continuously rewarding shareholders.

Currently, ExxonMobil’s quarterly dividend is $0.95 per share, equivalent to an annualized dividend of $3.80, yielding 3.27%.

In 2023, ExxonMobil returned a total of $32.4 billion to shareholders through dividends ($14.9 billion) and stock buybacks ($17.4 billion).

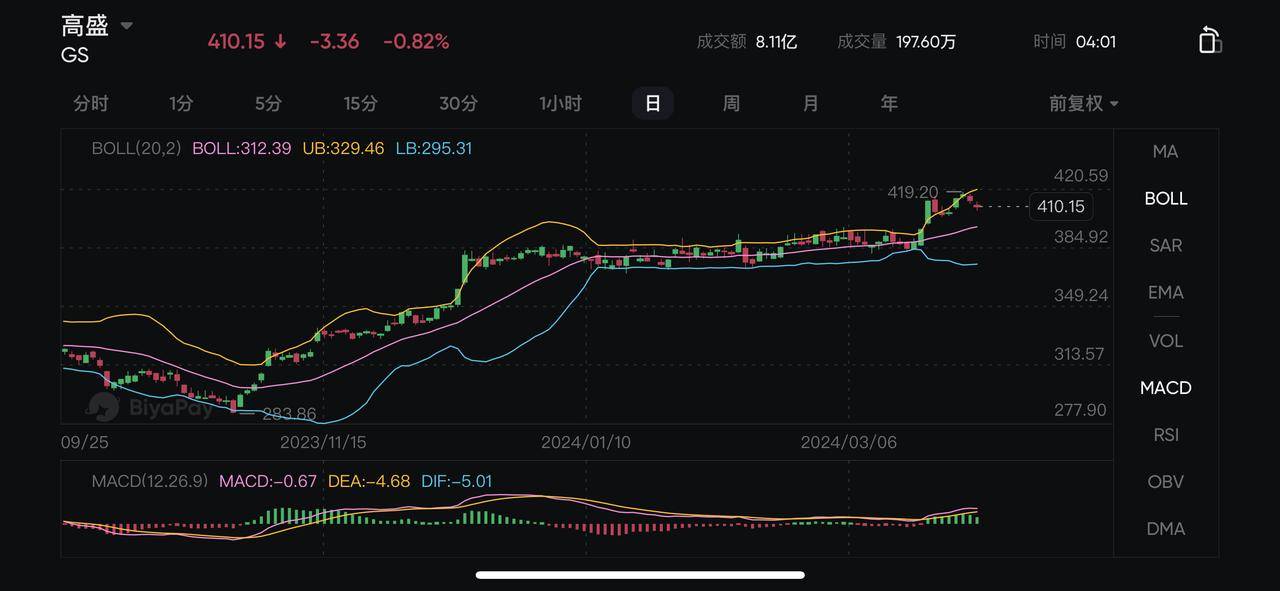

3. Goldman Sachs

Year-to-date 2024: Up 8.3%

Market Value: $143.2 billion

Last week, Goldman Sachs (NYSE:GS) closed at $417.69, its 52-week high, slightly below its historical high of $426.16 in November 2021, with a current market value of $143.2 billion.

In 2023, Goldman Sachs rose by 12.3%, and year-to-date 2024, it has increased by 8.3%.

April Catalyst: Goldman Sachs plans to release its first-quarter earnings report before the market opens on April 16th (Tuesday) at 7:30 AM U.S. Eastern Time (19:30 Beijing Time).

Its main business, investment banking, and wealth management services are expected to perform robustly, while a recovery in trading and IPO activities is anticipated to boost performance.

Wall Street expects Goldman Sachs to earn $8.87 per share in the first three months of 2024, approximately a 1% increase from the same period last year.

Meanwhile, revenue is expected to grow by 6.4% year-over-year to $13 billion, reflecting steady growth in investment banking and fixed income trading revenue.

It should be noted that among Wall Street’s large banks, Goldman Sachs is viewed as the most reliant on investment banking and trading income. With continuously increasing free cash flow levels, Goldman Sachs has been paying dividends for 26 consecutive years and has raised its dividend for the past 12 years. The annualized dividend per share is $11.00, with a yield of 2.63%.

Regarding how to purchase these U.S. stocks. One can use traditional brokerages like Interactive Brokers, Charles Schwab, Tiger Brokers, or the new blockchain wallet, BiyaPay.

I stumbled upon BiyaPay, a multi-asset trading wallet that excellently integrates digital and stock assets. On BiyaPay, one can deposit digital currencies like USDT to invest in Bitcoin, U.S., or Hong Kong stocks. You can also exchange USDT for USD or HKD to invest in U.S. stocks through other brokerages like Charles Schwab. I have used BiyaPay to transfer USD to Charles Schwab to invest in the U.S. stocks.