- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Exploded! Xiaomi's Car Exceeds Tesla in Several Metrics, Musk to Retort?

Xiaomi’s car, long awaited, has finally arrived

On the evening of March 28 at 7 pm, Xiaomi officially launched its first product, the Xiaomi SU7. During the launch event, Lei Jun, the Chairman and CEO of Xiaomi Group, introduced the five major technologies of Xiaomi’s car: electric drive, battery, large-scale casting, intelligent driving, and smart cockpit, and also announced the pricing of Xiaomi’s car, ranging from 215,900 to 299,900 yuan. On the evening of March 28, Xiaomi’s official Weibo account posted, “The big order broke 10,000 in 4 minutes. Broke 20,000 in 7 minutes. 50,000 units were ordered in 27 minutes after launch.”

According to Lei Jun, Xiaomi’s car aims to compete with Porsche and Tesla, creating the “dream car” of the new era in the automotive industry, focusing on good looks, enjoyable driving experience, comfort, and safety.

The chief automotive analyst stated that since Xiaomi officially announced its car-making plans, over 20 listed companies have expressed their intention to collaborate with Xiaomi’s automotive business. Leveraging Xiaomi’s strengths in intelligence, ecological synergy, fan effects, and channels, the delivery of Xiaomi’s cars is expected to gradually increase, and related component suppliers are likely to benefit significantly.

The announcement of Xiaomi’s car not only triggered a significant surge in the A-share stocks related to Xiaomi’s automotive industry chain on March 28 but also stirred waves in the overseas capital market. Xiaomi Group has Xiaomi Group-W (stock code 01810) listed in Hong Kong and Xiaomi Group ADR (stock code XIACY) in the US market.

On March 28, Xiaomi Group-W (stock code 01810) and Xiaomi Group ADR (stock code XIACY) continued to rise, with the increase expanding to 12%.

What is ADR?

Before explaining ADR/ADS, let’s first understand the rules for non-U.S. companies to list on U.S. stock exchanges.

According to U.S. policies, companies registered outside the U.S. cannot directly list there. Thus, if a foreign company wants to finance in the U.S. market, there are two paths: direct listing by registering a company in the U.S. and packing the listing entity into the U.S. company; or indirect listing through ADR/ADS.

Compared to locations like the Cayman Islands and the British Virgin Islands, the U.S. government has much stricter regulations on listed companies, leading many companies to choose the indirect listing method, issuing ADR/ADS through a U.S. depository institution.

ADR stands for American Depository Receipt

It’s issued by U.S. depository banks to American investors and traded on the U.S. securities market. Each ADR represents a certain number of shares of the listed company based on a specific exchange ratio. For example, if ABC Company (a fictional Australian company) trades at 6.7 Australian dollars (5 U.S. dollars) on the Australian Securities Exchange, a U.S. bank could buy a certain number of ABC Company shares at a 2:1 ratio and sell ADRs, meaning each ADR represents two shares of ABC Company, and should be sold for 10 U.S. dollars.

ADS stands for American Depository Share

It represents the actual underlying stock of an ADR. ADR is a proof of ownership for investors in ADS, similar to how a property deed relates to a house. During transactions, transferring the deed suffices without moving the house. Typically, one property deed represents one house, but one ADR can represent multiple ADS. For instance, a British company XYZ could trade ADRs on the New York Stock Exchange, with these ADRs issued at a rate of 5 ADRs to 1 American Depository Share (5:1) or any other ratio the company chooses. The underlying ADS usually directly corresponds to the foreign company’s common stock.

The differences between ADR and ADS

Includes face value, with ADS often representing only a fraction of the collateral stock’s face value, while ADR often represents several units (e.g., 10 shares) of the collateral stock as one unit of ADR. In terms of initiation, ADS is sponsored by stock-issuing companies that wish to attract U.S. investors without listing on the U.S. market, while ADR represents the right to buy foreign stocks for American citizens, initiated by banks and brokerages. In terms of trustees, ADS is issued in the U.S. by a trustee authorized by a foreign company, while ADR is issued by a U.S. commercial banks to facilitate the trading of foreign securities in the U.S.

Hot Xiaomi automotive-related stocks, Hong Kong-listed Xiaomi Group-W (stock code 01810) and U.S.-listed Xiaomi Group ADR (stock code XIACY), can be traded on the U.S. and Hong Kong stock exchanges, with trading recommended on platforms like Interactive Brokers or BiyaPay, which are regulated by the U.S. SEC and hold RIA and MSB licenses in the U.S. and Canada.

Musk’s Outburst Against Xiaomi’s Car?

With the highly anticipated unveiling of Xiaomi’s car pricing, the international market noted that the Xiaomi SU7 is $4,000 cheaper than the Model 3. Lei Jun repeatedly mentioned the Tesla Model 3 as a competitor and emphasized that the Xiaomi SU7 outperforms the Model 3 in terms of specifications. Lei Jun’s repeated calls for Model 3 users to consider upgrading have resonated globally.

As of the market close on Thursday, Xiaomi Group’s ADR surged by 12.13%. Meanwhile, Tesla shares fell by 2.25%, extending its first-quarter decline to 29.25%.

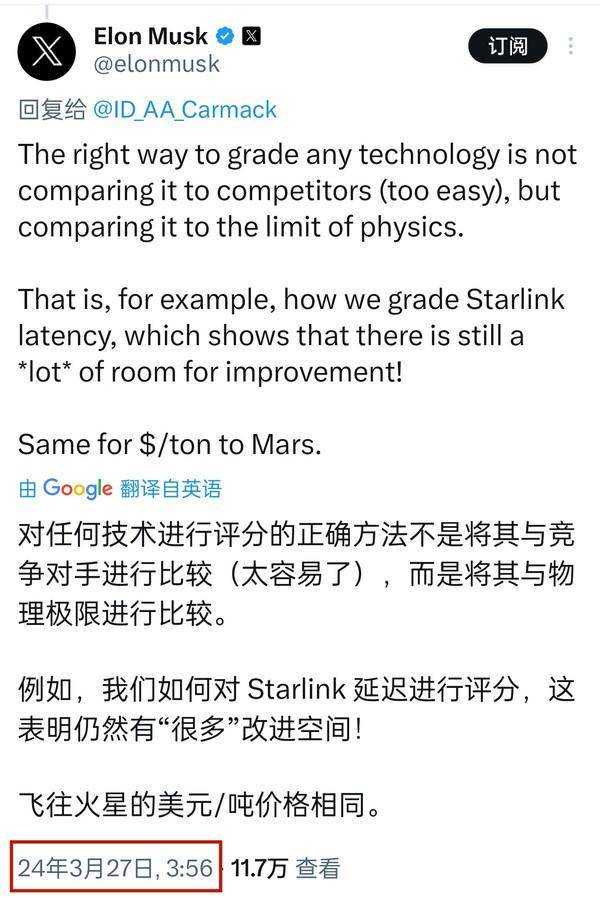

Following the launch event, a social media post featuring a screenshot of Musk’s comment on X suggested he was responding to Xiaomi’s car marketing. The screenshot showed Musk stating, “The right way to evaluate any technology is not to compare it with competitors (too easy), but against physical limits. For instance, how do we score Starlink’s latency, indicating there’s ‘a lot’ of room for improvement.” This led some media to interpret the screenshot as Musk’s response to the frequent mentions of Tesla at Xiaomi’s launch event.

However, further investigation revealed that this was not the case. Musk’s comment was actually a response to a foreign netizen discussing a technical issue, unrelated to Xiaomi’s car launch or Lei Jun’s comparisons. Moreover, Musk posted this comment at 3:56 on March 27, 2024, even before Xiaomi’s launch event at 19:00 on March 28, suggesting it was merely a coincidence and not a foreknowledge of the event.