- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Touchstone of the AI Craze: Why Did Astera Labs' Stock Soar 72% Upon Its Debut?

Riding the AI wave, a data center connectivity chip company that started in a Silicon Valley garage successfully went public. Due to its revenue growth curve being quite similar to Nvidia’s, it has also been called “Little Nvidia.” That company is Astera.

Last Thursday, Astera officially launched on NASDAQ, selling 19.8 million shares at $36 each, raising about $713 million. On its first day of trading, Astera’s stock price surged 72.31% to close at $63.02 per share, bringing its total market value to $9.459 billion. This increase was the largest first-day gain since June 2021 for US IPOs of companies raising $500 million or more.

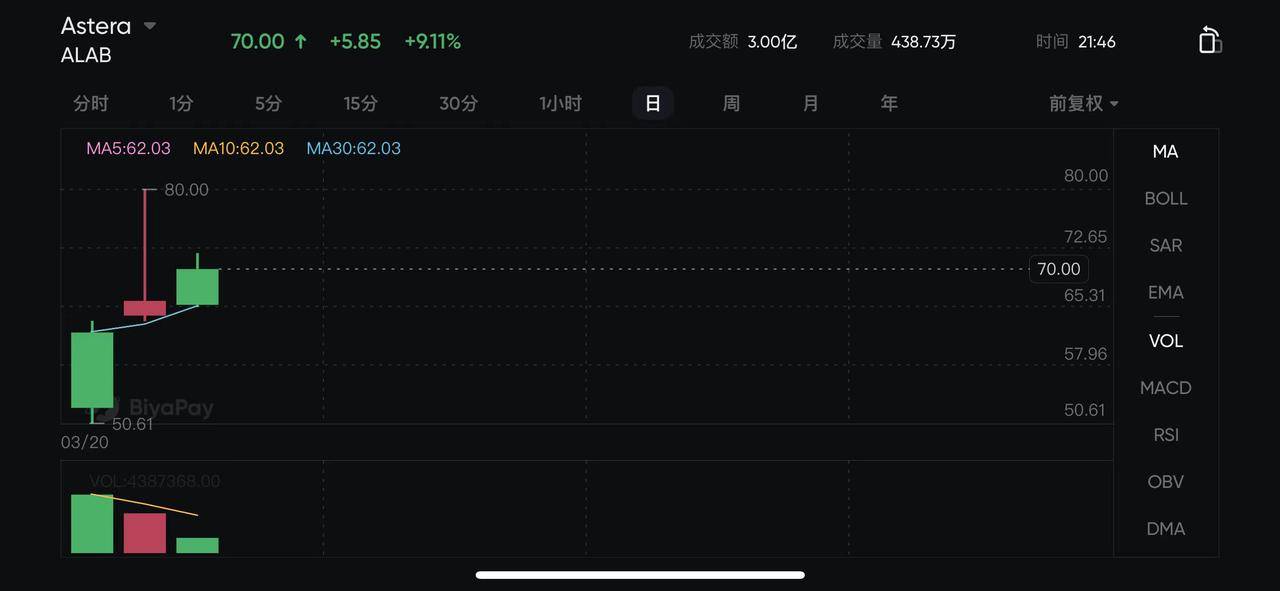

Astera’s stock price continued to rise, exceeding a 9% increase at the time of writing, with the stock price shown as $70 on the multi-asset trading wallet BiyaPay.

What kind of company is this, why such a surge, and can investors invest in it?

Let’s find out!

Who is Little Nvidia?

Astera Labs was founded in 2017 by Jitendra Mohan, Sanjay Gajendra, and Casey Morrison, who were then working at Texas Instruments. They had a moment of epiphany, realizing that with the rapid development of AI and machine learning, data connectivity would be a key issue, in addition to computing power.

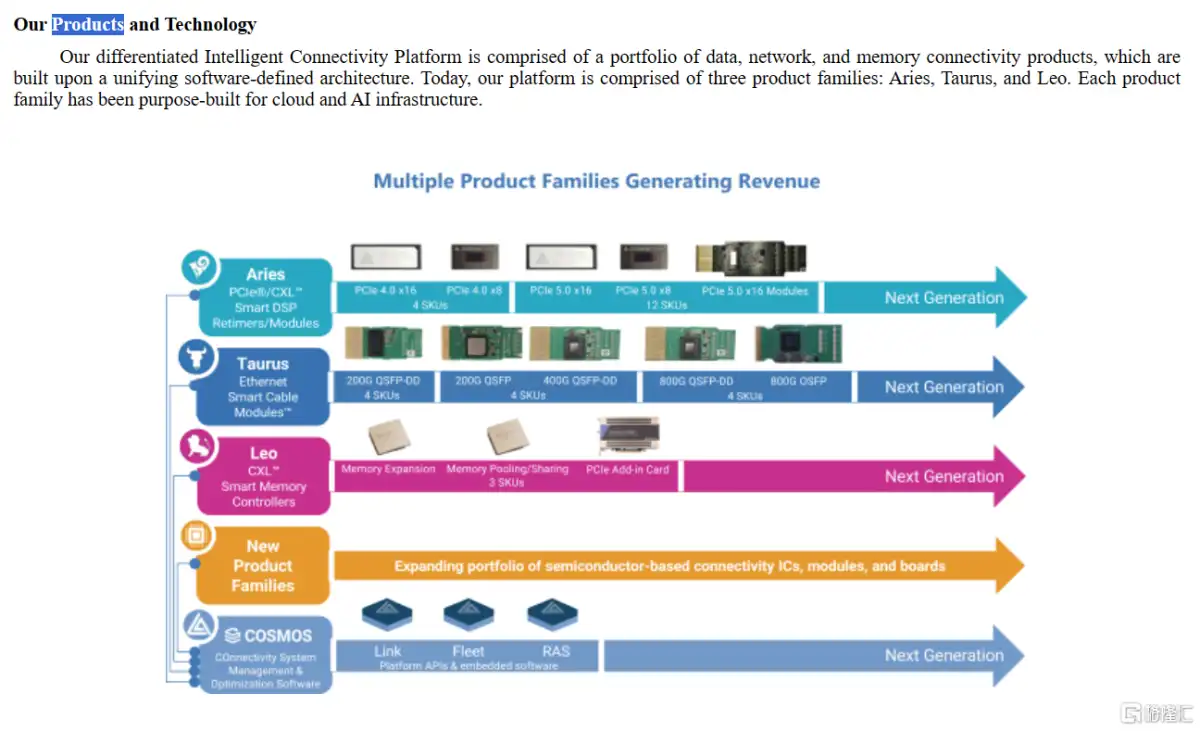

According to its website, one of Astera Labs’ core products is data and memory connectivity semiconductors. By designing and providing these critical connectivity semiconductors, Astera Labs enhances the efficiency and speed of connections between different software and hardware within data centers, helping cloud service providers and enterprise customers connect their server chips, memory, storage, and network devices. This enables data centers to more effectively support AI computing and other high-performance computing needs, optimizing data transmission and processing speed, thereby accelerating the operation and response time of AI applications.

This product was long considered unfashionable but was thrust into the limelight with the development of AI, especially the Transformer model. The computational requirements of the Transformer model are growing at an exponential rate, doubling every two years on average, leading to not only a massive shortage of computing power but also the so-called “memory wall,” which refers to the problems in connection and transmission between memory and data. Astera Labs’ products have finally found their place.

In addition to this core product, Astera Labs’ main products include the Aries PCIe/CXL Smart Retimer and Taurus Ethernet Smart Cable Modules, all deeply integrated with data center operations. Thus, chip manufacturers like Nvidia, Intel, AMD, and large internet companies such as Amazon and Microsoft have become its clients.

Some potential investors say, “Every Nvidia H100 chip needs them.” High-performance chips like the Nvidia H100 GPU require very high data transfer speed and efficiency. To fully leverage the capabilities of such high-performance GPUs, data centers need to adopt Astera Labs’ connectivity technology to ensure fast and reliable data transfer within the system.

Origin of the Name Little Nvidia

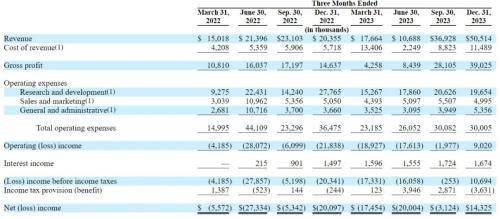

Astera Labs’ prospectus shows that its revenue growth curve is quite similar to Nvidia’s, hence the nickname “Little Nvidia.” Nvidia’s revenue increased by 126% in the fiscal year 2024 (ending January 31), surpassing $60 billion. Meanwhile, Astera Labs’ revenue was $34.8 million in 2021, $79.9 million in 2022, and $116 million in 2023, with projections reaching $250-300 million in 2024.

Astera Labs’ gross margin of nearly 70% is also comparable to Nvidia’s, reflecting the market’s recognition of its potential. After receiving Series A funding in 2017, the company’s valuation only crossed $100 million during its Series B funding in 2020. However, by the Series C and D rounds of funding in 2021 and 2022, the company’s valuation had soared to $950 million and $3.15 billion, respectively.

Nvidia (NVDA.US) and other AI-related stocks have skyrocketed in the past year, driving US stock indices to historic highs. Industry insiders indicate that, similar to the previous internet investment craze, this round of enthusiasm for AI concept stocks will first benefit hardware AI companies like Nvidia, then spread to infrastructure AI companies, with software AI companies being the ultimate beneficiaries. Astera Labs falls into the category of infrastructure AI companies.

Astera Labs’ IPO aligns with Wall Street’s appetite for artificial intelligence

Due to the need for extensive data movement within and around data centers for AI, Astera’s revenue has surged. After reaching $79.9 million in 2022, its revenue grew by 45% to $115.8 million in 2023. Some analysts believe that as the first publicly listed “AI unicorn,” the company could be an important litmus test for rekindling investor interest in technology IPOs, which have been largely dormant since the end of 2021.

Astera Labs’ IPO exceeded the scale of all recent US technology company listings. Before this, Instacart and Klaviyo went public in September last year, raising $660 million and $659 million, respectively.

It is noteworthy that Astera Labs has also been called the “first AI unicorn stock.” For a long time, the chip market was dominated by industry giants like Nvidia, Intel, and AMD, with few opportunities for startups. Astera Labs has become the first chip startup from Silicon Valley to go public.

According to Astera’s prospectus, its revenue for 2023 was approximately $116 million, a 45% increase year-over-year, with net losses reduced to $26 million. In contrast, the previous year’s revenue was only $79.9 million, with losses at $58 million.

Is Astera investable for investors?

Due to Astera Labs’ significant growth potential in AI and cloud computing connectivity solutions, and with the rapid expansion of the global cloud AI market, Astera is highly likely to benefit from this trend. Moreover, Astera has established its position in the semiconductor industry, conducting business with large chip manufacturers like Intel, Nvidia, and AMD. This relationship indicates Astera Labs’ strategic importance in the industry. Although Astera Labs is currently unprofitable, its strong annual revenue growth shows that the company is investing in its products and market expansion.

Thus, for investors willing to take certain risks, Astera Labs could be considered an attractive long-term investment option. Its strong positioning in AI and cloud computing and ongoing market demand provide a solid foundation for future growth and success. However, investors should be aware of the company’s current unprofitable status and potential volatility in the tech sector. It is recommended that interested investors conduct thorough research and analysis to ensure their investment decisions align with their risk tolerance and investment objectives.

If you are interested in investing in Astera, it is recommended to choose a reputable brokerage for investment management, such as Charles Schwab, a globally recognized investment brokerage. Opening an account with Charles Schwab provides a bank account of the same name, allowing for the transfer of digital currency (USDT) to the multi-asset wallet BiyaPay, and then converting to fiat currency for investment in US stocks through Charles Schwab. Investors can also directly invest in Astera using BiyaPay, simply by searching for the Astera ticker (ALAB) and then monitoring the stock price regularly to buy or sell at the right times according to their investment strategy.

Conclusion

Astera Labs’ successful NASDAQ debut has made it a hot search in the AI and semiconductor industries. With the continuous evolution of artificial intelligence technology and the rapid development of large models driving demand for AI technology, Astera Labs is expected to continue expanding its market share and enhancing its competitiveness in data centers and AI computing.

Astera Labs’ successful IPO and the subsequent surge in its stock price indicate investor optimism about the long-term growth prospects of the high-tech sector, especially artificial intelligence. As more tech startups plan to go public, this sector is expected to remain in focus and may further stimulate activity in the related stock market.