- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Three Essential Questions of US Stock Investment: Too Expensive? Still Buyable? How to Buy?

Since the beginning of this year, US stocks have attracted global investors with their vigorous upward trend.

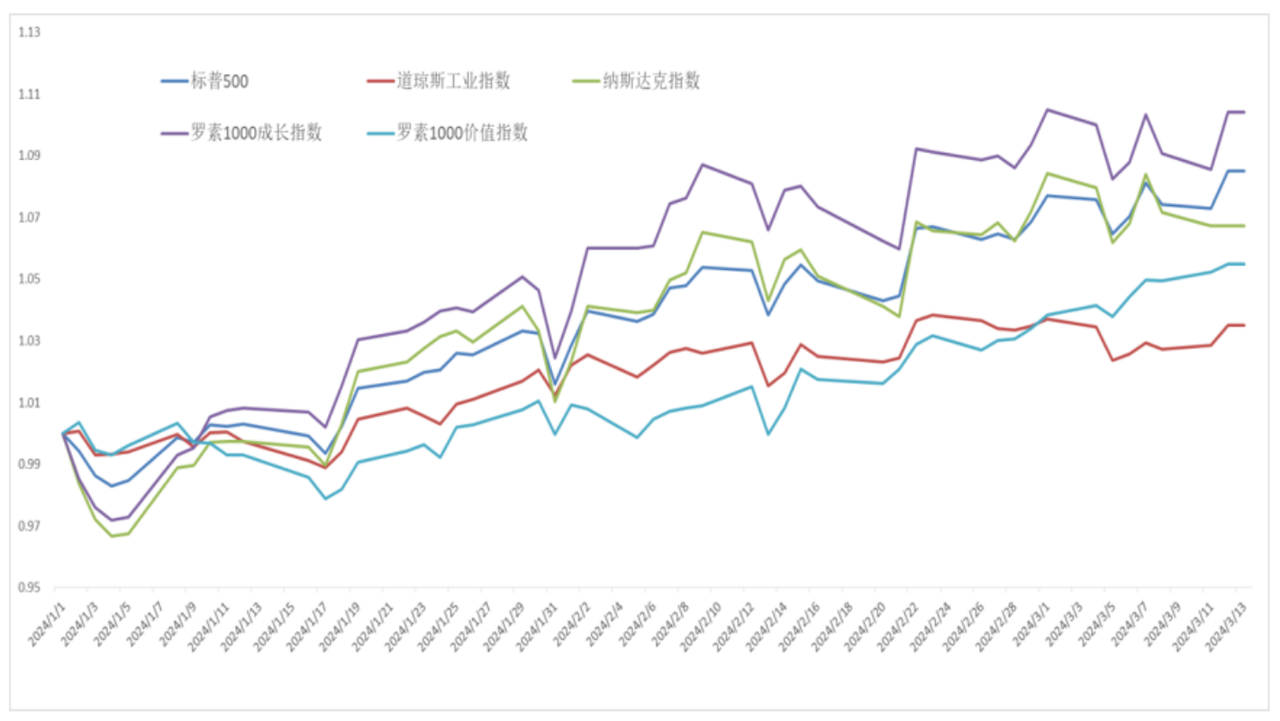

Particularly in February, the performance was strong, with the S&P 500 index rising by 5.17% and the Nasdaq index by 6.12% for the month. Boosted by the AI concept, the growth style continued to lead, with the Russell 1000 Growth Index gaining over 10% since the beginning of the year.

Figure: Performance of US broad-based index

At this point, investors are most concerned about whether US stock valuations are too high, whether it is still possible to get on board, and what risks may be faced.

Here are two conclusions to start with:

1.The US stock market has a significant “positive momentum effect,” with historically higher returns after reaching new highs compared to previous points in time.

2.The three major factors driving the long-term rise of US stocks—earnings, liquidity, and AI technological innovation — are still ongoing, making it a good time to allocate in US stocks.

Now, let’s discuss some common confusions in US stock investment and talk about the market strategy.

Can we still buy US stocks after significant rises?

After the strong rally in 2023, US stocks have continued their “good start” into this year.

Many investors wonder if it’s still possible to get on board after such substantial increases.

Let’s start with the basic characteristics of the US stock market:

1.US stocks have long bulls and short bears, with a high long-term win rate

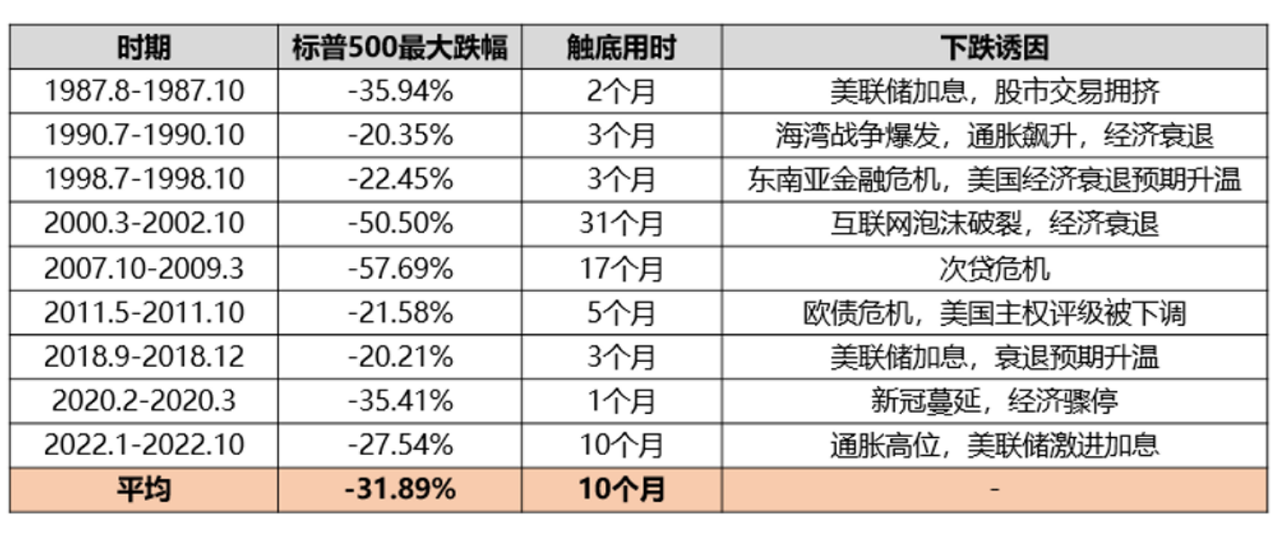

Looking back at the performance of the S&P 500 index over the past 40 years, from 1984 to 2023, there were only 9 years of decline, with more than 20% retracement occurring only 9 times, and on average, it took only 10 months to start a recovery.

Figure: Review of the US bear market

This shows that the US stock market is typically a long-bull-short-bear market, with significant retracements often triggered by specific macro events, such as wars, financial crises, the COVID-19 pandemic, Fed rate hikes, etc. In most calm periods, US stocks maintain fluctuating or moderate rising trends.

2.Significant positive momentum effect in the US stock market

Many domestic investors compare the current US market situation to the peak of the A-share bull market in 2021, followed by a lengthy correction period over three years. So, will the US stock market also suddenly correct significantly after such a rise?

In fact, judging from the historical performance of the US stock market, the answer may not be consistent with our understanding.

The return on investment after the US stock index hits a new high is higher than the return on investment at any point in time, indicating that the US stock index has a certain positive momentum effect. The so-called positive momentum refers to the possibility that a new high may bring better returns in history.

Of course, this result may only be based on historical calculations, and there may still be various unexpected Black Swan events in the future. But in the long run, investing in US stocks is still a matter with high winning and odds.

What is driving the rise in US stocks?

If we look at the valuation of US stocks from a numerical perspective, as of the end of February, the rolling ten-year percentile valuations of the S&P 500 and Nasdaq are 79.2% and 98.4%, respectively, indicating high valuation levels.

However, valuation is not the only reason affecting allocation decisions. We can analyze the driving forces behind the rise in US stocks from the following three factors: earnings, liquidity, and AI innovation.

1.Earnings

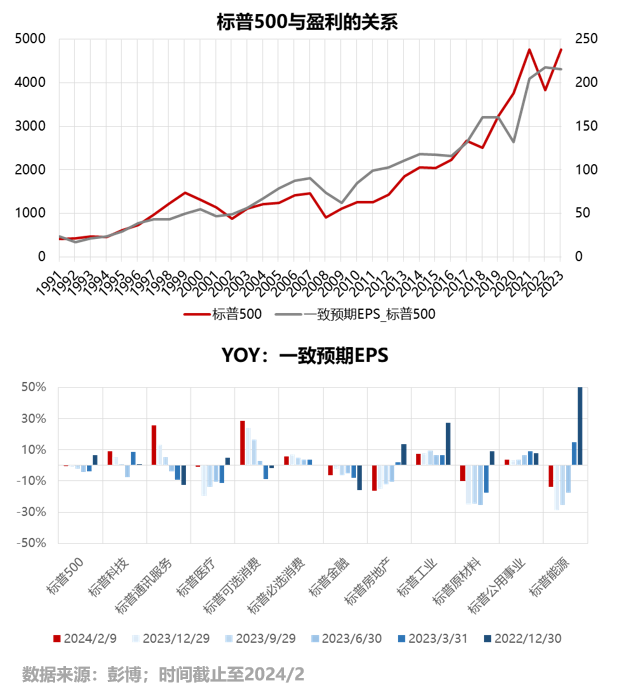

The core element for the long-term rise of US stocks is the continuous earning ability of companies. Looking at the performance of the S&P 500 over the past 20+ years, its long-term growth is highly consistent with corporate earnings, which has been the biggest driver of the long bull market in US stocks for nearly 40 years.

In 2024, driven by strong demand and AI-driven new business models, the S&P 500 and most sectors are expected to continue their year-over-year improvement, further driving positive index growth.

2.Liquidity

Financial liquidity has long been a major factor influencing US stock trends. US stock market liquidity consists of the following three parts: Financial liquidity = Federal Reserve liabilities - TGA - Reverse repos.

1)Securities holdings or borrowing by the Federal Reserve: liquidity provided through QE and various liquidity facilities;

2)Treasury General Account (TGA): a decrease means liquidity release, an increase means liquidity recovery;

3)Overnight reverse repos: funds placed with the Federal Reserve by money market funds, etc., where a decrease means liquidity release, and an increase represents liquidity recovery.

The rise in US stocks since October 2023 corresponds to an environment where reverse repos are rapidly releasing funds, and the TGA has completed replenishment without withdrawing funds, a situation that continues at present.

3.AI Innovation Drive

The rise in US stocks since 2023, led by AI and other technology sectors, owes much to the “Magnificent 7,” including Nvidia, which contributed to about 80% of the increase in US stocks. These seven companies still have strong earning capabilities, with valuations less than half of what they were during the internet bubble period.

After the emergence of ChatGPT last year, this year’s release of Sora by OpenAI has once again sparked a global wave of artificial intelligence technological innovation. Currently, AI innovation continues to play a strong role in driving US stocks.

So, how should one invest in US stocks?

Although US stocks continue to reach new highs, given the significant positive momentum effect and the three major driving factors behind US stocks still in play, it remains a good time to invest in US stocks.

In practice, how should one invest in US stocks?

First, choose an investment channel that suits your risk preference.

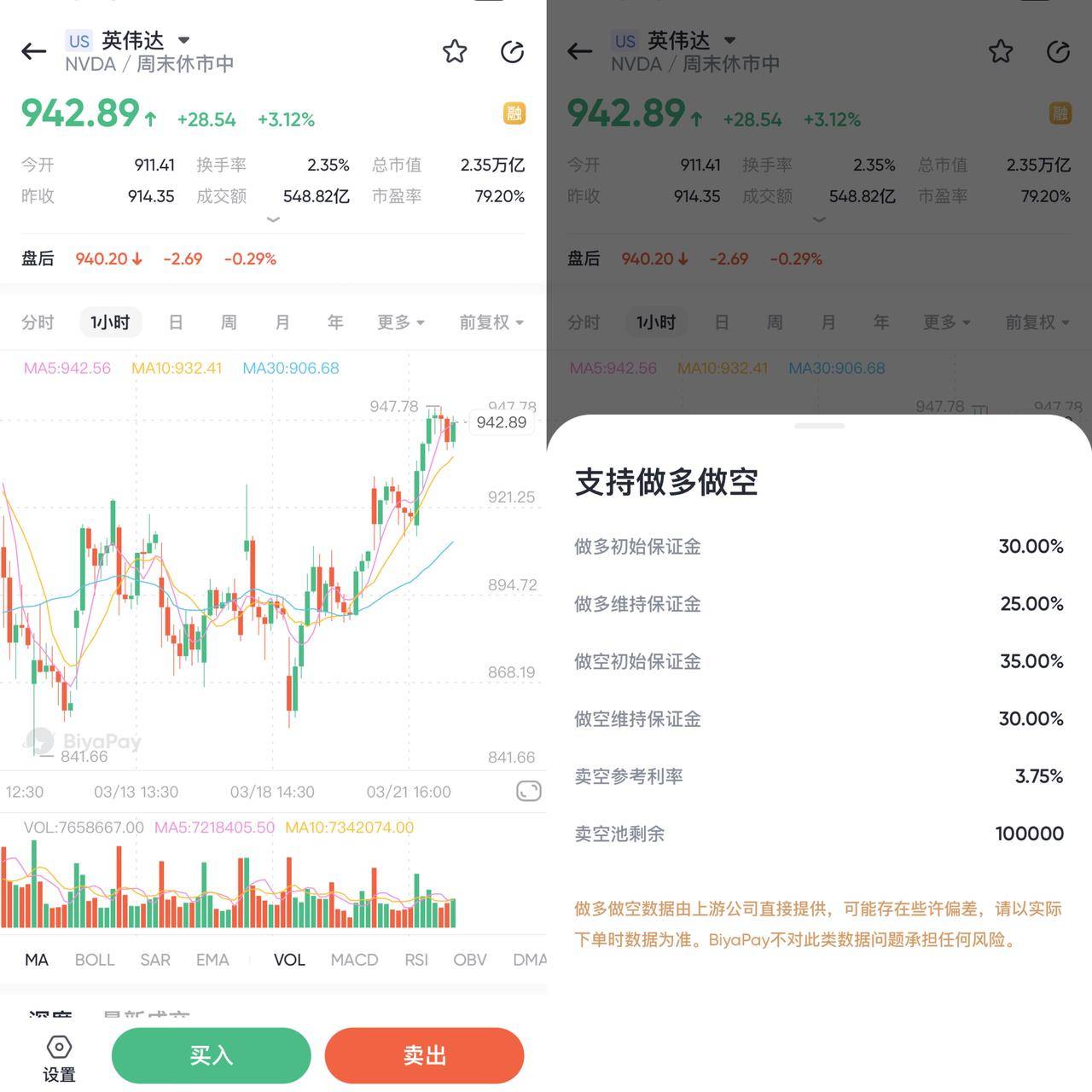

For investment platforms, Interactive Brokers, Charles Schwab, and BiyaPay are recommended. Interactive Brokers and Charles Schwab are US brokers, but their Chinese service experience is somewhat lacking, though they do offer low trading fees. Then there’s BiyaPay, which is more like a wallet-type broker, similar to Alipay in mainland China. It offers online account opening with services in both English and Chinese. Moreover, they provide a wide variety of tradable assets, not only US stocks but also Hong Kong stocks, cryptocurrencies, and more, making it a robust company.

I currently use the BiyaPay App for trading US stocks because it has the advantage of not requiring an overseas bank card. You can directly exchange currency on BiyaPay, and for funding Charles Schwab, it supports both wire transfer and ACH, with ACH transfers being fee-free and processed the same day, emphasizing speed and convenience.

Secondly, despite the positive momentum effect in US stocks, choosing a better entry point is also possible.

Typically, during the latter stages of rate cuts, US stocks are usually at a high point and can be considered a selling point, while the period before that might offer better buying opportunities. Investing in increments and buying more at low points are both good investment strategies.

Example: NVIDIA, Image Source BiyaPay App

Lastly, it’s advised to delve into Warren Buffett’s core stock-picking principles, which may inspire you or even lead you to re-evaluate your investments. Regardless of your thoughts, it’s perfectly reasonable. After all, there is no correct answer in investing. Even the greatest investor, Buffett, misses out on some good investments and makes mistakes. We just need to integrate Buffett’s investment philosophy into our own and continually refine it over time.

In conclusion, investing in US stocks is indeed a good choice. By understanding the basic questions of US stock trading, setting up a US stock account, funding it, selecting the right US stocks, and learning the skills of buying and selling US stocks, one can participate in the global stock market and gain more investment opportunities.

Investment involves risks, so one should proceed with caution when entering the market.