- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Arrival of the AI Era: What Lies Ahead for Apple? Can Vision Pro Save Apple?

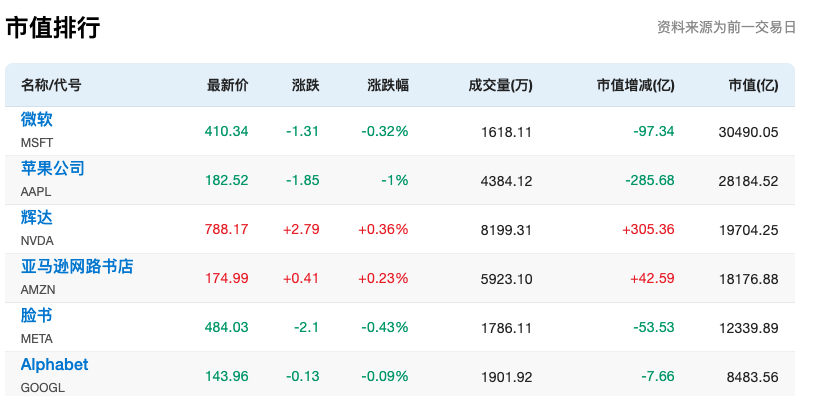

Last week, U.S. Tech stocks staged a “capital feast.” Boosted by the release of the Sora large model, Nvidia led the surge in AI company stock prices, reaching a market value of $2 trillion for the first time in history, and driving up the stock prices of companies like Meta and Microsoft. Market observers believe that AI is expected to further push Nvidia’s momentum, and after joining the “$2 trillion club,” surpassing Apple’s market value no longer seems out of reach.

In this tech wave triggered by large AI models, Apple has not been able to grab a piece of the action. Since being overtaken by Microsoft in market value, Apple’s stock price has been on a downward trend. The launch of its heavyweight mixed-reality wearable, Vision Pro, also failed to boost Apple’s stock performance. Since Vision Pro went on sale nearly a month ago, Apple’s stock has fallen more than 6%, with its current market value at $2.8 trillion, nearly $200 billion behind Microsoft. As of press time, according to the multi-asset trading wallet BiyaPay’s market display, Apple’s stock price is $182.52.

Despite these concerns, investment bank Bernstein believes that this tech giant still has a story to tell on this topic, all based on the iPhone and Vision Pro.

Apple Growth Narrative: The AI Smartphone

The term “AI smartphone” is considered somewhat “ambiguous,” as everyone seems to have a different definition of what it actually means. However, Bernstein analyst Toni Sacconaghi wrote in an investor report that most believe AI capabilities are largely “incremental” rather than revolutionary. Sacconaghi rates Apple as “market-perform” with a target price of $195.

Samsung recently launched the Galaxy S24 series, integrating several AI-related features, including photo editing, real-time translation, and photo tagging. Sacconaghi believes Apple could use AI for similar tasks but might push technology further given its ability to integrate software and hardware.

Sacconaghi wrote, “We expect potential AI features to also largely align with existing product capabilities, including advanced image and video capture/editing tools, translation and transcription, enhanced messaging support, enhanced Siri, and greater music playback automation. We also believe Apple will integrate its applications more closely and seamlessly to improve usability.”

Sacconaghi noted that other AI-specific features Apple might include could be related to the next generation of Apple chips—expected to be the 3nm A18 chip.

Will This Help Apple’s Stock Price?

The investment community’s view is that Apple has fallen behind its competitors in the generative AI field, despite increasing its investment in the technology—reportedly developing an internal version of ChatGPT. Apple’s market value has been surpassed by Microsoft and Nvidia, with Nvidia’s market value skyrocketing by 230% over the past year, becoming a symbol of generative AI.

Sacconaghi said that even if the AI features of the iPhone are not unique, the company’s marketing prowess is sufficient to drive a “substantial upgrade cycle.” Sacconaghi stated, “We note that Apple was relatively late introducing large screens, OLED (iPhone X), and 5G compared to its peers, but each triggered a meaningful upgrade cycle for Apple.”

He added, “Our analysis suggests that every 100 basis points change in the iPhone upgrade rate would increase sales by about 8 million phones, or about $7 billion in iPhone revenue, which would boost iPhone FY25 revenue by approximately 300 to 400 basis points, thereby increasing overall revenue growth by 100 to 200 basis points.”

Sacconaghi further mentioned that if Apple increases the price of the iPhone 16 due to AI features (similar to what Google did with the Pixel 8 and Pixel 7), sales growth could receive an even bigger boost. With revenue growth, an increase in stock prices naturally wouldn’t be an issue.

How to Buy Apple Stock

As one of the world’s most valuable companies, buying its stock is not difficult, with many brokers offering it, such as Tiger, Futu, and Interactive Brokers. However, due to various reasons, many Chinese investors find it difficult to open brokerage accounts. It’s recommended to choose a credible broker for investment, such as Charles Schwab, a globally renowned investment broker. Opening an account with Charles Schwab provides a bank account with the same name, and you can deposit USDT into the multi-asset wallet BiyaPay, then withdraw fiat currency from Charles Schwab to invest in the U.S. stocks.

BiyaPay is authorized by the U.S. Securities and Exchange Commission, and they have also opened up U.S. stock investment services. Investors can search for Apple’s stock code on the BiyaPay platform and purchase its stock. Investors can monitor Apple’s stock price regularly according to their investment strategy and buy or sell Apple’s stock at the right time.

Vision Pro—Apple’s Potential Counterattack

At the Apple Worldwide Developers Conference (WWDC 2023), Tim Cook continued Steve Jobs’ tradition of “one more thing” by announcing the new generation of spatial computing product—Apple Vision Pro. AI+ is seen as a key factor in the development of the virtual/augmented reality industry and the underlying technology driving the industry deeper, with Apple always being a “game rules maker” in the AI layout.

Apple is not a company that talks about its future products and services, but the company has made firm comments on generative AI in recent records, including this month’s earnings call. Apple CEO Tim Cook said on the earnings call, “As far as generative AI is concerned… as I’ve mentioned before, we have a lot of work going on internally, some things we’re very excited about, which we’ll talk about later this year.”

The integration of AI+ with AR/VR is a significant trend in industry development, whether looking at Apple’s products, Meta’s latest layout, or the impact of AI on device updates, indicating that fully integrating AI technology is an important part of the future development of the AR/VR industry.

“We’ve been researching AI+ integration with AR/VR technology for a long time because we think it’s a great idea, profound technology,” Cook pointed out, “This will turn the page to the next chapter, and it will be a huge leap.”

What the future holds for Apple remains to be seen.