- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA Once Again Dominates the Field! Analysts Exclaim "Mic Drop Moment," Confirming the AI Revolut

NVIDIA’s revenue and profits both skyrocketed year-over-year and exceeded expectations in the fourth quarter, once again dominating its peers and dazzling all of Wall Street.

NVIDIA CEO Jensen Huang stated that generative AI has reached a “tipping point.”

Kim Forrest, Chief Investment Officer at Bokeh Capital Partners LLC, commented on NVIDIA’s financial report, saying, “As NVIDIA goes, so goes the market.”

Wedbush analyst Dan Ives believes this is a new “mic drop moment,” with Huang compellingly proving his status as the “godfather of AI.”

1.NVIDIA’s performance sets records, with after-hours stock price surging by 10%

On the evening of the 21st local time (Wednesday), NVIDIA’s fourth-quarter earnings report showed revenue of $22.1 billion, a 22% increase quarter-over-quarter and a whopping 265% increase year-over-year; net profit was $12.3 billion, a 769% increase year-over-year, both exceeding analysts’ expectations. The quarterly revenue even surpassed the total revenue of 2021, with revenue and profits setting records for the third consecutive quarter. After-hours stock price momentarily jumped by 10%, with an after-hours price of $733.2 per share.

Before the announcement of the strong financial report on Wednesday, NVIDIA’s stock price had already soared by about 40% since the beginning of the year, driving the S&P 500 index up by about 30%. Over the past year, NVIDIA’s growth has exceeded 200%.

Behind the “dazzling” financial report is the still strong demand for AI hardware, which once again ignited enthusiasm in the stock market, driving AI concept stocks to collectively rise after hours.

- In terms of computing hardware, AMD, which had fallen by 0.8%, rose more than 4% after hours; Arm’s after-hours gains expanded to 6%; Broadcom rose more than 2.5% after hours.

- In terms of AI applications, Super Micro Computer (SMCI) rose more than 10% after hours, having previously fallen more than 10%; Palantir rose 4.3% after hours, C3.ai rose 4.5% after hours; Intel, which had fallen more than 2%, rose slightly after hours; Synopsys, which also announced earnings on the same day, rose 3% after hours.

- Among tech giants, Amazon rose 0.5% after hours, Microsoft rose 1%, Google’s parent company Alphabet rose 1.8%, and Meta rose 1.7% after hours.

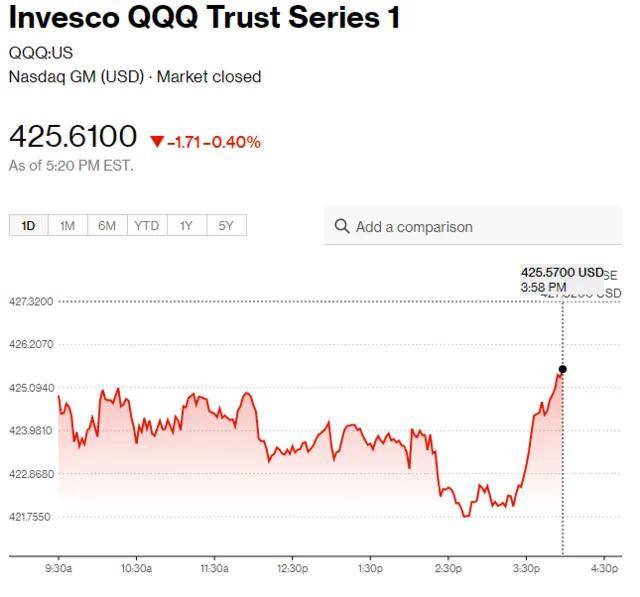

The Invesco QQQ Trust Series 1, one of the largest ETFs tracking the Nasdaq, rebounded sharply at the end of trading after three consecutive days of decline.

2."Generative AI has reached a tipping point"

After the earnings release, NVIDIA CEO Jensen Huang stated that generative AI has reached a “tipping point”:

“Accelerated computing and generative AI have reached a tipping point. The demand from companies, industries, and countries around the world is surging.”

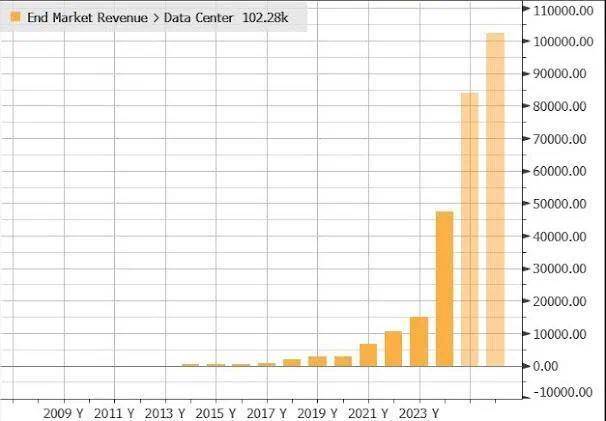

The earnings report showed that, as NVIDIA’s largest source of revenue, the data center segment’s fourth-quarter revenue exploded by 409% year-over-year, reaching $18.4 billion.

NVIDIA CFO Colette Kress stated that the supply of current GPUs is improving with strong demand. She expects the market demand for the company’s next-generation products to far exceed supply levels because “building and deploying AI solutions has touched nearly every industry.”

According to NVIDIA, the company’s next-generation “nuclear bomb level” AI chip, B100, is expected to be released in the coming quarters.

"As NVIDIA goes, so goes the market"

Wall Street continues to be bullish on NVIDIA, believing that the strong earnings report signifies that the AI craze will continue to support the broader market.

Kim Forrest, Chief Investment Officer at Bokeh Capital Partners LLC, commented on NVIDIA’s earnings:

“For the past 11 months, NVIDIA has been a market mover. As NVIDIA goes, so goes the market. It seems the results are already good enough—without any major positive or negative surprises. It indeed confirms the argument that artificial intelligence will continue to remain strong in the foreseeable future. This argument supported the market last year. Why not this year?”

Thomas Martin, Senior Portfolio Manager at Globalt Investments, stated:

“The demand for NVIDIA’s products and growth has obviously been so strong. As long as NVIDIA can continue to achieve growth, it can support a sky for the company, and the stock price will be supported.”

Adam Sarhan, Founder of 50 Park Investments, said:

“This is another explosive quarter. This is very beneficial for stock investors, as NVIDIA has shown us the prospects of artificial intelligence development. More importantly, the company has also shown us that the excitement of artificial intelligence can be translated into actual profits. This is very powerful, and they will continue to surpass Wall Street’s predictions.”

The options trading market, which heated up on the eve of the earnings release, also reflected traders’ high “AI faith.”

According to data from Cboe Global Markets, a few hours before the earnings release, widely traded call options bet that the stock price would jump to the $700-$800 range.

There were call options betting that NVIDIA’s stock price would soar to $1300, about twice the current stock price. If the market price really rises to that level, NVIDIA’s market value would rise to $3.2 trillion.

Senior technology analyst and managing partner at Deepwater Asset Management, Gene Munster, believes this is just the first of several AI “waves” that will drive NVIDIA’s stock price higher.

How to buy NVIDIA stock?

Buying NVIDIA stock requires opening a U.S. stock account. It’s important to choose a reputable broker for investment, such as Charles Schwab, a globally renowned investment broker. Opening an account with Charles Schwab provides a bank account of the same name. You can deposit USDT into the multi-asset wallet BiyaPay and then withdraw fiat currency to Charles Schwab to invest in U.S. stocks. BiyaPay has been authorized by the U.S. Securities and Exchange Commission, and they have also launched U.S. stock investment services. You can directly search for NVIDIA’s stock symbol on BiyaPay and purchase NVIDIA’s stock.

Additionally, There are reports that from March 18th to 21st, NVIDIA will hold its annual AI conference, GTC 2024, at the San Jose Convention Center in the United States. It is expected that more than 1,000 companies and 300,000 people will attend the conference in person or online. Technology giants such as OpenAI, Microsoft, Meta, and Google DeepMind will send representatives to attend, and NVIDIA’s supply chain companies like Foxconn and Quanta will also participate.

As the AI wave surges, are you ready?