- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Buffett is 'scheming' something? Sold 10 million shares of Apple, how should we view Buffett's move?

As the “god” of the stock market, Buffett has practiced the four words of “value investing” throughout his life.

Indeed, the stock god Buffett has made a big move recently.

On February 15th, Berkshire Hathaway, led by Buffett, released the U.S. stock holding report for the fourth quarter of 2023, showing that Berkshire Hathaway sold 10 million shares of Apple in the last quarter, with the average stock price during the period, the market value of the reduction is about 1.822 billion U.S. dollars.

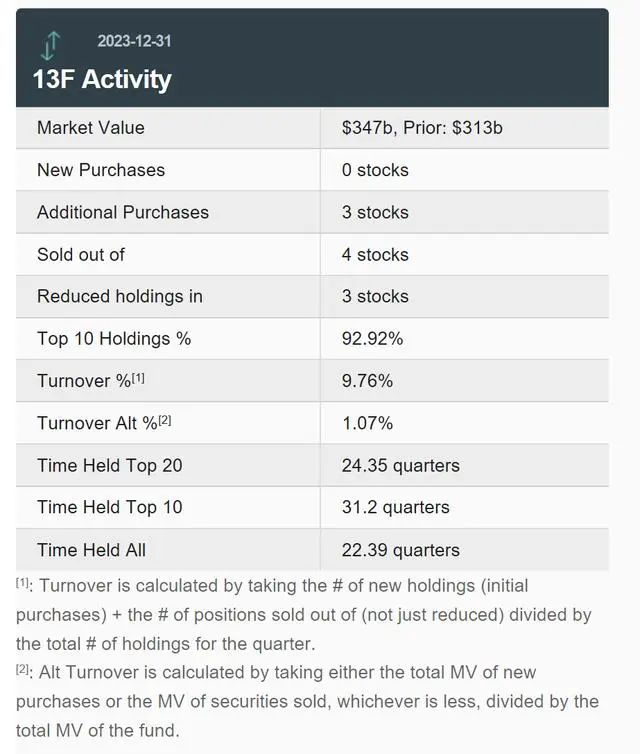

Additionally, according to statistics from the data platform WhaleWisdom, as of the end of last December, Berkshire’s total U.S. stock holdings were about 347 billion U.S. dollars, an increase of about 34 billion U.S. dollars from 313 billion U.S. dollars in the previous quarter. The top ten holdings accounted for 92.92%, with Apple making up 50.19%.

This reduction has inevitably caused a huge stir in the market. As Buffett’s “pet”, his choice of this position to cash out easily gives the outside world a bearish signal.

In fact, many investors think so. They believe that as U.S. tech stocks continue to rise, they have accumulated considerable risks, and the bubble in U.S. tech stocks could burst at any time, and Buffett’s reduction is a signal.

Of course, looking at Buffett’s overall holdings, this view seems untenable, it’s just some reasonable allocation in the company’s position.

Why did Buffett sell Apple shares again?

In December last year, Apple reached a historical high of $199.38 per share, with a total market value exceeding $3.1 trillion, after which Apple’s stock price entered an adjustment phase. Currently, Apple’s latest stock price closed at $184.15 per share, with a total market value of $2.8436 trillion. Compared to that time, Apple’s market value has evaporated by more than $200 billion. Notably, at the start of 2024, institutions downgraded the stock rating of Apple’s announcement.

Regarding Buffett’s reduction in Apple, many investors believe it is due to Apple’s own performance, weak iPhone sales, lack of innovation, and the new product Apple Vision Pro also encountered a “crash”, the stock price’s volatility and decline, has already been surpassed by the continuously rising Microsoft, giving up the throne of the world’s highest market value.

I think Buffett’s reduction this time may not just be based on Apple’s own performance, but more on an assessment of the overall market environment and future predictions. Like deep thought after a feast, when everything seems too perfect, it might be the moment to reassess and adjust.

Will Buffett significantly reduce his holdings in Apple in the future?

I don’t think it’s likely.

Buffett once said, “High-tech companies change too fast, I really don’t know if the sustainable competitive advantage of companies can be maintained over the next ten years.” Therefore, he has always maintained a “respectful but distant” attitude towards tech companies. Not until 2016 did Buffett’s choice of tech stocks seem to change. In 2016, Buffett made up his mind to buy Apple, and this action was quickly ridiculed by Wall Street.

However, from a performance perspective, Apple was exactly at a turning point in performance, and Wall Street’s bearish voices on Apple were not in the minority, but faced with Wall Street’s ridicule, Buffett did not care. From 2016 to 2018, Berkshire spent $36 billion to buy 5% of Apple’s shares, and in the following four to five years, this investment earned Berkshire’s shareholders at least $100 billion.

In later interviews, Buffett explained why he bought Apple, considering it a consumer goods company using technology, belonging to the consumer goods industry. That is to say, the logic of Buffett’s purchase of Apple was still not technology, but consumption.

Although the documents for the fourth quarter of 2023 show that Berkshire sold 10 million shares of Apple and bought 16 million shares of Chevron, Apple remains the largest heavy stock, accounting for 50.19% of the disclosed assets. Based on the current stock price, its holding size is about $170 billion.

Despite the recent unsatisfactory performance of Apple’s stock price, I believe it is unlikely to significantly reduce Apple’s holdings in the next few years. After all, there were increases in Apple in the fourth quarter of 2022 and the first quarter of 2023.

How should we view Buffett’s significant reduction in Apple? What signals does it release?

I think it can be viewed from three aspects:

- It shows that Buffett’s attitude towards tech stocks is changing, especially against the backdrop of Apple’s poor stock performance.

- It reflects Buffett’s cautious attitude towards the current market environment and his pursuit of a diversified investment portfolio.

- It’s an adjustment to the excessive proportion of Apple stocks in Berkshire’s investment portfolio to reduce the risk of a single asset.

In recent investment dynamics, Berkshire’s increased holdings in energy stocks are also worth deep thought by investors.

Just like in this time, the two companies added in Berkshire’s top ten holdings are Chevron and Occidental Petroleum, both energy companies. These two energy companies have not risen in the past year, but Buffett continues to increase holdings, perhaps seeing the future economic growth’s demand for energy, or their excellent cash flow.

Buffett’s strategy may indicate the long-term growth potential of the energy industry. With the global economic recovery, the increase in energy demand may be one of the reasons Buffett is bullish on energy stocks. Additionally, the increase in energy stocks may also reflect Buffett’s recognition of investment opportunities in the transition from traditional to new energy. Investors might glean insights into the future development trends of the energy market and Berkshire’s investment layout in this trend.

Here I share with you an investment tool worth using, a multi-asset trading wallet BiyaPay, which not only supports real-time online trading of U.S. and Hong Kong stocks but is also a convenient and fast fund inflow and outflow tool. Recharging digital currencies (such as BTC, USDT) to exchange U.S. dollars, Hong Kong dollars, British pounds, etc., to bank accounts, the exchange happens the same day without limits, which is a two-fold benefit.

Finally, I also remind all investors, when making investment decisions, to consider their risk tolerance and investment objectives, to make reasonable asset allocation. Maintain independent thinking, do not blindly follow the trend.