- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

NVIDIA's stock hits a new high, surpassing Amazon and Google in market value, becoming the third lar

At the beginning of 2024, a number of US stocks rose one after another. In the second round of large technology stocks, the most eye-catching star was NVIDIA (NVDA.US). According to the multi-asset trading wallet BiyaPay, as of the close of February 16, NVIDIA quoted $726.13. Since the beginning of this year, NVIDIA’s share price has risen by nearly 50%.

With the continuous rise of NVIDIA’s stock, NVIDIA’s market value has now surpassed Amazon and Google’s parent company Alphabet, becoming the third largest company in the US stock market, with a market value of 179 million US dollars, which is approximately equal to the total market value of “China Mobile + Guizhou Maotai + China Petroleum + China National Offshore Oil Corporation + Big Four Banks”.

The reason for the rise in NVIDIA stock

The surge in Nvidia’s stock price was boosted by news of several fund companies increasing their holdings.

Billionaire Ray Dalio’s Bridgewater Fund securities filing shows that the fund increased its stake in NVIDIA by 458% to 268,489 shares at the end of last year. As of the end of December last year, the value of these shares was $133 million.

Another fund company, Rokos Capital Management, also increased its stake in Nvidia. As of the end of December last year, the fund purchased more than 254,000 shares of Nvidia stock worth more than $126 million, according to securities filings.

The more important reason is that NVIDIA is the leader of the AI era.

Just before the rise of the AI wave in October 2022, Nvidia’s market value was less than $300 billion, far behind Amazon and Alphabet’s market value of over $1 trillion at the time.

After the emergence of the chatbot ChatGPT ignited the AI wave, the market demand for NVIDIA AI chips surged. NVIDIA’s stock price more than doubled last year, but the company’s crazy rise is far from over.

Just entering the second month of 2024, Nvidia’s stock price has risen nearly 50% so far this year, adding about $600 billion to its market value, exceeding its market value increase in the last seven months of 2023.

In early January, NVIDIA released the GeForce RTX 40 SUPER series of desktop GPUs with high-performance generative AI capabilities, including the RTX 4080 SUPER, RTX 4070 Ti SUPER, and RTX 4070 Super, and has also made progress in AI-related components and software.

Recently, NVIDIA also launched Chat with RTX, a demo application that allows you to run your own AI chatbot on your personal computer. Whether it’s a YouTube video or a personal document, it can be used to generate summaries or obtain relevant answers based on personal data. The entire process takes place entirely on your local computer, and you only need an RTX 30 or 40 series graphics card with at least 8GB VRAM.

Due to the above reasons, NVIDIA’s stock price continues to rise to new highs.

Will NVIDIA continue to rise in the future?

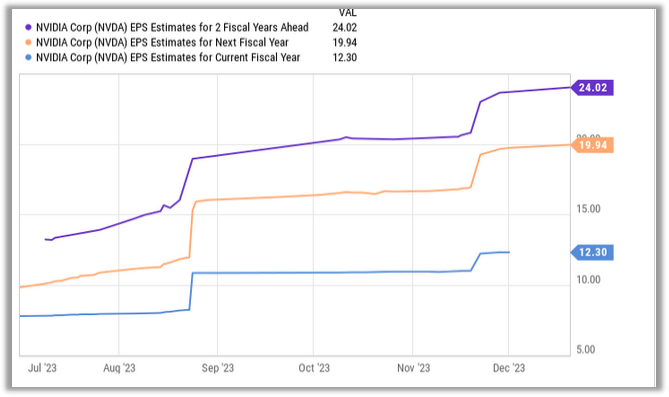

2023 can be said to be the best year for NVIDIA since its establishment nearly 30 years ago. Due to the increase in demand for training and inference computing power driven by large language models, the market demand for NVIDIA AI chips (H100, A100, etc.) and HGX platform has also surged. As a result, NVIDIA’s stock price has risen by nearly 240% in 2023.

Therefore, the editor will continue to be optimistic about NVIDIA in 2024, mainly for two reasons.

1. The personal computer market shows signs of recovery

In 2022, macroeconomic headwinds dealt a heavy blow to the technology market and triggered a sell-off. The Nasdaq 100 technology sector index also fell by 40% at that time. However, with the easing of inflation and the increasing interest in emerging AI industries, the technology industry began to recover in 2023 and may continue to improve in the new year.

According to Gartner’s data, the shipment volume of personal computers in 2022 decreased by 16%. The reason is that consumers who bought new computers in the early stages of the epidemic had no motivation to upgrade or replace them, and inflation and rising interest rates also affected consumers’ discretionary spending. However, this number has improved in the third quarter of 2023, and the quarterly performance of multiple related companies also indicates that the personal computer market is recovering.

In terms of business related to personal computers, NVIDIA mainly categorizes it as a gaming business because its hardware is used by consumers to assemble high-performance gaming computers. With the recovery of the personal computer market, NVIDIA’s gaming business revenue has increased by 81% year-on-year and 15% quarter-on-quarter (as of the third quarter of fiscal year 2024 ending on October 29).

2. NVIDIA will still maintain its dominant position in the AI field

Although companies like AMD and Intel (INTC) are also working on GPUs, they have mainly been developing and promoting Central Processors (CPUs) for many years, while Nvidia has made GPUs its own strategy and focus. Therefore, when technology companies shifted their focus to AI and the demand for GPUs that provide computing power for AI surged last year, Nvidia’s market share in the AI chip field quickly reached nearly 90%.

The surge in AI chip sales is also reflected in NVIDIA’s financial report. As of the third quarter of fiscal year 2024, NVIDIA’s revenue increased by 206% year-on-year, and operating income increased by 1600%. The increase in market demand for AI chips also led to a 279% increase in NVIDIA’s data center revenue in the third quarter.

Although Nvidia profited from the lack of competition in the AI chip market in 2023, this situation may change in 2024, as AMD and Intel have announced that they will launch new AI chips in the coming months, which has made some investors worried about Nvidia’s prospects in 2024.

The editor thinks investors don’t need to worry at all.

According to Grand View Research’s prediction, the annual compound growth rate of the AI market will reach 37% by 2030. If this growth rate can be achieved, the market size of this industry will exceed $1 trillion by 2030. This means that even if new competitors emerge, NVIDIA has enough market space to continue to maintain its dominant position in the AI field.

In addition, although AMD and Intel have been challenging NVIDIA’s dominant position in the GPU market for many years, they have not succeeded (NVIDIA already occupies more than 80% of the GPU market share, and AMD and Intel’s market share in this field is constantly shrinking), so even in the AI field, this competition landscape will not change significantly.

Given NVIDIA’s leading position in the AI field and its resurgent personal computer business, the company still has huge growth potential in 2024 and beyond.

How investors can buy NVIDIA stock

To buy NVIDIA stocks, you need to open a US stock account. However, due to various reasons, it is very difficult for many Chinese investors to open a securities account. Here, the editor believes that we should choose a more credible securities firm for investment, such as Jiaxin Wealth Management is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit USDT into the multi-asset wallet BiyaPay and then withdraw fiat currency to Jiaxin Securities for investment in US stocks.

BiyaPay has been authorized by the US Securities Supervision Commission and has also launched a US stock investment business. You can also directly invest in US stocks on BiyaPay. Investors can search for NVIDIA’s stock code on the platform and buy NVIDIA’s stock. Investors can monitor NVIDIA’s stock price regularly according to their investment strategy and buy or sell NVIDIA’s stock at the appropriate time.

Conclusion

The rise of NVIDIA represents the arrival of an era - the era of artificial intelligence. As investors, we must put certain energy and positioning above the times.

The important thing is to turn the things you are optimistic about or concerned about into positioning. We have found that successful people can constantly iterate. When new things come, they can constantly generate new ideas, keep up with the times, and put iterations into practice, turning them into benefits and benefits. Those who have been washed away by the big waves, although they know this opportunity, have not done it or done it backwards, such as speculating on concepts. But if they invest in a company driven by business in an era, it is completely different.

Therefore, we have no reason not to embrace this era.