- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

The Foundation for a Bull Market in U.S. Stocks in 2024 is Already Set, How Should Investors Approac

Last year, overseas markets performed excellently, with major broad-based indices in the U.S. stock market achieving remarkable results. At the beginning of 2023, as the macroeconomy performed better than expected, the U.S. stock tech sector saw a significant uptrend. Later, driven by the AIGC concept and supported by ample liquidity, many software and semiconductor tech stocks performed well.

Entering 2024, with products from overseas markets, including the Nikkei, returning to investors’ sights, whether and how to continue investing in U.S. stocks from an asset allocation perspective are key concerns for many investors.

U.S. Macro in 2024 — The Foundation for a Bull Market Has Formed

Before analyzing, let’s review why the U.S. economy showed unexpected resilience in 2023:

- U.S. Consumer spending remained robust, supported by excess savings and wage increases, maintaining high growth in consumption.

- Technological advancements stimulated corporate investment, and the U.S. government’s push to bring manufacturing back spurred economic recovery.

- Inflation continuously declined, and the negative impacts of interest rate hikes were lower than market expectations.

Looking forward to this year’s U.S. macro environment, we believe the expectations for a “soft landing” for the U.S. economy are ample. With ongoing inflation decreases, falling interest rates, and stable economic growth rates, the foundation for a bull market in the U.S. stocks are preliminarily set.

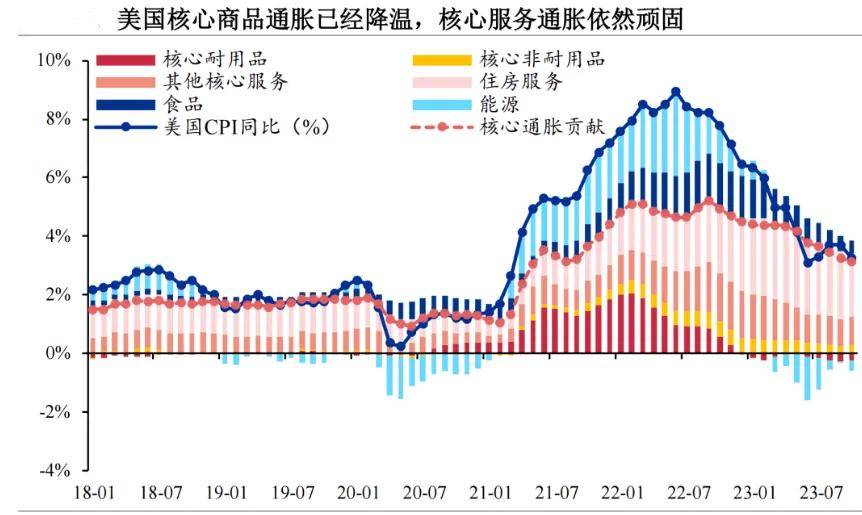

(1)Inflation Aspect

Before this year, the decline in U.S. Inflation was mainly attributed to the cooling of the real estate market under high interest rates, a decrease in world trade, weak demand from China, among other factors. International commodity prices were generally stable in 2023, creating favorable conditions for controlling inflation in the U.S.

Breaking down into services and goods, this year’s inflation situation in the U.S. also shows some signs. First, there’s high demand for services, and during this round of rate hikes, the U.S. unemployment rate has been stable, and income decreases slowly, hence consumption demand remains in the expansion zone. On the other hand, demand for goods is relatively weakening and may no longer pose a “re-inflation” threat in the short term.

(2)Fiscal Aspect

Historical experience shows that U.S. stocks perform well during the plateau of high interest rates just before the start of a rate-cutting cycle. Moreover, a single monetary policy is not the key factor for this round of a “soft landing” in the U.S. economy. If we consider fiscal and monetary policies in tandem, it’s not hard to see that every turn in the post-pandemic U.S. economy has been in sync with the expansion or contraction of monetary and fiscal policies.

Coordination between fiscal and monetary policies is a key factor in guiding the U.S. economy towards a “soft landing.” For example, the industrial policies such as the “Infrastructure Investment and Jobs Act” and the “CHIPs Act” continue to strongly drive the return of manufacturing, leading to sustained rapid growth in manufacturing construction spending, and corporate investment is expected to perform well at the beginning of the year.

U.S. Stock Asset Allocation Direction in 2024 — Nasdaq

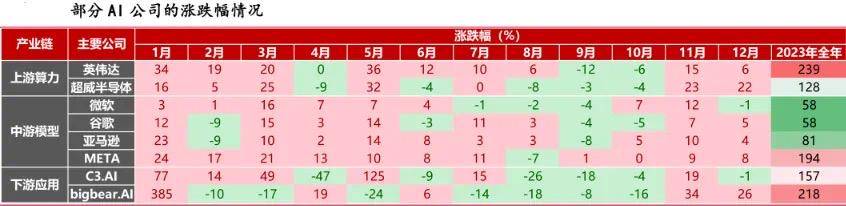

Last year, the Nasdaq index delivered excellent returns to investors due to favorable business cycles, economic resilience, and technology innovation driven by generative AI.

Most notably, driven by the release of chatGPT, the AI industry continued to contribute catalytic hotspots, with leading companies successively deploying in the AI industry chain, leading to strong rallies.

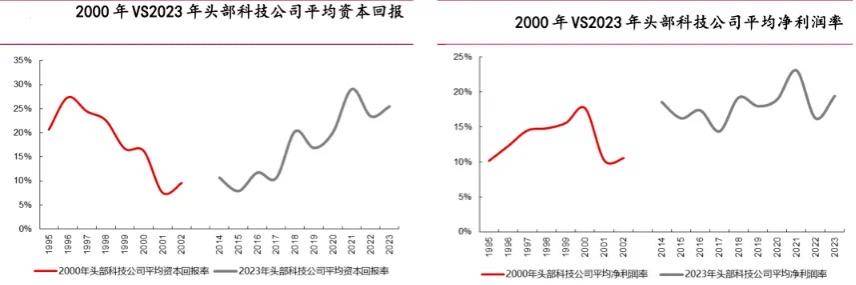

From a fundamental perspective, the current market fundamentals are well-supported, with the revenue market cap ratio, average return on capital, and average net profit margin of current tech leaders all higher than those of the main tech leaders during the 2000 tech bubble, with the average return on capital reaching nearly 30%.

Compared to before the 2000 tech bubble burst, when the indicators for tech leaders had deteriorated, the current situation is quite the opposite. U.S. tech leaders have strong profitability and cash-generating abilities. According to Guolian Securities, U.S. Tech companies continue to invest even in an environment of rising interest rates and borrowing costs, indicating strong defensiveness and an accelerating layout in AI, gradually broadening their “moats” with good growth prospects.

Specifically, we recommend focusing on the Nasdaq 100 index, which hit a new historical high on Thursday (18th), rising by 1.47%. Its surge was mainly driven by two pieces of news: TSMC’s Q4 performance greatly exceeding expectations, and recent bullish views on Apple from Bank of America, upgrading Apple’s stock rating to buy and predicting a 20%+ rise in Apple’s stock price over the next 12 months, leading to a significant rise in Apple’s stock price.

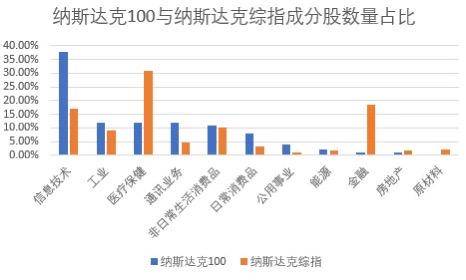

Index-wise, the Nasdaq 100 index, comprising global tech giants like Nvidia, Microsoft, Tesla, etc., stands out for its strong bargaining power in the supply chain and technological innovation capabilities. Compared to other indices, we are more optimistic about the performance of the Nasdaq 100 index in the upcoming market for the following reasons:

(1)The tech attribute of Nasdaq 100 index constituents is prominent, with a high concentration in industry distribution. Specifically, the information technology industry has the largest weight in the Nasdaq 100 index, followed by healthcare, communication, and industrial sectors.

(2)The historical performance of the Nasdaq 100 index has been better, with long-term returns significantly outperforming the three major U.S. stock indices, showing relatively higher elasticity. Analyzing the past decade, the Nasdaq 100 and mainstream broad-based indices’ annualized return rate was 18.1%, better than the Nasdaq index (13.0%), S&P 500 index (12.2%), Dow Jones Industrial Average (16.2%), etc., fully reflecting the quality of Nasdaq 100 index constituents.

The marginal improvement in the macro liquidity environment will support the continued dominance of the tech style in the broader market. Specifically, investors can actively focus on the Nasdaq index ETF (159501), with corresponding connection funds (A/C:016532/016533) available for selection.

Hidden Direction for U.S. Stock Asset Allocation in 2024 — S&P Biotech

The biotech industry has always been a key area of technological and industrial revolutions in recent years, with a very broad prospect. Especially last year, innovative drugs, led by semaglutide, opened growth space for many pharmaceutical companies. Moreover, U.S. Biotech companies have obvious advantages, and the innovative drug market has a favorable development environment, making the biotech sector also worth attention this year.

Potential favorable factors for U.S. Biopharma stocks this year include:

- Major pharmaceutical companies still have a strong acquisition desire, especially prominent at the end of 2023.

- The current industry valuation is still at a historical low.

- The Federal Reserve may start cutting interest rates in 2024.

- The FDA is open and reasonable, with the number of drug approvals in 2023 increasing by 50% compared to the previous year.

Additionally, the long-term success elements for innovative pharmaceutical companies include: front-end R&D, clinical capabilities, commercialization capabilities, and internationalization. The U.S. market is precisely the most fertile land for the pharmaceutical industry’s development prospects worldwide.

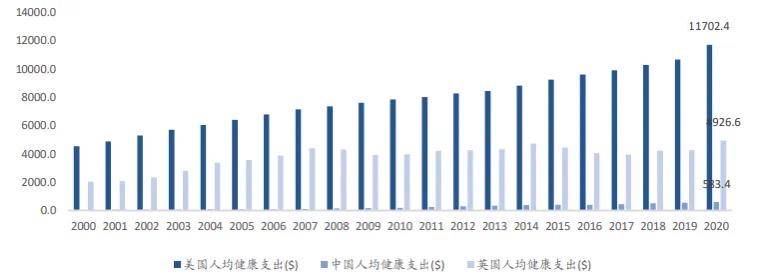

Taking commercialization as an example, the U.S. is the major economy with the highest per capita health expenditure, the largest share of GDP, and the highest proportion of health expenditure in government expenditure. Since 2000, the U.S. per capita health expenditure has risen by an average of 4.9% per year, reaching 9.8% in 2020, accounting for 18.8% of per capita GDP.

High medical expenditures fully reflect the high marketization level of the U.S. pharmaceutical market, and sectors such as pharmaceuticals, biotech, and medical devices in U.S. stocks benefit from strong payment capabilities and free pricing strategies, ultimately forming the unique industry advantage of U.S. pharmaceutical stocks. After years of development, the U.S. The pharmaceutical market has become an investment opportunity that cannot be ignored.

Index-wise, among the many indices in the pharmaceutical sector, we recommend the S&P Biotech Index, which is an equal-weight configuration focusing on small but beautiful U.S. biotech companies with strong technological innovation attributes and relatively large growth space.

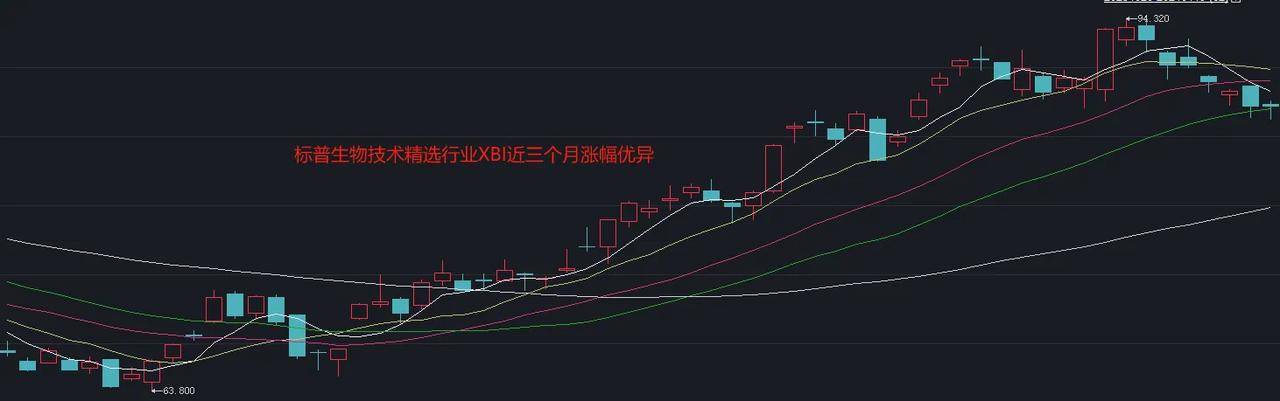

Specifically, investors can focus on the S&P Biotech ETF (159502), closely tracking the S&P Biotechnology Select Industry Index (SPSIBI.SPI), following the same index as the largest U.S. biotech ETF (XBI), currently offering a high cost-performance value.

In summary, in the U.S. stock market, which has performed excellently in recent years, combining macro fundamentals and fiscal policies, we are optimistic about the performance of the tech sector this year. Therefore, we prefer two ETFs — the Nasdaq Index ETF (159501; A/C:016532/016533) and S&P Biotech ETF (159502).

In personal asset allocation, it is highly recommended to allocate overseas assets in the portfolio, which can provide a wealth of asset targets, fully enjoy the fruits of development from different economies globally, and the low correlation between assets can also help investors significantly diversify risks. For purchasing U.S. stocks and ETFs, there are more options with traditional brokers like Interactive Brokers, Charles Schwab, Tiger Brokers, or on the new blockchain wallet BiyaPay. BiyaPay not only allows for purchasing U.S. stocks and ETFs but also Bitcoin, potentially being the first global platform that can both trade stocks and cryptocurrencies.

BiyaPay, this multi-asset trading wallet, was discovered unintentionally and is quite interesting. BiyaPay is the best platform combining digital and stock assets, where you can recharge digital currencies like USDT to invest in Bitcoin or U.S. and Hong Kong stocks, or recharge USDT to exchange for U.S. dollars or Hong Kong dollars to invest in U.S. stocks through other brokers like Charles Schwab. I invested in U.S. stocks through Charles Schwab by transferring U.S. dollars via BiyaPay.