- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Investing in U.S. Stocks Regularly: Achieving Financial Freedom Is Not a Dream!

Dear investor friends, do you find the journey to recoup your investments a bit bumpy?

The challenging investment path for ordinary people

It’s important to remember that the goal of investing is to profit, not just to recover the initial capital. However, why is it that after entering the market with confidence, we often suffer merciless blows from the market? From once having grand ambitions of making substantial profits to now reluctantly pursuing a break-even point, what principles lie behind this transformation?

Let’s explore the mysteries of the market together.

Taking the Nasdaq index as an example (image from the multi-asset wallet BiyaPay):

From the graph, we can observe two significant trends emerging over time:

The market’s volatility is gradually decreasing, and the market’s bottom is continuously rising.

What message does this convey?

The overall market is on an upward trend, and the excess returns from contrarian investing are gradually diminishing. Although there are still opportunities to profit from a contrarian approach, these chances are quietly slipping away.

So, what causes us to frequently lose our way on the investment path?

The answer may lie in the asymmetry of information. Many novice investors rush into the market when it’s hot but neglect the importance of accumulating experience and observing the market during calm periods. In the world of investing, the early bird catches the worm, and having advanced information and calm analysis is undoubtedly key to success.

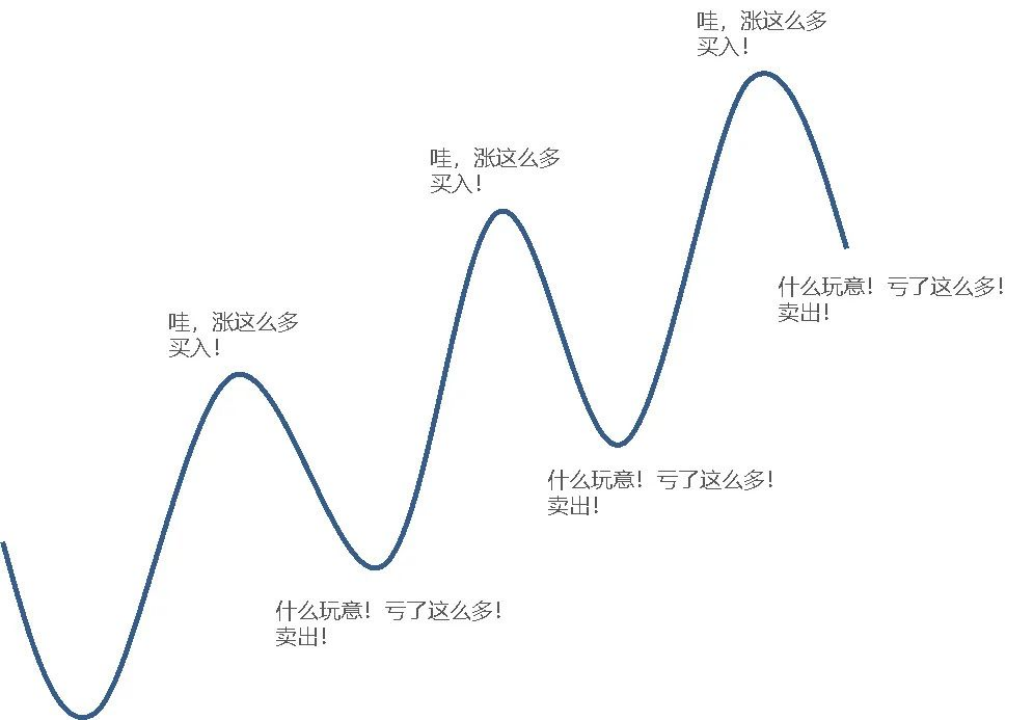

It’s evident that most investors start investing when the market has already risen significantly, and they opt to wait and see during downturns, even ignoring opportunities to enter the market.

How to solve this investment dilemma - Regular Investing

To address this issue, the most direct method is to implement a regular investment strategy. Regular investing means investing a fixed amount consistently in any market condition, such as $2,000 monthly, $500 weekly, or even $100 daily. As long as your income can cover the investment amount, you can execute a regular investment plan.

If investing is likened to warfare, selecting targets is a strategic capability, while deciding when and how much to buy is a tactical ability. Regular investing, then, is about leveling the tactical playing field by adopting a fixed frequency approach (i.e., foregoing tactical capabilities).

What problems can regular investing solve?

After years of practice and data analysis, I’ve found that regular investing significantly reduces maximum losses. Engaging in regular investments at almost any time can reduce the maximum loss by about 15% compared to lump-sum investments. For instance, if a lump-sum investment incurs a 20% loss, the maximum loss for regular investing would be about 5%; for a 30% lump-sum loss, regular investing would reduce the maximum loss to about 15%. Although this 15% reduction might seem limited, it’s precisely this difference that allows investors to hold their ground at the market bottom, survive the darkness, and welcome the dawn.

What issues does regular investing solve for individual investors?

The core advantage of regular investing is balancing investor emotions and logic. In lump-sum investing, it’s often difficult for emotions and logic to coexist. At market lows, investor emotions might lead to blind redemptions, despite logic suggesting they should increase their holdings; at market highs, emotion-driven blind purchases occur, despite logic indicating risks. Regular investing can alleviate this issue, helping investors remain calm and rational through market fluctuations.

How to choose investment targets

In the investment field, many investors lack tactical skills. Therefore, compared to making decisions on their own, a regular investment strategy can better compensate for this shortcoming. We also understand the importance of selecting investment targets, as strategic direction determines investment outcomes.

Looking back at the best global assets over the past decade, including U.S. stocks, real estate, and cryptocurrencies, it’s clear that while the real estate market has low liquidity, cumbersome transactions, numerous restrictions, and high valuations, the crypto market is highly volatile, with uneven project quality and excessive risk. Therefore, we prefer investing in U.S. stocks, followed by ETFs for cryptocurrencies.

Take the Nasdaq 100 index as an example; this index has performed exceptionally well, rising nearly tenfold from its 2009 low to date, with a reasonable valuation (overall P/E ratio of about 25 times), indicating rapid company performance growth.

Why is the Nasdaq 100 index so strong? A closer look at its constituents reveals the reason.

Currently, the top ten companies in the Nasdaq 100 include Apple, Microsoft, Amazon, Facebook, Google A, Google B, Intel, Comcast, Cisco, and Pepsi, accounting for over 55% of the index’s weight. Additionally, the top twenty include Netflix, Nvidia, Costco, Starbucks, and other businesses. These companies have a global presence, industry leadership, deep moats, strong innovation capabilities, and rapid revenue growth.

Why choose the U.S. stocks?

I’m honored to share the same viewpoint as the legendary investor Warren Buffett - bullish on U.S. stocks and profiting from this perspective. During Forbes magazine’s 100th-anniversary celebration in 2017, Buffett stated that the only direction for the U.S. stock market is up. He believed the Dow Jones would break one million points within 100 years (at the time, the Dow was around 22,000 points).

Having some experience investing in U.S. stocks, I’ve become more familiar with their characteristics compared to my initial novice stage:

(1) U.S. stock volatility is generally lower than other stock markets, with relatively higher predictability;

(2) U.S. stocks better represent the short-term direction of risk assets, hence the movement of U.S. stocks is almost completely opposite to that of gold and medium-to-long-term U.S. bonds. This provides investors with hedging options, such as an equal-weight allocation between QQQ and TLT;

(3) U.S. stocks tend to rise slowly and fall quickly, but they rise for longer periods and fall for shorter ones. Therefore, if U.S. stocks experience a significant drop, it’s likely a good investment opportunity;

(4) For Chinese investors, U.S. stock funds can hedge against currency devaluation (as the underlying assets are priced in dollars);

(5) Given enough time, “U.S. stocks always go up” is almost a certainty.

Although many discussions about U.S. stocks mention that they have been in a long bull market since early 2009, accumulating unprecedented risks, few pay attention to the nearly three-month adjustment in Q4 2018. During this adjustment, both the Nasdaq and S&P 500 indices fell more than 20%, entering a bear market by standard definitions. However, U.S. stocks made a strong comeback at the start of 2019, continuously reaching new historical highs amid fluctuations.

So, how can ordinary investors start regular investing?

Before regular investing, the most important step is finding a platform for investing in U.S. stocks.

Due to various reasons, it’s quite difficult for many Chinese investors to open brokerage accounts. I believe it’s essential to choose a reputable broker for investing, like Charles Schwab, a globally renowned investment brokerage. Opening an account with Charles Schwab also provides a bank account in the same name. You can deposit USDT into the multi-asset wallet BiyaPay and then withdraw fiat currency to invest in U.S. stocks with Charles Schwab Securities. BiyaPay is authorized by the U.S. SEC and has also launched U.S. stock investment services. You can directly invest in U.S. stocks on BiyaPay. After selecting a suitable platform, you can start regular investing.

What is your regular investing goal? How much money is needed to achieve it?

The first step in a regular investment plan is to clearly define your goal. With a clear goal, you can exit at profit when the goal is reached and plan your investment period based on the goal.

We need to calculate how much money is needed to achieve the goal and consider how much idle funds we have for long-term financial investment. Once this is clear, we can allocate regular investment funds and plan the amount for each period.

Finally, plan the period and frequency of regular investments.

Regular investing is a long-term behavior. We need to set a continuous investment period, whether it’s 1 year, 3 years, 5 years, or longer. Typically, the market goes through a bull-bear cycle in about 3-6 years. If the investment period is too short, the desired investment effect may not be achieved. The specific frequency of regular investments can be determined based on the planned investment amount. If the monthly investment amount is relatively small, such as around $500 or $1,000, a monthly investment method can be used. If the monthly investment amount is larger, it can be split into weekly investments.

Then, select a suitable U.S. stock target and execute the plan.

Summary

For those with limited time who don’t want to spend years and significant losses exploring stock market strategies of chasing highs and lows, regular investing undoubtedly offers convenience. By persistently sticking to the plan without excessive worry, investors can reduce loss risk and increase the possibility of profit.

Those who mock others often find themselves in a cycle of ridicule and being proven wrong. For those with investment wisdom and actual profits, even rebutting such comments seems unnecessary.