- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Buffett Has Invested Half of His Funds in Apple, But Faces Triple Setback at the Start of 2024. Is T

Buffett, the world’s most renowned investor, manages Berkshire Hathaway, one of the largest investment companies globally. His investment philosophy is centered around value investing, favoring companies with strong competitive advantages, stable profitability, high returns, and good management.

In his portfolio, Apple Inc. holds the largest share. According to the 13F report submitted by Berkshire Hathaway in March last year, Apple accounted for 46.44% of Buffett’s portfolio, with a market value of about $150 billion. Buffett began investing in Apple in 2016, earning over $100 billion from this stock, making it his favorite.

Buffett’s key logic for investing in Apple is well-known:

- Deep moats

- Strong earning power

Firstly, let’s look at Apple’s moat.

Apple is the world’s largest manufacturer of smartphones and personal computers, boasting significant brand recognition and market share. As of 2022, Apple held 15% of the smartphone market share and 10% of the personal computer market share.

Notably, Apple’s iPhone line dominates the high-end market, thanks to its excellent user experience and brand appeal, generating significant profits. Additionally, Apple’s services, such as iCloud, Apple Music, and the App Store, provide stable revenue streams.

Another strength is Apple’s leadership team, led by CEO Tim Cook.

Since Cook became CEO in 2011, the company’s stock price has increased nearly tenfold. Apple’s strong brand influence, exceptional product design, user experience, and extensive ecosystem help maintain its competitive edge, continuously introducing market-leading products and services.

Next, let’s examine Apple’s earning capability.

Berkshire Hathaway’s portfolio includes well-known companies like American Express and Coca-Cola, all of which have strong brands. This has always been Apple’s key competitive advantage and differentiation factor, likely noticed by Buffett when he first invested.

The consumer electronics industry is typically challenging for sustained success due to fierce competition and price pressures. Apple’s unique position allows it to defy the odds and demonstrate its pricing power. Apple sells its hardware products at high prices, yet consumers continue to show strong willingness to pay.

From Jobs to Cook, past and present leaders have excelled in maintaining Apple’s brand strength, giving Buffett confidence in its future dominance.

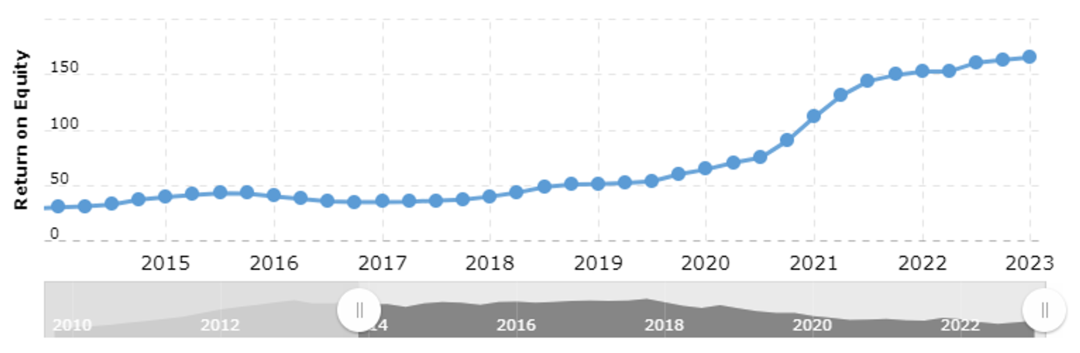

Before investing in a stock, Buffett wants to ensure the company’s future profitability. From the fiscal year 2016 to 2023, Apple’s net income grew at a compound annual growth rate of 14.7%. It’s hard to imagine profits not continuing to grow in the coming years.

Perhaps the most crucial factor that led Buffett to add this tech stock to Berkshire’s portfolio was its absurdly low valuation. In the first quarter of 2016, Apple’s average P/E ratio was 10.6. Given brand recognition and impressive financials, this valuation made it a no-brainer buy at the time. This is why Buffett seized the opportunity.

However, in the just-arrived year of 2024, Apple, the king of stocks, faced three major setbacks, dragging down the entire NASDAQ.

Since mid-last year, Apple’s stock has been downgraded repeatedly. While previous downgrades had little effect on Apple’s stock price, this year’s two instances significantly impacted Apple. The beginning of the year saw a sudden announcement of a comprehensive antitrust lawsuit against Apple in the U.S., targeting its strategy to protect the iPhone’s dominant position.

Upon the news, many investors frantically sold off Apple, leading to a rapid decline in stock prices within minutes. However, institutions took advantage of the low prices to buy Apple before closing.

So, is this the “end of days” for Apple, or just a temporary “winter”?

I believe it’s just a temporary “winter.”

After all, Apple has recognized the importance of artificial intelligence for its future development.

If Apple fails to adopt AI correctly, it may fall behind more innovative and advanced products.

In 2023, Apple invested $22.61 billion in R&D, showing its foresight in technology adoption. It has made significant progress in early AI fields, with Siri being a prime example.

Cook mentioned that Apple has been researching various AI technologies, including generative AI. Reports indicate that Apple has negotiated with major news companies for licenses to use their materials to train its generative AI models. This further shows Apple’s active pursuit of expanding AI applications to maintain its lead in technological innovation.

Since Buffett heavily invested in Apple, it has increasingly become a mature value stock rather than a growth stock. This is evident from its financial reports, with Apple’s revenue declining year-over-year for four consecutive quarters from Q4 2022, with only a 2.1% year-over-year growth in Q4 2023.

However, it’s comforting that the core of Apple’s ecosystem—the iPhone—remains strong. Despite significant challenges in the Chinese market, the overall sales of the iPhone 15 series have remained robust, proving the series’ success.

Moreover, I believe Apple’s business model, with its “deep moat” as Buffett says, will continue to grow steadily, regardless of where future technology trends emerge.

The latest financial report shows that Apple’s active device base now exceeds 2.2 billion units, continuing to show steady growth. In the latest quarter, Apple’s transaction accounts and paid accounts also reached all-time highs.

Therefore, Apple’s future remains trustworthy for investors. Although it has passed its explosive growth phase, it still has a steady income growth momentum. I think for investors who do not seek excitement and excess returns, buying on dips and holding long-term is undoubtedly a wise choice. Let me share with you the investment tool I am currently using, a multi-asset trading wallet—BiyaPay. It supports real-time online trading of US and Hong Kong stocks and is a convenient and fast fund inflow and outflow tool, allowing for the exchange of cryptocurrencies (such as BTC, USDT) for fiat currencies like USD, HKD, GBP to bank accounts, with same-day settlement and no limits, truly achieving two goals with one effort.