- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

Zuckerberg's Net Worth Surges by $273 Billion, Surpassing Bill Gates, All Thanks to These Details in

On February 1st, Meta (formerly Facebook, ticker symbol META), released its fourth quarter and full-year earnings report for 2023.

The quarterly performance significantly exceeded Wall Street expectations. Following the release of the report, the stock price surged about 20% on Friday, marking the third highest single-day gain in history.

This rise increased Meta’s market value by over $200 billion, pushing its total valuation to more than $1.2 trillion.

For the average investor, how can one seize such an opportunity?

1. Why Look at Earnings Reports?

Buying a company’s stock means investing in the company. Investors need to understand a company’s operating condition, estimate the business’s value, and decide whether it is worth purchasing. There are many factors that can influence a company’s potential for growth, and earnings reports provide a sample for analysis. Stock traders can get a general understanding of the company’s main business operations, financial condition, and data performance through the information in the earnings report.

Analyzing a listed company’s financial statements is a complex and detailed process, involving an assessment of the company’s financial health, operational efficiency, and market position among other aspects.

2. Read the Annual and Quarterly Reports

- Annual Report (10-K): Provides a comprehensive overview of the company’s financial performance, business summary, and market risk information.

- Quarterly Report (10-Q): Offers updates on the company’s financial performance and significant events in the most recent quarter.

3. Analyze Financial Statements

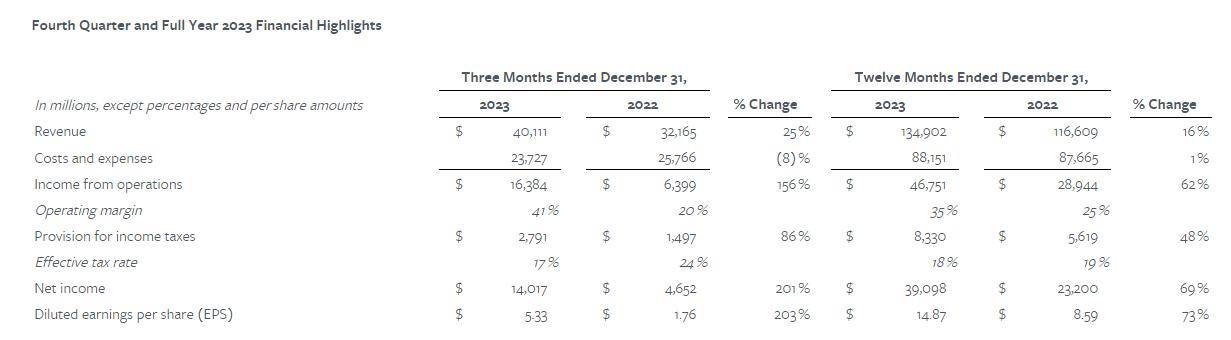

This earnings report highlights the most important points at the very beginning.

From this, we can see that Meta’s fourth-quarter revenue grew 25% from the same period last year, increasing from $32.2 billion to $40.1 billion. This is the highest growth rate since mid-2021, further proving that the online advertising market is continuing to rebound. Moreover, Meta’s net profit more than doubled from $4.65 billion a year ago to $14 billion.

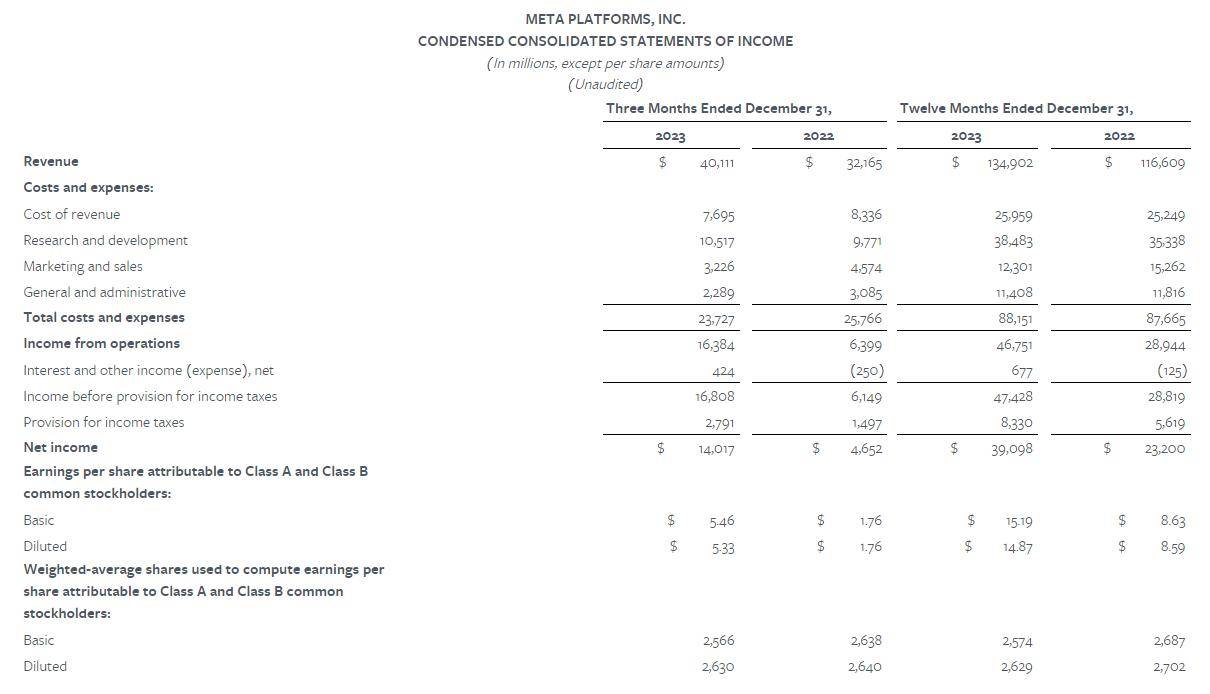

Income Statement (Profit and Loss Statement)

- Revenue: Check the company’s total revenue and net revenue growth trends.

- Gross Profit Margin: Sales revenue minus the cost of goods sold, which measures sales efficiency.

- Net Profit: The company’s profit after deducting all expenses, a key indicator of profitability.

- Earnings Per Share (EPS): Reflects the profit situation per share of stock, an important metric for assessing profitability.

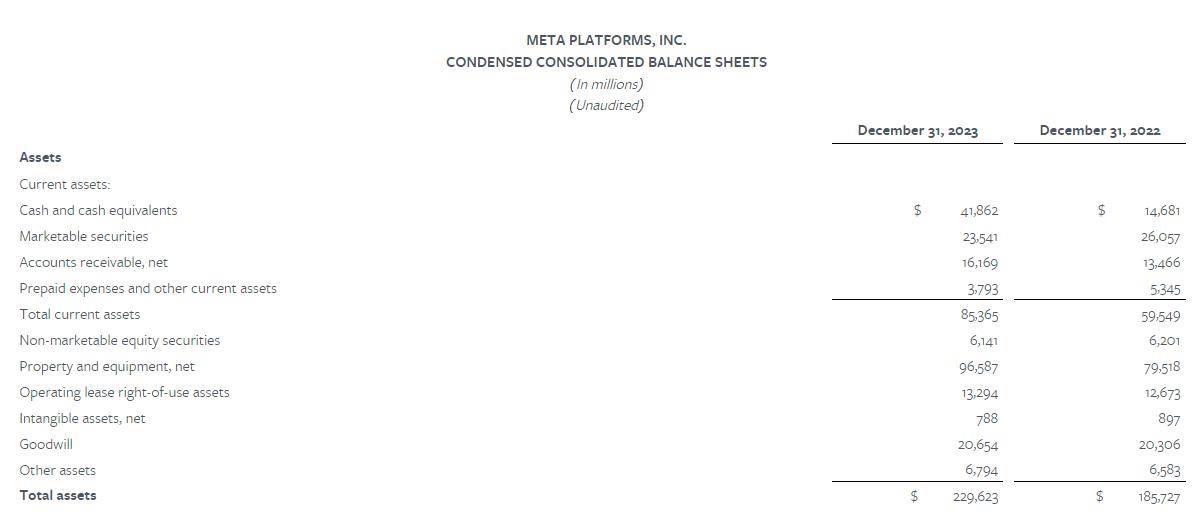

Balance Sheet

- Assets: All resources owned by the company, including current and non-current assets.

- Liabilities: The company’s debts, including current and long-term liabilities.

- Stockholder’s Equity: Also known as net assets, it’s the balance of the company’s assets minus liabilities.

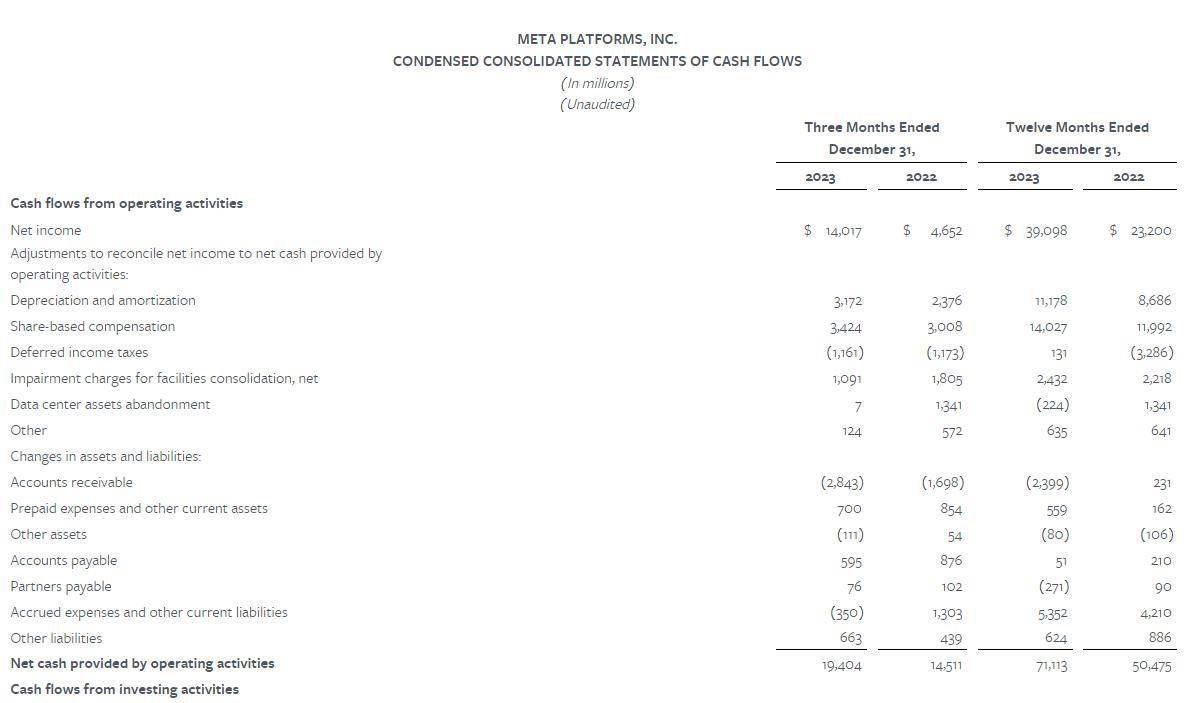

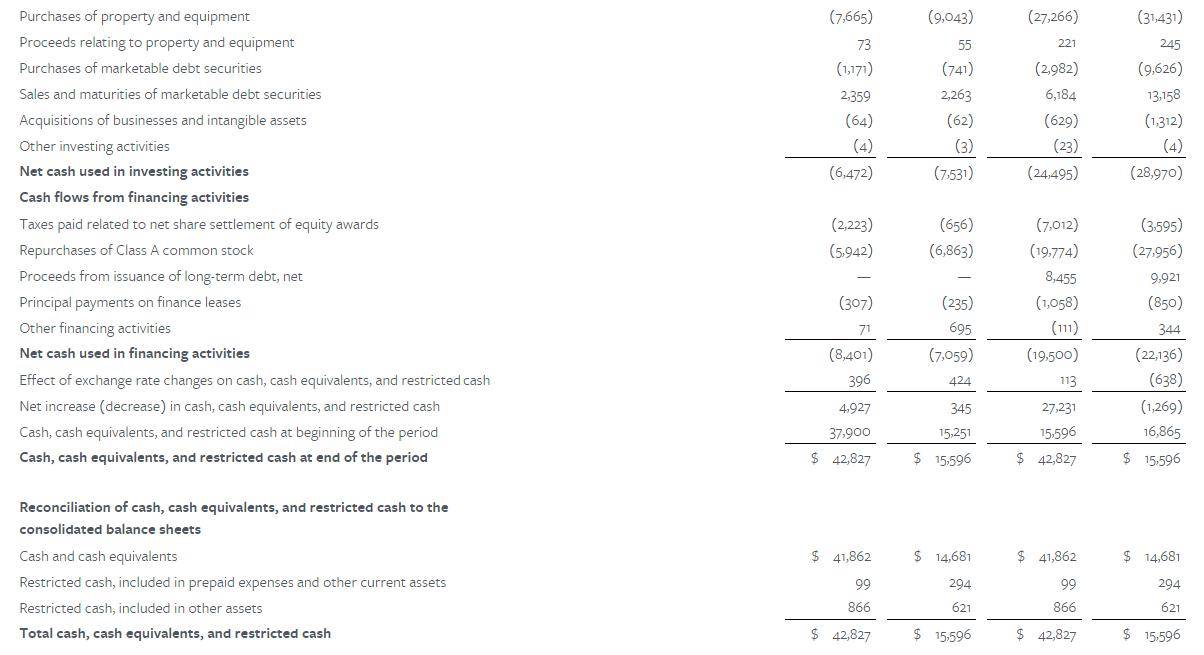

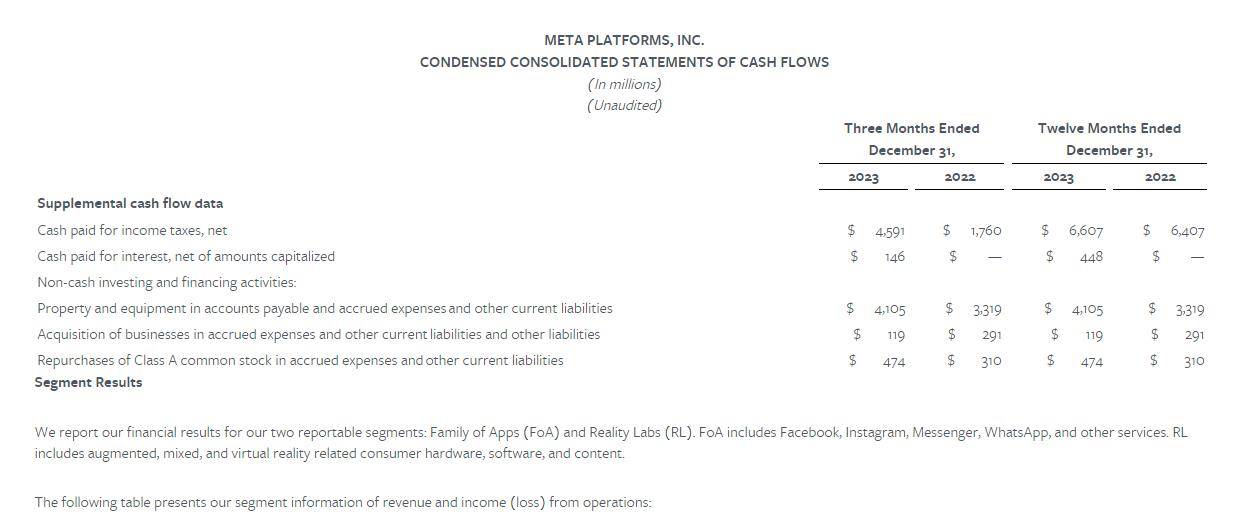

Cash Flow Statement

- Cash Flow from Operating Activities: The cash flow generated by the company’s main business operations.

- Cash Flow from Investing Activities: Cash flow generated by the purchase or sale of assets.

- Cash Flow from Financing Activities: Cash flow generated by the company through issuing stocks or bonds.

4. Evaluate Financial Ratios

- Current Ratio: Measures the company’s ability to pay off short-term debts.

- Debt to Asset Ratio: Measures the proportion of debt to assets, reflecting financial risk.

- Return on Equity (ROE): Measures the efficiency of using shareholder funds.

- Return on Assets (ROA): Measures the efficiency of using all assets.

5. Competitor Comparison

- Compare with other companies in the industry to understand the company’s financial performance and market share, and gauge its position within the industry.

6. Market Environment and Risk Factors

- Understand the macroeconomic conditions, industry trends, and specific risks faced by the company.

7. Management Discussion and Analysis (MD&A)

- Read the MD&A section to get management’s views on financial conditions, operational results, and future outlooks.

Meta’s CFO stated in the earnings report,

- "We expect total revenue for the first quarter of 2024 to be between $34.5 billion and $37 billion. Our guidance assumes that the impact of foreign exchange rates on year-over-year total revenue growth is neutral.

- We expect total expenses for the full year 2024 to be in the range of $94-99 billion, consistent with our previous forecast. We continue to expect several factors to drive the increase in total expenses for 2024:

- We expect capital expenditures for the full year 2024 to be between $30-37 billion, an increase of $2 billion over the previous range’s upper limit.

- We anticipate that investments in servers (including both AI and non-AI hardware) and data centers, as we intensify site construction efforts using the newly announced data center architecture, will drive growth."

8. Other Key Information

In the “Fourth Quarter and Full-Year Operating and Other Financial Highlights” section, Meta also announced a $50 billion stock repurchase program.

Additionally, in the “Meta Initiates Quarterly Dividend” section, it announced that it would pay its first quarterly dividend to investors, distributing 50 cents per share on March 26th.

These two key pieces of information were well received by investors and analysts. An analyst from Quilter Cheviot stated: “This is a symbolic moment, indicating that Meta has turned the corner since its difficulties in 2022.”

Analyzing the financial statements of listed companies requires professional knowledge and experience. These steps and indicators are just starting points. Learning accounting and financial analysis principles in depth and accumulating experience in practice can more effectively assess a company’s financial health and performance prospects. Then, investors can validate their conclusions by trading on platforms like Interactive Brokers, BiyaPay, etc., which allow trading in US and Hong Kong stocks, margin financing, and also support transactions in Bitcoin, ETFs, and digital currencies.